Keeping up with the complicated tax code can create stumbling blocks for small businesses who spend substantial time and money to prepare accurate returns and avoid audits. Tax compliance can be a surprising cost for business owners, with retail small businesses spending 163 hours and an average of $17,000 per month on sales tax compliance alone.

Some challenges, like the ever-changing tax code, may be outside of your control, but getting your business obligations organized with a simplified process can reduce the time and money spent on tax preparation and compliance.

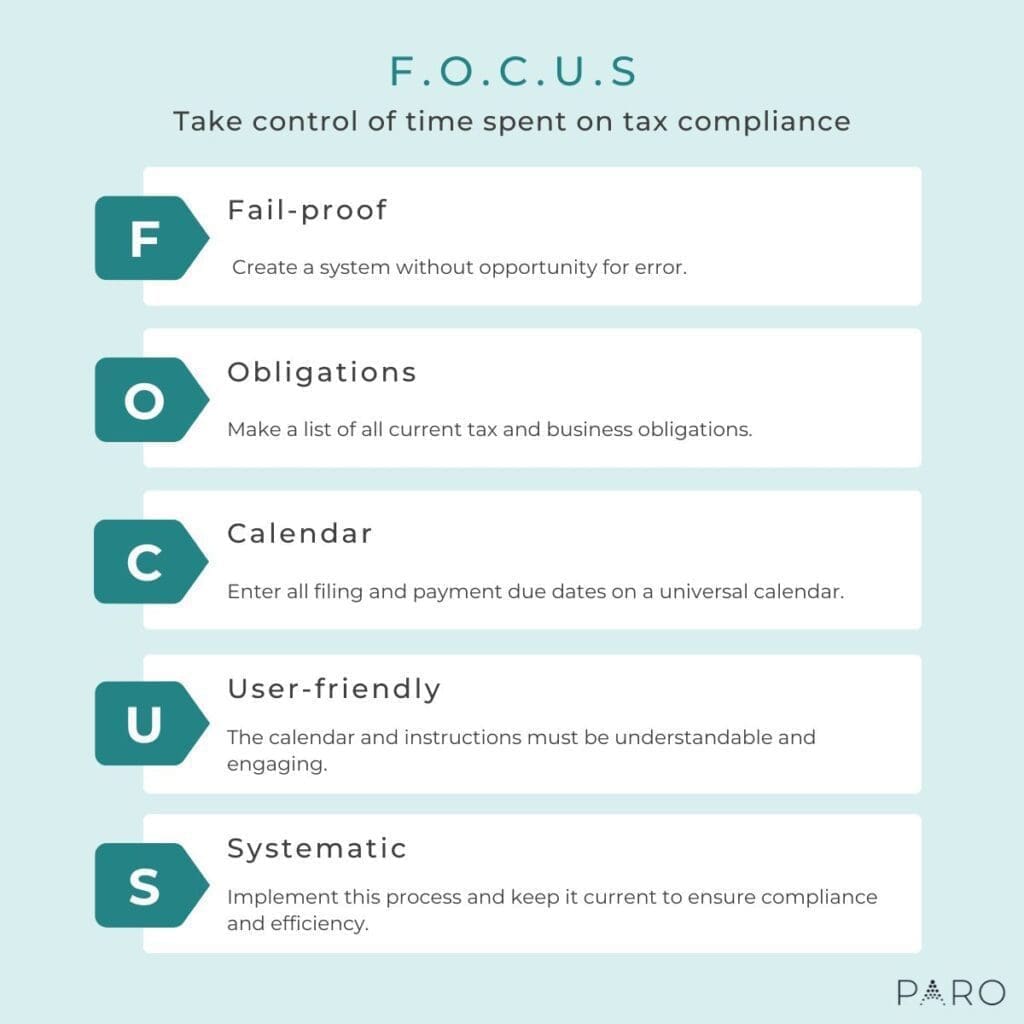

Use FOCUS to put your business obligations on autopilot

Paying taxes, filing returns, renewing licensing agreements and other similar tasks require a tight process. Use the five steps of the FOCUS mnemonic below to help you meet your tax compliance obligations more effectively.

1. Set your sights on building a fail-proof process

Building safety checks into your business processes can help you avoid costly errors that take you away from your most important business priorities. Utilizing checklists, reminders and human checkpoints will make completing necessary tasks easier and more efficient. Checklists offer a full-proof method of tracking each process so that important dates, processes and documentation do not fall through the cracks. Standardized methods of gathering data and processing payments will free up your time to work on developing new products and or getting ready for your next launch.

