Businesses seldom have the luxury of maintaining the same pace for very long. Supply issues, an influx of orders or economic downturns can create anomalies. But sometimes the business trajectory is squarely headed toward growth or contraction. When that becomes apparent, the next step is to consider whether your current business entity choice is still the best fit for your organization.

Several reasons could prompt you to change your formal business structure, but minimizing the tax burden on your owners and timing the change correctly should be major considerations as you move forward.

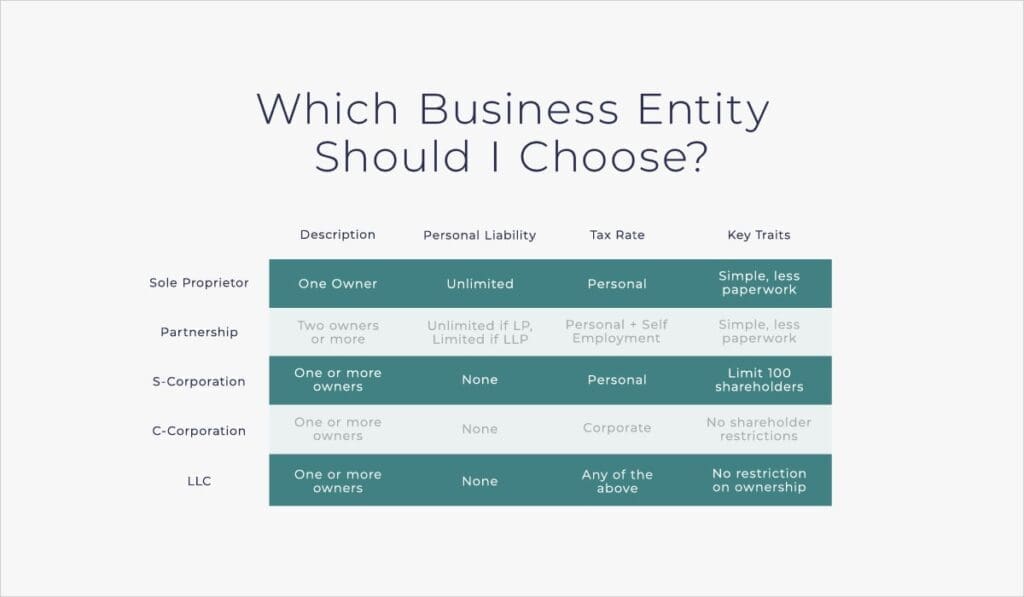

A Business Entity Refresher

Business owners choose their business entity type by selecting and filing the appropriate documents along with their associated fees, or by default when no selection is overtly made.

Sole Proprietors and Partnerships

When businesses open their doors without a shred of paper, they have two common options in the way of business entities. If the entity is one person, it’s a sole proprietorship. If it’s more than one person, it’s a partnership. Those are the defaults.

Naturally there is more complexity that can—and should—be added as revenues increase, employees are hired and potential liability risk develops. In both sole proprietorships and partnerships, there is unlimited personal liability unless the partnership structure expressly limits it.

A partnership where two or more people own the business should evolve from a simple partnership. That partnership may start with a verbal agreement to either:

- A limited partnership (LP), where there is one general partner with unlimited liability, and the others with limited liabilities; or

- A limited liability partnership (LLP) where every owner has limited liability.

Corporations

Corporations are formed as separate entities from the owners and shield the owners from personal liability in most situations. Exceptions are made for fraud and negligence, but for standard business operations, the owner wouldn’t have their own assets at risk in the event of a bankruptcy or lawsuit.

The two types of corporations—as they relate to taxes—are C corporations (C-corps) and S corporations (S-corps). C corporations are taxed at the corporate level, and owners are taxed again on distributions. By contrast, S corporations are taxed federally at personal tax rates (like sole proprietors and partnerships) and taxed by most states similarly. They may be taxed by some states as corporations, and in Louisiana, as a hybrid of the two.

Limited Liability Companies (LLCs)

Unlike corporations, limited liability companies (LLC’s) are entities created by state statutes. This allows the LLCs to choose the form of business that they will file their income taxes under, which could be either as sole proprietors, partners (LP or LLP), as a C corp or S corp. Most LLCs are sole proprietors or partnerships that file as LLCs to gain the limited liability protection that they offer.

Tax Obligations

Where federal taxes are concerned, the IRS taxes company profits at personal tax rates, corporate tax rates or both.

