As new accounting technologies automate compliance work, businesses are turning to accounting advisory services to take over their full accounting and finance needs. The modern accountant is now one that can provide client accounting services (CAS) to provide more value to CPA firm clients or clients of their own.

“When you go to advisory services, where the accounting industry is headed towards, it’s a more proactive approach to accounting,” states Alvonn F, MBA, a fractional accountant that specializes in advisory. He offers his insights on CAS, its benefits and best practices for successful implementation.

What Are Client Accounting Services (CAS)?

Traditional accounting involves largely retrospective tasks—i.e., looking at historical financial records, preparing tax returns or performing basic bookkeeping tasks. Regardless of who completes the work, there is no way to differentiate the final product. For this reason, CPA firms have been expanding their service offerings by not just reporting on the past, but making suggestions for their clients’ futures.

CAS allows accountants to use historical reports to analyze client challenges and suggest growth strategies. Examples of these solutions can include tax planning, technology stack implementation and cash flow forecasting.

“I think it’s super important and relevant now, especially with economic uncertainty and the need to be more proactive…you know, even as forecasting becomes way more advanced, people are becoming so much more proactive in their accounting,” says Alvonn.

How Does the Client-Accountant Relationship Change?

When accountants transition to CAS, they often build stronger client relationships. Alvonn explains that, unlike a traditional account, a firm offering CAS is not simply making sure that everything is good, compliance wise. “[They] give advice to make sure that the business actually survives,” states Alvonn.

In other words, the accountant delivers projects with the aim of helping the client’s business grow. This can, in turn, build trust with the client. CPA firms and their talent must be willing to go deeper into client relationships, looking more frequently at clients’ real-time performance and checking in with clients on a set continuous cadence.

The Benefits of Offering Accounting Advisory Services

As the accounting industry evolves, CAS is becoming a popular service line for accounting firms. The benefits to both CPA firms and independent accountants leading their own team include:

- Stability: Alvonn articulates, “You can go from offering one-time, yearly services…to recurring monthly services”. Advisory services require more frequent deliverables than compliance services, so there is more guaranteed work for the accountant.

- Expertise: The most valuable insights for a client comes from accountants who are experts both in their accounting practice (e.g., tax preparation, financial forecasting, etc.) and the client’s industries. An accountant has the opportunity to showcase their knowledge in the industries he/she has experience in while continuing to build expertise through the client engagement.

- Value-based pricing: Alvonn F. stresses that value-based pricing provides higher revenue for the accountant. Accountants get to increase their fees in a value-based pricing model because CAS are inherently more complex than traditional compliance services.

That being said, CAS also provides ample benefit to the client, making it a winning strategy for both parties. These client benefits include:

- Expertise: The client gains not only a subject-matter expert in accounting or financial analyses, but also an expert in the client’s industry. Oftentimes, that means the expert can identify more efficient standard operating procedures (SOPs) for clients and advise on important industry news or regulations.

- Troubleshooting for financial growth: In its most basic form, CAS can help a firm identify and troubleshoot its financial challenges. When done perfectly, it can unlock major financial growth opportunities for a client’s business.

- Partnership: An advisor is often far more invested in growing a client’s business and setting it up for future success. That partnership gives clients the reassurance that they are working with a growth partner as opposed to a transactional partner.

