Inflexible or static budgets may make sense for a small business or a company with predictable expenses and revenues. However, most growing companies find themselves with more complex, flexible budgeting needs as their original assumptions quickly become irrelevant throughout the accounting period.

Embracing budget flexibility through a flexible budget offers a clear picture of company performance. It enables real-time adjustments as revenue, costs, and other external factors change, ensuring your budget remains relevant even in fluctuating economic conditions.

What Is a Flexible Budget and How Does It Work?

Flexible budgeting assigns budgets to each business department based on a percentage of the revenue generated from that group, which means that these budgets are adjusted as revenues change throughout the year.

While a flexible budget takes more time to implement and maintain, it makes it easier to quickly change course based on new insights from your variance analysis or from rolling forecasts. Because of the need for real-time insights, this process requires more financial analysis and strong analytical talent to implement.

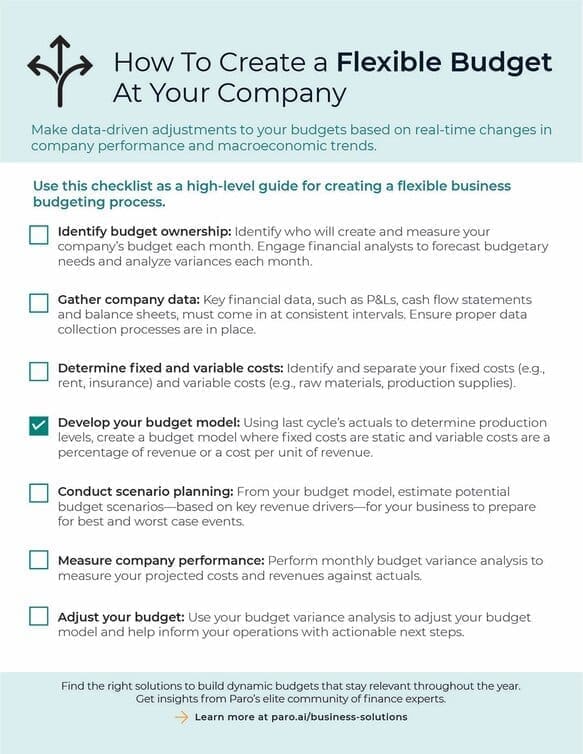

For businesses seeking to implement increased budgeting adaptability, our checklist outlines the steps needed to create a flexible budget that adapts to changing conditions. Download the checklist below to start building a budget that grows with your business.

Static vs. Flexible Budget: Which Is Better?

When evaluating your budgeting options, it’s essential to consider the differences between a static budget vs. a flexible budget. A static budget assigns a fixed amount of money to each company department, usually based on the company’s revenue forecast that may not end up holding true as the year progresses. In contrast, a flexible budget adjusts to changing revenue and expense levels, offering greater adaptability.

Static budgeting is relatively simple to maintain, but there are some key drawbacks:

- Budgets have to be recalibrated entirely if the forecast or other factors change.

- The budget is based on assumptions that are likely to change as time continues.

- Static budgets don’t offer insight into current performance.

The Advantages of Budget Flexibility

A survey by Gartner shows that 72% of businesses are prioritizing flexibility in their budgeting process in order to deal with disruption and changing demands. This prioritization lends itself to faster, data-driven decision making for the following reasons:

- A flexible budget makes it easy to analyze multiple performance scenarios for a fiscal year by inputting a range of variable cost scenarios.

- Regular variance analysis can indicate which departments are hitting their forecasts and which aren’t meeting expectations, allowing for greater accountability and adjustment.

- As revenues increase, businesses can adapt more quickly and capitalize on stellar performances with added spend for certain departments or initiatives. The reverse is also true, where businesses can reduce spend quickly as revenues decrease.

- Using real-time data, companies can proactively address—rather than react to—economic impacts on their production and costs by adjusting their budgets accordingly.

Is This Method Right for My Business?

In a flexible budget, fixed costs are inputted as static values, but variable costs are calculated as a percentage of total revenue. Thus, the budget will automatically change based on how much revenue the company drives.

These budgets are perfect for companies whose variable costs can be directly tied to revenue, as the “variable cost: revenue” ratios are imperative for the flexible budget formula calculation.

This type of budgeting is also ideal for a company that has a centralized reporting system for financial data. Once the budget is set, financial analysts must periodically measure the company’s actualized budgets to compare the variance between the projected budget and the actual budget. This analysis is crucial for maintaining relevancy, and it can only be done with timely, centralized financial data from each business department.

How To Create A Flexible Budget

Businesses looking to implement a more adaptable budget ought to preemptively hire or allocate financial resources to create and maintain it. Generally, budget analysts or FP&A consulting (financial planning and analysis) professionals take on the responsibility of creating the budget, monitoring spending and making recommendations based on performance. These resources are imperative to ensure that the budget remains relevant as company performance and other factors change.

Companies also need to set up data collection systems to perform periodic budget variance analysis. Budget variance is the difference between budgeted expenses/revenue and actual expenses/revenue. It’s a good gauge of whether each company department is on track to meet its targets. Measure budget variance after each accounting period. This requires updated P&L, cash flow and balance sheet accounts from each department at consistent intervals.

Once the team is assembled and the data collection systems are in place, companies can take the following steps to implement the budget:

- FP&A experts create a budget model that assumes static fixed costs and calculates variable costs as a percentage of total revenue.

- The company uses the model to create potential budget scenarios based on the company’s revenue forecasts.

- FP&A experts perform a budget variance analysis after each accounting period to compare the projected budgets to the actual budgets.

- Budget owners adjust the budget to adapt to new factors and changes in performance. This adjustment should happen quarterly (or even monthly for seasonal businesses) to keep your budget relevant.

Transition to Dynamic Budget Planning

Interested in finding a flexible budgeting solution for your business? Paro offers solutions to help you create flexible budgets and perform in-depth financial analysis to enable faster data-driven decision making throughout the year. Your business will be matched with a remote expert from a community of the top two percent of finance professionals to support and inform your strategy.