Automated bookkeeping has revolutionized how businesses manage their finances. With the advent of automated bookkeeping software, businesses can now put many tasks on autopilot, much to the relief of business owners and teams that are stretched thin.

However, while automated accounting software has many advantages, it’s not without its pitfalls and limitations. There are subjective insights and nuances that only a human bookkeeper can provide. So what does that mean as you implement automated accounting workflows within your business?

Is Automated Bookkeeping Just About Technology?

Automated bookkeeping refers to the use of technology, particularly automated accounting software, to streamline various tasks related to accounting and financial management, such as:

- Recording and categorizing transactions

- Automating invoices and payments

- Processing payroll

- Creating financial reports

- Scheduling calendar and email functions for accounting workflows

- Maintaining and pulling records for tax preparation

Whether AI or a common software, the goal of automating accounting workflows is to reduce inefficiency and free up time for existing employees to focus on driving the business forward. For businesses outgrowing their current accounting capacity, bookkeeping automation can help scale the business and increase time for forecasting or financial strategy.

However, effective automation requires technology and human intelligence to work together. And businesses get the most value from their automation tools when their technology is used to broaden their accountant’s role and enable more time for expert advisory.

The Benefits of Automated Software

There’s no doubt that automated bookkeeping is necessary for growth. With 43% of businesses reporting that time-consuming, manual processes is a top-three obstacle for their finance function, automation ultimately solves the bandwidth problem.

There are many advantages of automated accounting workflows, such as:

- Reduced errors and increased data accuracy

- Faster data visibility and real-time updates

- Safer data storage and access

- Increased productivity at a lower cost

- Reduced employee burnout from time-consuming, repetitive tasks

It’s important to note, however, that while bookkeeping automation has many advantages, it is not a perfect solution. It comes with its own set of limitations and risks that require human intervention.

The Limitations of Automated Bookkeeping: Why You Need a Human Touch

While your software can streamline data entry and repetitive tasks, it can’t account for the real-life experiences and insights of a bookkeeper or accountant.

Where does the human touch play the biggest role within automated bookkeeping?

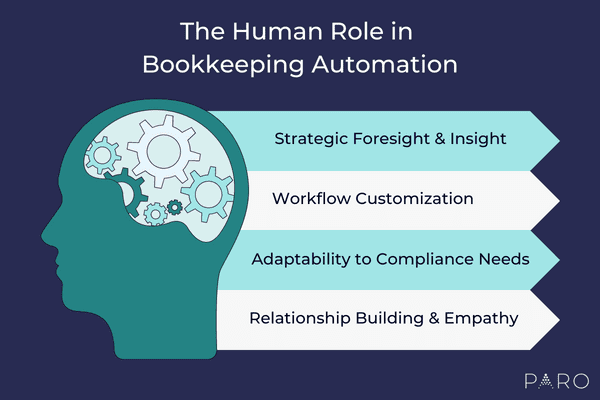

Workflow Customization

Many businesses require customized reports or have unique workflows. Businesses may not always get the desired level of detail needed for their reporting. Or, they’re forced to figure out costly workarounds in order to accommodate for those unique workflows.

In addition, automated software may not integrate well with other systems, such as payroll, inventory management or enterprise resource planning systems. A human expert can help SMBs design an integrated system that works well for their business and that meets their unique workflows.

Strategic Foresight & Insight

Automated software lacks the capability to provide expert insights and recommendations for the long-term growth of your business. Without the strategic recommendations of a human expert, businesses may miss out on growth opportunities and limit their ability to adapt to changing business conditions. With their industry knowledge, their adaptability to unexpected changes and their foresight for new trends, an accountant can be a true advisor in a way that your technology alone cannot.

Adaptability to Compliance Needs

According to a Sage survey, 79% of accountants believe that rapid regulatory changes are forcing them to change their processes. For businesses whose technology doesn’t support new compliance measures, accountants can find new ways to improve on the resulting increase in manual processes.

Software must be managed and adapted by an accountant or bookkeeper to pace with change. And many complex transactions cannot be put on autopilot due to software limitations. A professional can also help navigate difficult transactions to help you stay in compliance, such as:

- Transactions involving mergers, acquisitions or international transactions.

- Transactions with complex tax implications (e.g., tax-deferred exchanges)

- Equity transactions (e.g., stock options, restricted stock units, compensation)

Initial rules that you set up to process and categorize your transactions may not apply as transactions become increasingly complex. A professional can update those rules within your software with a better understanding of compliance and best practices.

Relationship Building & Empathy

Your automated software can process or retrieve data for you when you need it, but it’s not there to answer your tough questions or “what-ifs” that keep you up at night. Accountants and bookkeepers for business offer empathy and trust, which are imperative as you grow and navigate new territory as a business. They can teach, resolve conflicts, negotiate with external parties and consistently help communicate a vision to you, your team and your stakeholders.

Master Your Bookkeeping Automation with Human Expertise

Take charge of your accounting workflows and capture the benefits of a more efficient accounting solution with Paro’s accounting and bookkeeping services. Tap into an elite community of finance experts to build an automated accounting function for your business. Paro’s experts are skilled in the industry’s common—and not-so-common—accounting software, so you can find the right skills for your unique needs.