A business’s financial reporting is important at every growth stage, but it becomes increasingly critical for companies that are scaling quickly. Accurate financial reports are the basis for:

- Understanding the true economic health of your business

- Making qualitative business decisions

- Adhering to regulatory and tax compliance

- Tracking cash flow, capital expenditure and creditworthiness

Protect your financial reporting quality to enable data-driven decision making and avoid costly corrections as your business continues to grow.

Reporting accuracy is a challenge for scaling businesses

As a business grows, operational processes become more complex, which can strain existing finance and accounting controls. This is especially true if those systems are not optimized to scale.

Middle-market executives agree that inaccurate reporting is an obstacle for finance and accounting. According to a study of 500 senior finance executives, nearly 40% of businesses with $11M-$50M annual revenue cite that inaccurate financial reporting is one of their top three most significant finance and accounting challenges. As revenue increases, so do the concerns, with 50% of businesses at $51M-100M annual revenue sharing the same challenges.

Businesses should proactively assess and adapt current processes to prepare for challenges at the next growth stage. Start by considering these six risk factors to help position your company for future success.

6 Risks to Financial Reporting Quality

1. You’re facing staffing inconsistencies

Upheaval in the labor market means businesses are facing rapid turnover and talent gaps. This can halt a company’s ability to consistently adopt new financial reporting systems and processes as a lever for growth.

Staffing and retention challenges also lead to skill gaps within internal teams due to varying ranges of experience among employees. There can be skill disparities even with fully staffed financial departments. For example, lack of technical skills in process management tools, such as ERP systems, could slow down optimization of lackluster financial processes. Currently, 60% of surveyed businesses use an ERP system, but only 36% say their team fully understands these systems.

As a growing company, business resilience and strong accounting leadership hedge on the skills and expertise of your staff. Financial reporting quality and accuracy relies on both process continuity within the team, as well as an understanding of best practices and technical tools.

2. You’re operating within manual systems

Manual processes tend to sneak up on a company as it grows. In early stages of financial maturity, businesses can manage to conduct manual accounting practices with limited in-house resources.

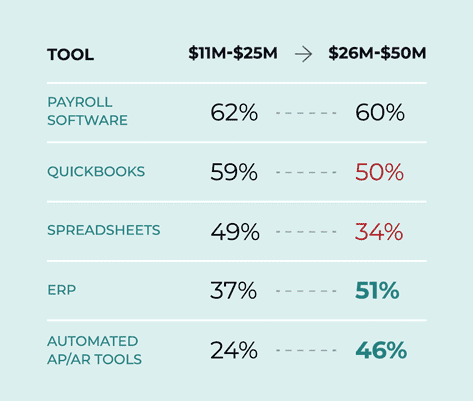

As the volume of revenue increases, however, it will be more difficult for your team to remain efficient and avoid accounting errors. Businesses with higher financial maturity will inevitably need to veer from error-prone spreadsheets to automated software.

Automated processes, such as accounts receivable (AR) and accounts payable (AP), are indeed necessary, and the sooner your business moves to integrate them, the stronger your financial reporting quality becomes.

3. You’re not consistently reviewing your month-end close process

Inefficiencies in your month-end close processes can also become a strain on your internal resources. With larger workloads and slower processes, your financial reporting is at greater risk of error. A study from Ventana Research reveals that “midsize organizations are slow closers,” with 59% taking more than a week to close their books. Of those, 54% rely extensively on Excel spreadsheets in the process.

Reviewing and improving your month-end close process on a regular cadence requires your business to:

- Expose inefficiencies

- Prioritize risks and categorize accounting errors

- Create new standard procedures and schedule corrective actions

Simple adjustments can result in a big payoff by reducing friction in your monthly processes and increasing operational efficiency.

4. You’re reconciling information from multiple sources

As transaction volume increases, AR reconciliations become a challenge for your financial team. The Journal of Accountancy recommends strong accounting leadership as a hedge against reconciliation woes, stating that financial leadership can take the helm in “tracking the completion status of all reconciliations, making sure the reconciliations are finished on time and following up on incomplete or late reconciliations.”

When working with a slew of electronic transactions and customer portals, payment and remittance information comes flooding in from multiple sources in various formats. Timely tracking of these transactions is essential to avoid reporting and accounting errors.

5. You’ve just acquired a company

While a successful acquisition is cause for celebration, it can also be a risk to your financial reporting. Perhaps you’re considering an acquisition, or you’ve recently acquired a new company and are struggling with the unfamiliar territory of intercompany accounting (ICA).

Acquiring a company may mean that you’re inheriting a less mature tech stack or that your team must integrate disparate accounting systems. Your accounting team then becomes an indispensable component in the success and compliance of your M&A efforts. Comprehensive financial leadership with a deep understanding of your industry and its nuances will significantly reduce the risks to your financial reporting during your company’s evolution.

6. You don’t have an objective eye to look at your processes

When you’re pursuing fundraising or your bandwidth is low, you may be too “in the weeds” to notice minor accounting errors that compound over time. Having an objective third-party perspective can quickly catch those errors in real time to prevent them from getting worse.

Seek the help of a trusted accounting controller to uncover underlying risks. Their job is to oversee the accounting functions of a business, ensure accurate ledgers and adhere to financial regulations. In addition to improving financial reporting accuracy, they can act as a trusted consultant to help position your business for sustainable growth.

Invest in finance and accounting to drive growth

When you implement detail-oriented oversight, you improve your financial reporting quality. Paro delivers flexible accounting solutions to optimize your reporting and accounting processes. Receive technical and industry-specific expertise from a community of elite, remote finance experts to improve your company’s reporting accuracy and reach greater financial maturity.