chapter 02

The Dual Role of AI Applications in Finance

Understand the strategic value of AI, as well as its limitations, to combat concerns and hesitations around its adoption.

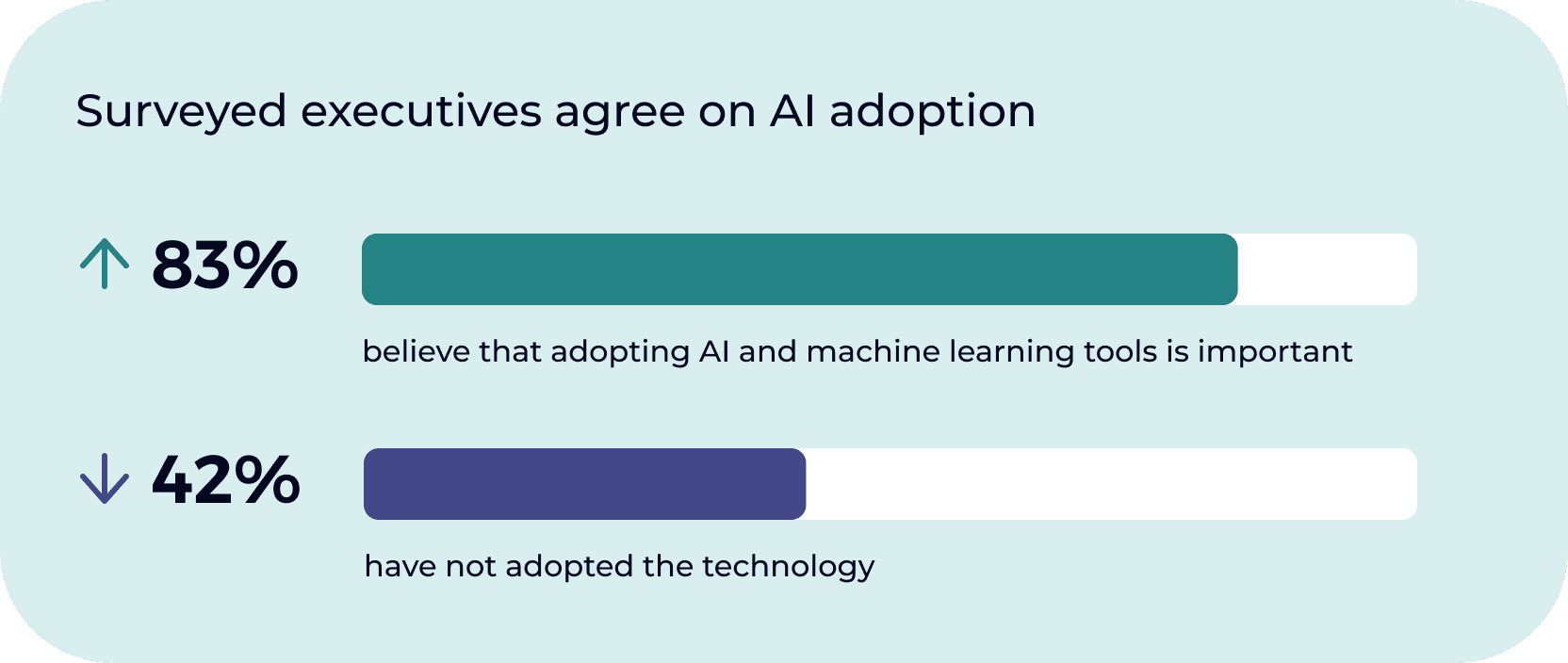

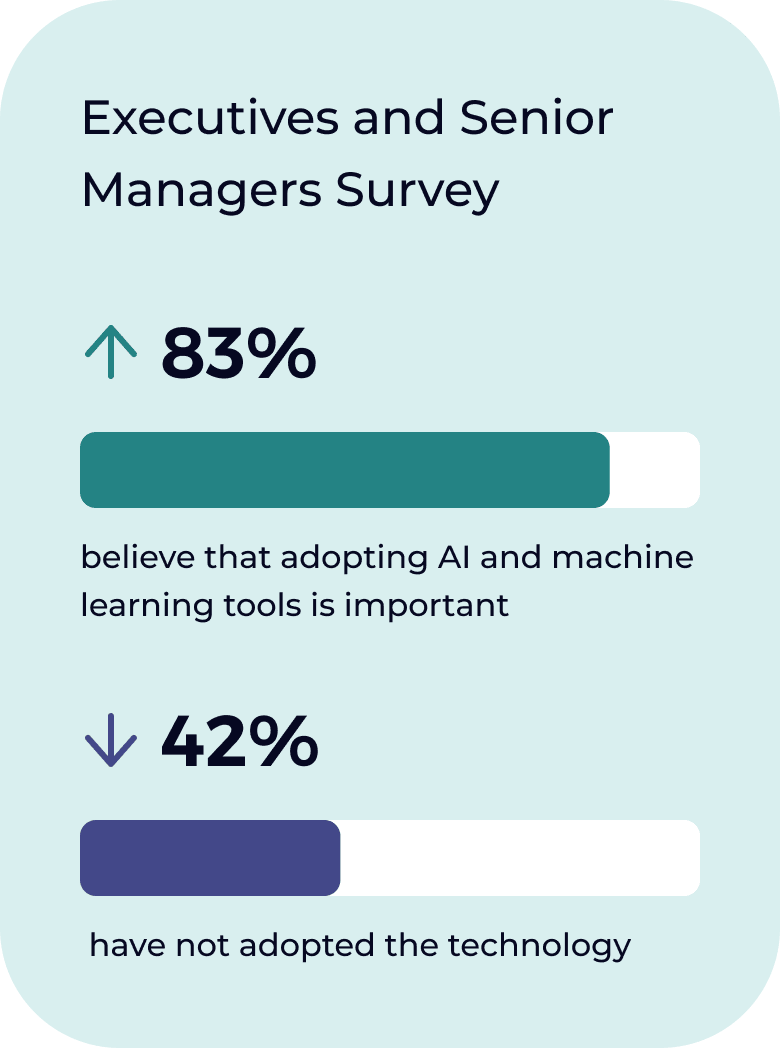

DOWNLOAD FULL REPORTThough businesses believe in the power of AI, they’re still hesitant to adopt it. One of the top concerns they report—just under data security—is the loss of human judgment or oversight. This oversight is key to the successful implementation of AI models, and it starts with understanding the technology’s strengths and weaknesses.

AI Applications

The wide range of AI applications in finance fall under two primary uses:

As a Tool to improve efficiency and workflows

- Aggregate, process & visualize large data sets

- Automate workflows like AR/AP or transaction categorization

- Automate fraud detection and compliance monitoring

- Help design polished presentations and documents

As a Strategic Guide to identify complex patterns and generate complex analysis

- Analyze internal and external data to forecast trends and opportunities

- Conduct scenario planning to model decisions without wasting resources

- Uncover growth drivers and identify opportunities for new services, customer segments, etc.

RELATED READING

The Do’s and Don’ts of AI Forecasting

AI forecasting can provide greater accuracy than traditional financial forecasting models. Follow these tips to get the most out of your AI. Read more ›

AI & the Art of “Why”

Roughly one third of executives feel that AI tools lack transparency. To combat the black box problem, professionals must learn the basics of AI models and be ready to challenge model outputs with domain expertise and intuition.

The benefits of AI applications in finance are undeniable, but so is the importance of human oversight. Knowing exactly why AI is your solution and being able to discern when a “wait-and-see” approach would work better is a critical part of planning your finance transformation.

Humans Must Inject Nuance

Imagine a cosmetics manufacturer with a deep supply chain wants to add an AI assistant to automate the process. However, the assistant doesn’t take into account specific supplier details, such as payment terms. If your AI can’t handle the essential nuances of your business or industry yet, you’re not going to get the ROI you want.