2. Assess your obligations

It may feel like a tedious task, but assessing and organizing all of your compliance responsibilities will pay dividends later. If your finance department is lean, an accounting or tax expert can help you assess your business obligations and guide you through changing regulations and the information you need to maintain compliance.

Start with your basic tax forms. Income tax forms vary depending on your tax entity type. Include these items within your list.

- Begin with your business income tax return and potentially your personal income tax return if you want to consolidate your obligation list.

- Next, include any estimated tax returns, K-1 partner or shareholder information returns with space for each filing and payment due date.

- If extensions are the norm for your business, include extension forms, the preliminary payment due date, the new extended filing due date and its final payment date.

Do you have employees?

- Each employee will fill out W9 forms when they are hired. Have them updated if new information is received.

- You must provide W2 forms annually to employees by January 31.

- File Form 941 quarterly with the IRS and Form 940 annually for employment taxes withheld and due.

Do you pay independent contractors or lawyers?

- 1099-MISC and 1099-NEC forms are required when dollar thresholds are met. Due dates may vary when filed electronically versus on paper.

Do you have physical or economic nexus outside of your home state?

- Ensure you are tracking your sales tax compliance for each state where they are due. Routinely check state laws, thresholds and due dates. Many states have recently updated their tax regulations.

Record each type of business license, tax and contract obligation that comes to mind. Search your accounting records for anything coded to licenses, fees, taxes, professional memberships (if they are expected in your field) and mortgages. If your business is more mature, you may keep a lease schedule. Consider all of your federal, state and local obligations as well as any health or safety obligations that are required for your business. Drop in dates or months next to each obligation for additional organization.

If you work with a CPA or EA (enrolled agent) to file your tax returns, or if you use a third-party administrator to prepare your payroll, then note all future meeting dates with these professionals and when you need to supply them with the information required to complete the returns or processes. If you do not know the dates offhand, set a placeholder for them. Then, work your way back from those placeholders and record the dates and duration you’ll need to start collecting the data for those meetings.

For each obligation requiring payment, list the filing and payment dates separately. The activities may be completed by different individuals or incur a processing delay. Separating the filing of the forms from the payments ensures that both will be completed.

3. Create a master calendar

Paper and large whiteboard calendars are good, but an electronic calendar that includes all of the details for completing tasks—as well as reminder and assignment tools—is ideal. Include notes describing which reports need to be pulled, the locations of hard-copy documents and anything else that will be helpful down the line.

The IRS offers an online tax calendar with continually updated federal filing dates. Use a separate calendar—whether you subscribe to it or download it—rather than embedding it into a specific person’s calendar. This will allow it to be universally shared and can be used as the base for your comprehensive tax compliance calendar. The IRS tax calendar includes listings for all entity types and different payroll frequencies, so loading it into a separate calendar is a good way to determine if it’s helpful to you or if it adds too much clutter.

4. Make tax compliance user-friendly

There is no value in consolidating your compliance obligations if the information you have gathered can’t be readily accessible to those who need it. A dense tome of regulation language may be glanced at during an audit, but it is unlikely to be adopted and relied upon if it’s not in a pleasing format with clear instructions and guidance.

Your compliance calendar will be the primary element that users routinely engage with, but you may also consider preparing a standard operating procedure (SOP) that describes the review process, dates and instructions more deeply. Include it in your business continuity plan should it ever be needed. Have a non-accounting team member review it to ensure that they understand the company’s obligations, when they occur and how to pull the data to support filing a tax return and preparing a payment.

Creating a user-friendly process also means using digital tools available for accounting, finance and tax management. If you are preparing your information manually, you may be incurring additional time and opportunity costs. It also makes it more difficult for multiple team members to review information in real-time from separate locations. Investing in more practical tools, or turning to an expert to help you implement and navigate these tools, can significantly reduce the time spent processing and pulling data.

5. Rely on a systematic approach

Investing time and energy in a new process may seem costly, but beginning with an initial hour time block and continuing to diligently hone your compliance documentation will quickly produce beneficial results.

Keep your tax compliance process updated as you incur new obligations. Schedule time to annually revisit the process, ensuring it is meeting your needs. Effective planning for tax and business obligations will ultimately transition you from a reactive approach to a proactive one, thereby lowering the time and resources spent on tax compliance.

Get support for your business’s tax preparation and compliance

Do you want to simplify tax season and focus on growing your small business? Do you need help navigating tax obligations and the tax code overall? Paro can match your business with tax planning and filing solutions to help you stay compliant, file more efficiently and save your business money that you can use to invest toward your strategic goals.