chapter 01

Unpacking Finance Transformation

Learn which forces are reshaping the finance function and how you can craft an effective response.

DOWNLOAD FULL REPORTWe asked senior business leaders in finance and accounting about their readiness for the future. From an overwhelming embrace of AI and machine learning to data and analytics challenges, their experiences reflect those of many businesses in today’s environment.

To understand what it means to embrace the future of finance, first understand what’s impacting the finance function.

Sources of Change & Impact on the Finance Function

Tech innovation

- Automation frees up finance professionals from mundane, repetitive tasks to focus on strategy.

- Advancements in data-sharing, ERPs and reporting expand the finance team’s purview cross-enterprise.

- Predictive modeling and analytics improve forecasting and decision making on resource allocation, pricing, M&As, etc.

- Technology increases the need for AI “trainers” and data scientists.

- A slew of new platforms, tools and services lead to difficulty prioritizing investments.

Data proliferation

- Pressure exists to achieve ROI from data investments by generating real-time insights.

- Data-sharing across the value chain offers more visibility into partner, vendor and competitor activities.

- Data loss and security issues increase risk.

- Inefficiencies grow in data storage, access and sharing.

Global disruption

- Demand rises for always-on, agile reporting and planning.

- Obsolescence of traditional reporting cycles and tools grows.

- CFOs emerge as a strategic influence on the C-suite.

Remote work & the freelance economy

- Fractional talent models offer flexibility in hiring.

- New workforce preferences and models result in difficulty attracting and retaining talent.

Expanding business ecosystems

- Nontraditional players are partnering and diversifying into legacy markets.

- New business models are enabled by innovation.

Transformation Takes a Village

While the strategic imperatives apply broadly across the enterprise, the specific tasks of finance transformation look different for everyone at the line-of-business level.

LEADERSHIP & STRATEGY The CFO

- Drive finance transformation and change management through data strategies, digital talent, cross-enterprise communication and flexible talent structures.

- Oversee technology audits and investments to enable transformation.

FINANCIAL PLANNING The Analyst

- Upskill in data science, machine learning and strategic storytelling to extract insights from data.

- Visualize data and identify AI use cases to guide strategy and facilitate discussion.

TECH INFRASTRUCTURE IT

- Develop cross-departmental communication and collaborate on AI use cases and business requirements.

- Implement self-service analytics tools and optimize data infrastructure.

TRANSACTION PROCESSING Accounting, Bookkeeping, Tax & Compliance

- Develop cross-departmental communication and collaborate on AI use cases and business requirements.

- Implement self-service analytics tools and optimize data infrastructure.

Build Your Finance Transformation Roadmap

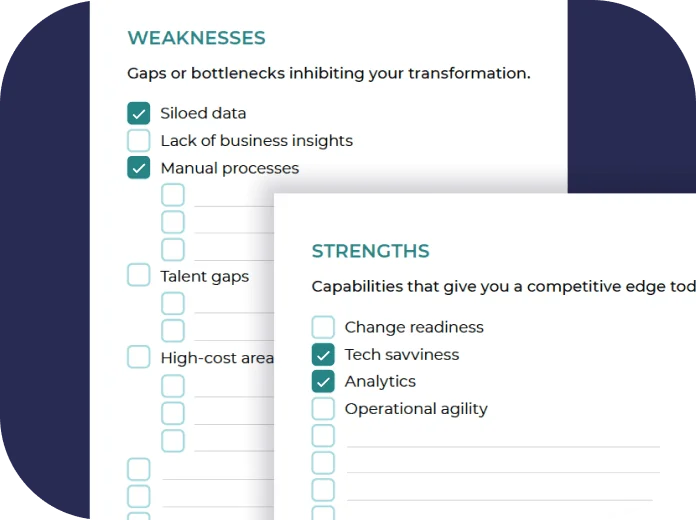

Not sure where to begin? Think about your company’s core values, strategic vision and industry. Then, download this SWOT framework to visualize how your finance function needs to change to achieve your goals.

DOWNLOAD The CHECKLISTUncover the Blueprint for Finance Transformation

Get all of the insights from the playbook to share with your team.

About the Future of Finance Survey

The Paro Future of Finance survey used online interviews conducted among members of the Vitreous World panel, with respondents representing US-based C-Suite executives or senior management in Accounting or Finance; the resulting sample was statistically representative.