The Tools Are Not Autonomous—at Least, Not Yet

Can you trust AI? Garbage in equals garbage out, but even good data isn’t a sure bet to accurately address your challenges. You need accounting and finance domain experts to participate in your AI model’s learning— monitoring, challenging and asking questions like:

-

Are the AI’s data sources reliable and unbiased?

-

What are the biggest influencers behind the AI’s recommendation?

-

Do the AI’s forecasts align with reality when compared against non-training data?

If the AI is making unrealistic recommendations, what kind of constraints can you program into it to make its output more useful? What proof points can you build in to track and evaluate your results?

With Paro’s AI model, we did some high-level sanity checks and got to work building constraints into it. When we asked it to optimize growth, it recommended we hire 60 sales reps by the end of the month, which was unrealistic. Adding constraints helped us build confidence that what it was recommending was within reach. – Dan Wywrot, former Paro VP of Finance

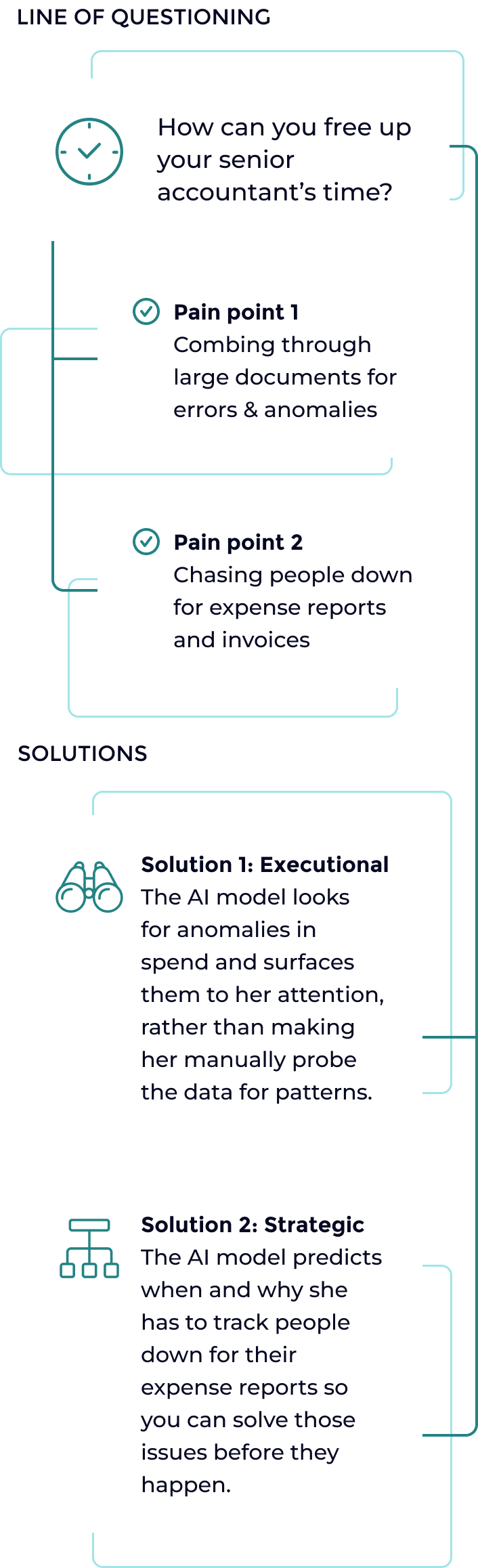

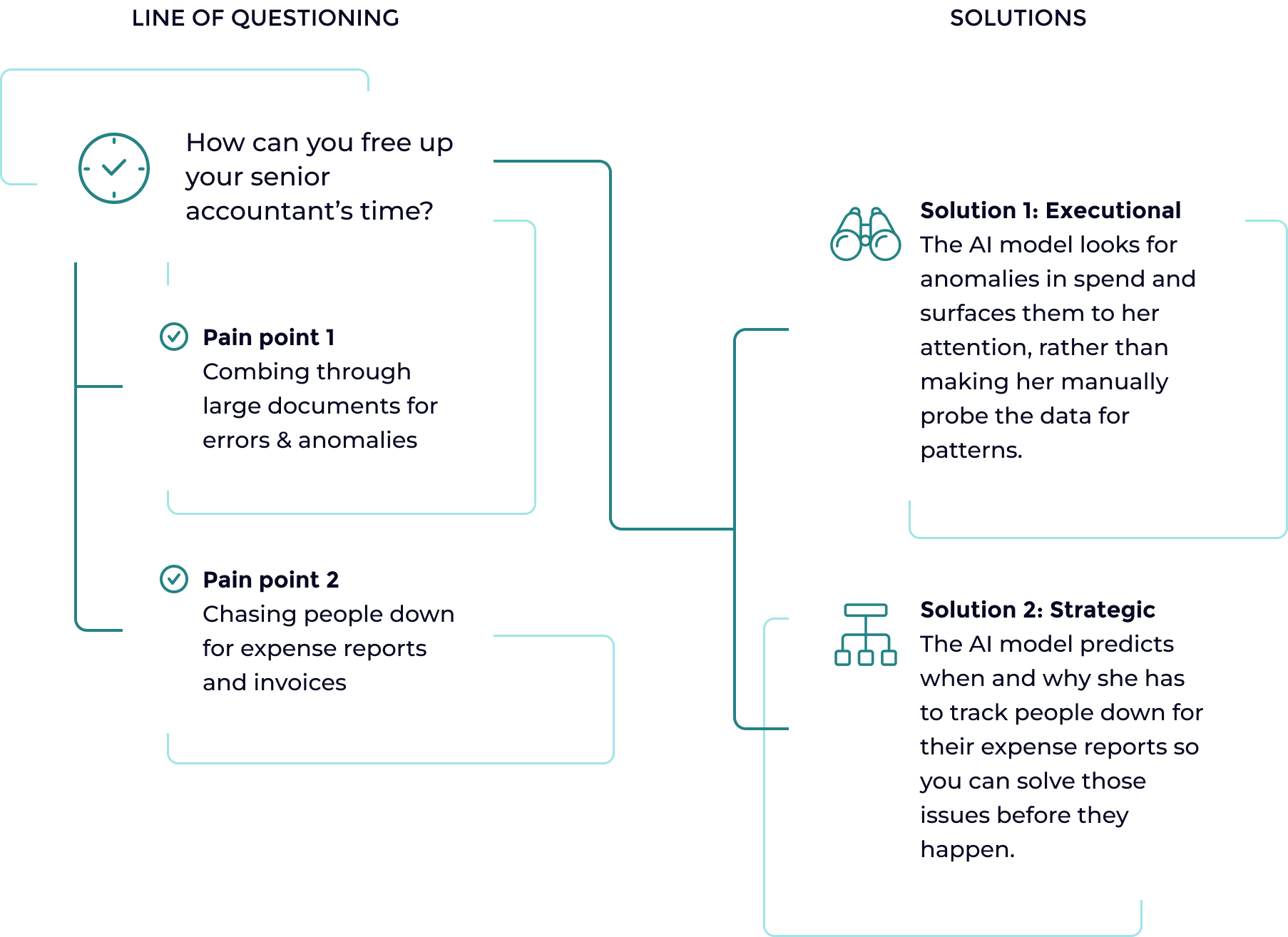

3 Steps to Build a Business Case for AI in Finance

Address a specific problem or pain point rather than shopping for features first. Start small and take incremental steps.

Don’t rush if the AI isn’t ready to handle the specific nuances in your business base.

Consider whether you should buy or build. It may make more sense to buy certain capabilities first and build just a small portion internally.

AI in Action: 1 Problem, 2 Solutions

For companies venturing into AI, start by talking to your stakeholders and look for processes that require speed and repetition at scale.

Uncover the Blueprint for Finance Transformation

Get all of the insights from the playbook to share with your team.

About the Future of Finance Survey

The Paro Future of Finance survey used online interviews conducted among members of the Vitreous World panel, with respondents representing US-based C-Suite executives or senior management in Accounting or Finance; the resulting sample was statistically representative.