Businesses that wait until tax season to identify savings risk missing out on greater tax efficiency and opportunities to make their initiatives more profitable. Smart business tax planning requires staying abreast of policy changes, fluxes in the economic climate and new tax credit opportunities that can be incorporated into strategic reviews and financial analysis year-round.

Determine what your business can plan now to proactively reduce tax obligations for the 2023 tax year and prioritize profitability beyond the regular tax season.

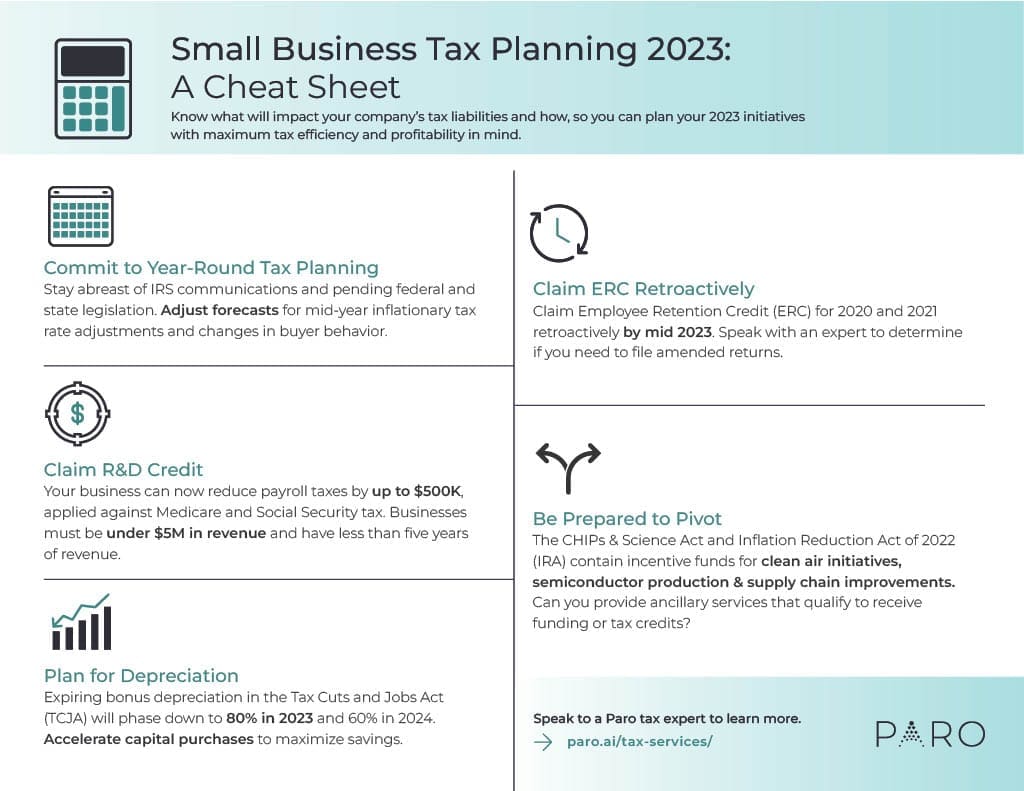

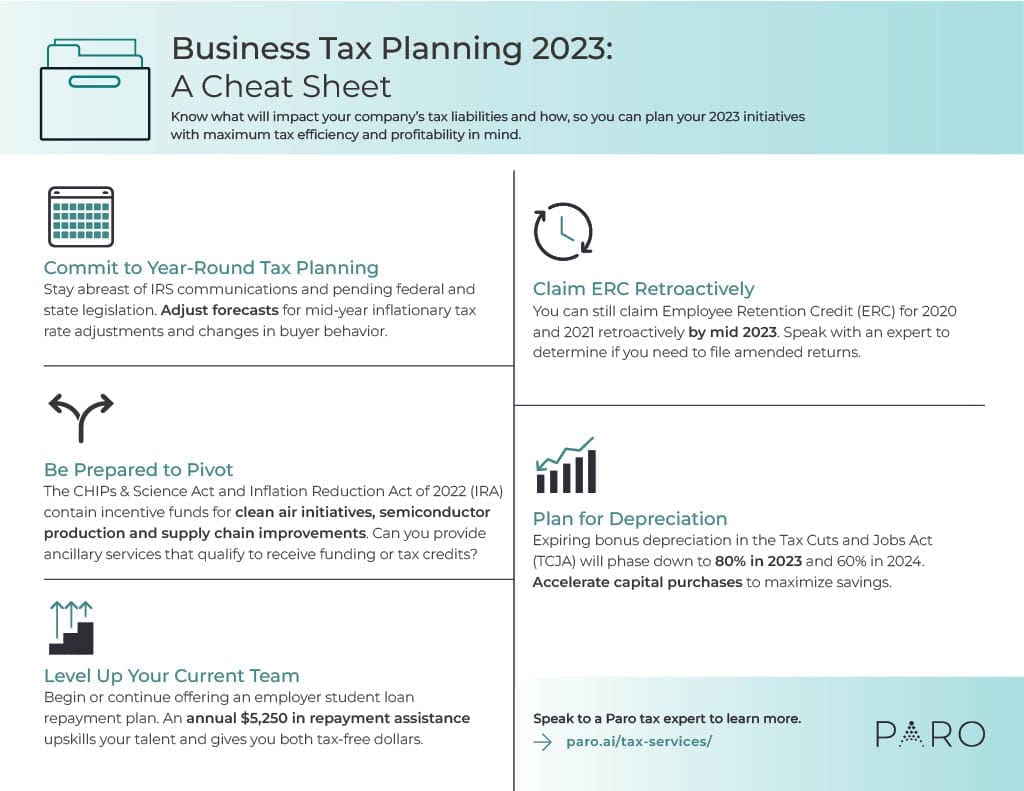

Do You Qualify for Employee Retention Credit (ERC)?