Personal Taxes

When personal tax rates are involved, the business entity is considered a disregarded entity or a ‘pass through.’ The company’s tax obligations are passed to the owners and submitted on their personal 1040 income tax returns. Sole proprietors calculate their business tax liability on Schedule C and file them in conjunction with their 1040 personal income tax returns.

Partnership tax returns and S corporations returns are calculated and filed before breaking down the tax obligations for each owner. Both groups of owners will receive Schedule K-1 forms that provide them with the details to fill out Schedule E with their 1040 returns in order to indicate their portion of the entity’s income or losses.

Self employment taxes (15.3% in 2024) are owed by sole proprietors and partners on business income, whether they’ve extracted the money for their own use or left it in the business to help it grow. S corporation owners are not subject to self-employment tax and will pay standard employment taxes (7.65% in 2024) on funds distributed for their salaries.

Corporate Taxes

Corporate tax rates are charged to C corporations, and the profits are often considered to be double-taxed, because the corporation tax returns document the tax liability of the corporation itself. When distributions are made to owners, the profits are then taxed to the owners as capital gains taxes.

When to Consider Changing Business Entities for Tax Purposes

Tax minimization strategies are those that help owners minimize their tax liability while still following all tax regulations. Maintaining a corporation is typically more costly than using a simpler business structure, and while potentially complex, the tax advantages may certainly be worthwhile for you personally as well as for your company.

Comparing the corporate tax rate (21% currently) with your personal income tax bracket (10% to 37%) is often the first step in considering entity changes for tax purposes. Consider the cost of making the change (including potential legal, accounting and filing fees) and the financial and organizational needs of the new business structure. Keep alert to potential tax rate changes as you perform your due diligence. A tax rate change may negate some advantages of changing entities, but other considerations may still provide a compelling argument to update your entity choice.

Timing Your Entity Update

You may not always have the luxury of deciding when an entity change should be filed or become effective, such as when a partner passes away. But when the option is available, timing can play a critical role in creating a smoother transition — and it’s best to start planning early.

When requesting an election to file as an S corporation (form 2553), the IRS requires that the election be made within the first 75 days of the tax year (for a 1/1 effective date, it must be submitted by 3/15). Or, if planning ahead, it can be filed anytime during the prior year for it to begin on the first day of the next tax year. Making a clean transition at the start of a tax year will make the change infinitely easier than applying for relief with a late election, which may or may not be accepted. (Note: use form 8832 for other entity classification changes such as adding a partner, changing to a C corporation or switching to a single owner election.)

Additional Reasons to Consider Changing Tax Classifications or Entity Structures

Tax advantages are a great reason to update your entity choice, but they are not the only time you should consider it.

- Business loans – Banks are more hesitant to lend money to sole proprietors and simple partnerships that do not have formal business structures in place.

- Business risk – Growing businesses can see an increased risk of insurance claims and legal actions. Sole proprietors, simple partnerships and LPs should consider enhancing their personal liability protection by changing to an LLP, LLC or corporation.

- Raising capital – Being able to raise money through the sale of stock requires corporate formation.

- Expected sale – Corporation ownership exists beyond any individual. If you ultimately want to sell your business, a corporate entity will be more attractive to potential buyers.

Potential Hurdles When Changing Business Entities

While changing your tax filing entity can be an excellent strategy to manage your tax obligations, be sure to understand the nuances of the new tax entity and the consequences of the change.

- In some states, adding a new partner can immediately dissolve an existing partnership and require new certifications, permits and agreements.

- Entity changes may require a new EIN (employer identification number). While they are free and easy to obtain, you will want to ensure that the transition to the new number occurs in a timely manner.

- For all entity types, be certain to consult an expert or conduct extensive due diligence if you have tax nexus in multiple states. Registering the new entity and understanding the tax treatment and foreign qualification in each may be simple, or it could take careful planning to meet each state’s requirements.

- While most states automatically accept S corporation status from your IRS filing, a few require that you file with them individually for the same designation. State licenses and permits may also need to be updated with entity changes.

- S corporations are limited to 100 shareholders who are all domestic owners. If foreign shareholders or a greater number of shareholders is desired, it may be the right time to change to a C corporation.

Enhance Your Tax Strategy

The choice of business entity affects the amount of taxes you pay, the paperwork you must file and, ultimately, your personal liability. Your entity choice and timing should be skillfully evaluated and promptly implemented when the change is advantageous to your business and its owners.

If your organization is evaluating its tax strategy and exploring additional ways to minimize its tax obligations, schedule a consultation with Paro to find tax planning, filing and strategic support from a top-of-class fractional professional with the expertise to carefully assess your situation.