For small businesses, every resource counts. Your cash management and profitability determine not just survivability, but your position in a competitive market. Accurate financial statements tell you, your stakeholders and the IRS a lot about your business historically, but it’s cost analysis, budget performance and internal reporting that can give you granular, actionable insights for profitability. Are you investing appropriately in managerial accounting as a part of your overall accounting function?

Financial Accounting vs. Managerial Accounting: What’s the Difference?

Think about the financial reports that your accountant or bookkeeper creates each accounting period. What do they tell you and who do they best serve? As your business grows and evolves, your reporting will need to become more detailed and strategic. In other words, you’ll need to build on your financial accounting and external reporting with relevant management reports to drill down deeper.

What’s the difference?

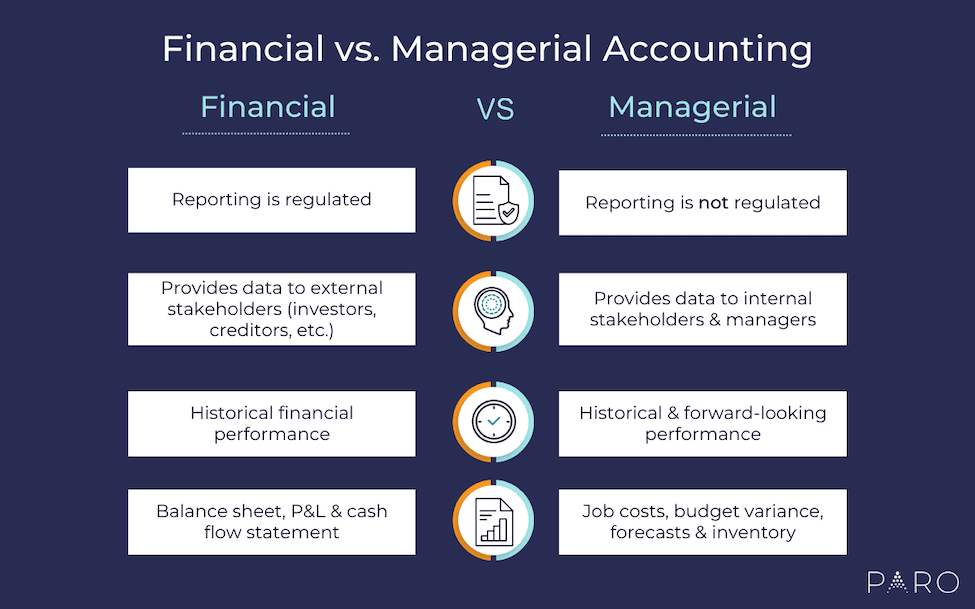

Financial accounting involves recording transactions and preparing financial statements for external stakeholders. This type of accounting is focused on accuracy and meeting compliance standards as required by GAAP (Generally Accepted Accounting Principles). It provides historical performance data to help leaders identify trends and for stakeholders to evaluate the company’s liquidity and overall health.

Managerial accounting, in contrast, is not regulated. This freedom allows accountants to prepare and present custom financial reports and dashboards that are highly effective for internal users. These reports allow leaders to go deeper into the risks, costs and potential benefits within individual departments or projects. This subset of accounting gives you insights into the steps you can take to make operations more efficient and profitable.

Managerial Accounting: Shifting the Focus Internally

The focus of management accounting is in providing valuable analytics and metrics to empower better decision making. The reports produced span from departmental budgets to lease or buy decisions to daily operational metrics. These reports offer performance feedback and outlook projections for the company as a whole or within subsets..

While some financial professionals are titled managerial accountants, others work under the titles of controllers and financial analysts. Each position performs a significant amount of management accounting work in their job.

Managerial accounting focuses on three main areas:

- Planning: Preparing a budget, monitoring results and adjusting forecasts in response to actual results, economic indicators and new information.