The monetary benefits of the Employee Retention Credit (ERC) are substantial—up to $5,000 per employee in 2020 and up to $21,000 in 2021—but the timeline for claiming them is running out. Claims for 2020 ERC begin expiring in 2023, so better include this in your tax planning for next year.

Businesses that haven’t claimed Employee Retention Credits for the 2020 and 2021 tax years should have their circumstances professionally evaluated for eligibility.

If your business claims ERC, you must amend income tax returns to record additional funds attributable to the corresponding period(s). Those that qualify as recovery startup businesses have the potential to claim an additional $7,000 for 2021 Q4 wages.

Claim More in Research & Development Credits

Beginning in 2023, small businesses and startups can apply to claim qualified small business payroll tax credits for research activities of up to $500,000 against their Medicare and Social Security taxes. Businesses must be under $5 million in revenue and have less than five years of revenue to qualify. The R&D tax credit has improved tax efficiency in industries such as manufacturing, information, finance and insurance. Millions of tax credits are also claimed in other industries including health, agriculture, entertainment, transportation, and more.

Accelerate Purchases to Benefit from a Reduced Depreciation Rate

The Tax Cuts and Jobs Act (TCJA) will continue to demand attention as various provisions expire or are phased out over time. The 100% bonus depreciation—also known as Section 179 deductions—will end in 2022. There will be a 20% step down in the bonus depreciation percentage each year from 2023 to 2026.

An 80% depreciation rate is still a significant amount, so businesses planning expenditures within the next four years should accelerate their qualifying purchases (e.g., computers, software and certain vehicles) when possible. The tax efficiency gained from reducing tax rates is greater when tax rates are higher.

Note: Under the TCJA, the current top corporate federal corporate tax rate is scheduled to change from 21% to 28% in 2023.

Pivot with the CHIPs & Science Act

In August 2022, the CHIPs & Science Act was signed into law. It allocated funding to encourage American-made semiconductors, address supply chain vulnerabilities and revitalize scientific research and technology leadership and development.

The act includes $39 billion in clean air incentives and a 25% tax credit for capital expenses for manufacturing semiconductors and related equipment. Tooling businesses and those with specialty expertise can choose to support the initiative and carve out a profitable niche.

The program’s infrastructure also supports streamlined project permitting through interagency collaboration, which will further help facilitate project implementation. American industries that depend on semiconductors for their products can surely benefit from this act and should consider including it as part of their tax planning strategies.

Reevaluate Your Business Entity

Pass-through entity businesses—sole proprietors, partnerships and some LLCs—should conduct annual examinations to determine whether their business entity type is still optimal for their business. A thorough cost-benefit analysis will look at income thresholds, the cost of the change and the work involved. When examining available tax planning strategies, consider if changing to an S corporation or C corporation will provide further savings.

Support Student Loan Forgiveness Programs

The 2022 Student Loan Relief program to cancel debt for borrowers and adopt income-based payments is currently on hold after being blocked by a court ruling. Loan forgiveness could be back on the table, however, in the future.

While this is especially important for business owners in small business tax planning, it’s also beneficial to employees of larger companies . If available, encourage and assist employees in applying for these programs to help relieve their financial stress and boost morale in the workplace.

On the other hand, the Employer Student Loan Repayment plan may have been eclipsed by the 2022 program. However, it still remains available for larger employers who can contribute as much as $5,250 in repayment assistance per year.

Implemented in 2020 as part of Section 2206 of the CARES Act (Coronavirus Aid, Relief and Economic Security), the program was extended an additional five years in 2021. Both employers and employees gain from tax-free payments that can be made directly to employee borrowers or their educational institutions.

Track Inflation and Economic Volatility

In October 2022, the IRS responded to rising inflation by making more than 60 rate and tax provision adjustments for 2023. Annual business tax planning activities should include comprehensive reviews of tax rates and regulations, as well as state and local taxes.

Inflation Reduction Act Tax Credits & Funding

The expansive Inflation Reduction Act of 2022 (IRA) contains a variety of provisions that begin in 2023. Existing alternative fuel vehicle credits for consumers are expanded to include pre-owned cars and consumer vehicles. The provisions also lift the cap per manufacturer.

Demand will spike for alternatively fueled vehicles in an already compressed market. Whether buying one personally or buying a fleet of heavy-duty trucks for your business, take time to understand available credits and vehicle prices, weights, batteries and origin requirements necessary to take advantage of the opportunity.

But remember, putting a limit on out-of-pocket Medicare costs, extending the Affordable Healthcare Act and investing in energy production and manufacturing all come at a cost.

Primary funding of the IRA includes three main sources:

- Enhanced IRS tax enforcement

- A 15% corporate alternative minimum tax

- Prescription drug price reform

Additionally, a new one percent excise tax on the fair market value of stock repurchased in buybacks will affect many larger businesses. From a tax perspective, the act provides multiple opportunities for tax incentives. You may consult an expert to learn more how you can include it in your tax planning strategies.

Get More Business Tax Planning Support

Take advantage of opportunities for greater tax efficiency beyond tax season. Qualified, remote tax experts at Paro can quickly assess your company structure, operations and financials. They can expedite developing 2023 tax planning strategies unique to your organization. Get matched with a tax professional that can set the pace for year-round tax planning.