Essential Skills for a Successful CAS Practice

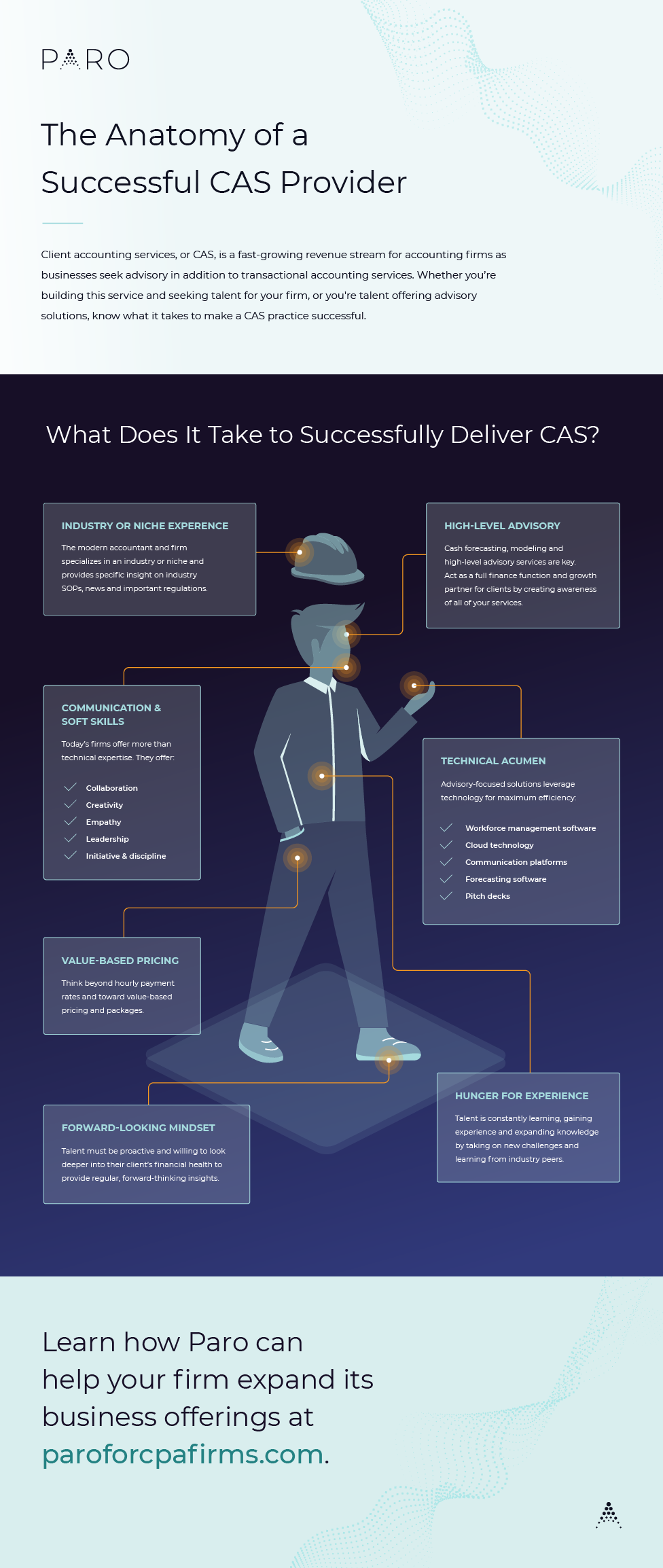

In order to officially scale existing services to include advisory, there are certain skills that an accountant within a CPA firm—or independently—must demonstrate:

Analytical Skills

Financial analysis, and especially forecasting, is an essential skill for fulfilling high-level advisory and differentiating your value. With firms now offering flexible CFO solutions, talent must have the technical acumen to perform financial analyses and make strategic recommendations.

Alvonn F. advises, “You have to be able to use the numbers to forge a plan for the company to go forward.”

Tech Stacks and Software

Efficiency is important when moving to high-level analysis. Firms offering these full-suite services need to have the necessary technology and technological expertise within its staff to make strategic recommendations.

Beyond that, however, Alvonn recommends that accountants also be proficient in tools that aid client relationships, such as:

- Workforce management software

- Document capturing software

- Communication software (e.g., Slack)

- Screen recording software (e.g., Loom)

“You have to make sure that you have an ability to communicate with all the different people that [are] involved in the process. So whether that’s the contractors that you have, the employees in your business, or whether it’s a client, you have to make sure that you have great workforce management software,” Alvonn says.

Soft Skills

The more closely accountants work with their clients, the more they become a partner in the client’s business. With this partnership comes the need to tailor written and verbal communications to the preferences of the client. Creativity, empathy and discipline are a few of the communication and soft skills that talent should possess.

Steps such as bi-weekly meetings can help a CPA build trust with clients and move towards a modern relationship.

Niche Expertise

The most efficient finance professionals are those that have years of experience in one or a few specific industries. They know the common practices and challenges for the industry and are thus able to better inform their client’s financial strategy.

“If you focus on one or two industries, then you’re so knowledgeable about it that you can be much more efficient and help your clients as much as possible,” says Alvonn.

Due to his expertise in the cannabis industry, for example, Alvonn is able to help clients solve challenges that are unique to their industry. As a young legal industry with many regulations that have not yet come out, he notes that many tax strategies have not yet been tested in the tax court. Therefore, knowing these limitations and regulatory issues helps him advise clients on key business decisions.

Develop a CAS Practice for Your Firm

Need help developing an advisory arm for your firm? Paro can help you flexibly source remote finance professionals for your firm. Our elite experts deliver specialized industry expertise tailored to your clients’ needs with fast and efficient onboarding. From bookkeeping to financial analysis, Paro provides staff augmentation services to help you build your CAS practice.