- Controlling: Conducting variance analysis, identifying trends and investigating discrepancies to course correct or put in controls to manage risks.

- Decision making: Compiling data, information and presenting options in response to ad hoc questions. Questions posed can include determining how to prioritize advertising spend, allocate IT resources for upcoming projects or requesting financial models to support a merchant account selection process.

When speed to market counts, leveraging management reports prepares businesses to make faster, more precise decisions. Companies of all types benefit from a greater focus on internal reporting. Service businesses, merchandisers and manufacturers gain more control over their products, pricing and inventory when advanced analytical techniques and evaluations are applied within the accounting function.

Components of Management Accounting: Job Costing, Budget Variance and More

The flexibility of management accounting allows you to glean insights frequently and with customization. Management reporting provides specialized information around profitability and performance metrics, as well as non-financial metrics. But in addition to profitability KPIs or customer satisfaction data, these major components of managerial accounting can help you track performance and improve profitability:

Job Costing or Cost Accounting

Job costing or cost accounting allows you to assess the costs associated with individual jobs or projects. In manufacturing, for example, it assigns the cost of converting raw materials into finished goods at various stages of completion. Fixed and variable costs are assigned and allocated to provide manufacturers with valuable information for pricing, inventory management and production automation.

Analyzing costs and cost variances at a granular level gives you deeper insights into areas of inefficiency or risk, so you can make better decisions around operations, pricing and product.

Budget Variance Analysis or Performance Variance

Budget variance analysis compares expected budget performance with actual results. It’s important for businesses to track variances on a monthly basis to adjust forecasts and future budgets for better accuracy. Having more accurate assumptions can help you make more proactive management decisions to reign in spending or boost investment in production for best selling products.

Cash Flow Forecasting

Cash flow forecasting projects cash flow fluctuations and prepares businesses to correctly time CapEx (capital expenditure) purchases in sync with revenue availability. When additional funds are needed for expansion or research and development projects, providing lenders with a supported cash flow forecast can facilitate a smoother loan process.

Cash flow reporting is an important part of resource allocation and budget planning. A controller can provide cash flow forecasts and recommendations to improve cash flow via inventory management, investments and more.

Inventory Analysis

Inventory analysis ensures goods are available to fulfill orders. Properly classifying supplies to limit excessive purchases will reduce dead stock and waste. Inventory reporting can help you more accurately calculate your cost of goods sold (COGS) and make better decisions around production and inventory levels to reduce shrinkage, carrying costs and other issues affecting your profitability.

Accounts Receivable

Aging reports categorize outstanding debts owed to a company by due date categories (current, 30, 60 and 90 days old). This categorization helps to manage collection efforts and make decisions of when to stop extending credit to specific customers. Using a days sales outstanding (DSO) metric, management can quickly gauge collection trends and call in sales executives to aid in collection efforts when their accounts are overextended.

What Skills Do You Need to Enhance Your Accounting Function?

Accountants and controllers with a managerial background are highly sought after due to the tangible benefits derived from their expertise. Businesses can hire a certified management accountant (CMA) who has completed a bachelor’s degree in managerial accounting. Or, they can hire a professional with similar work experience in managerial reporting. With required education, references and successful examination, specialty credentials can also be earned from the Institute of Management Accountants (IMA), the American Institute of Certified Public Accountants (AICPA) and similar organizations.

The main attributes of a skilled managerial accountant or controller include extensive experience with internal reporting, communication and creative problem solving.

Recruiting managerial accounting professionals can be challenging in a tight job market. Hiring vetted outsourced professionals on a part-time basis is an excellent way to begin expanding your management reporting metrics. Whether on an ongoing, part-time basis or ad-hoc, outsourcing provides flexibility and speed for working with financial experts.

Paro can match you with specialized accounting and controller expertise to help you build internal reporting and enhance strategic decision making. Our vetted fractional experts are among the top two percent in finance talent across the country, available to advise your business affordably and at your pace.