Cash is king, and poor cash flow is most often the culprit behind a failed business. For small businesses, your ability to cover your operations is crucial, but you also want enough left over to invest in growth. If you’re seeking a business loan or you want to better track spending against your targets, then a cash flow forecast is the first step in managing your position and making informed decisions. Learn the components of a basic 13-week cash flow forecast for small business and how to use and adjust them as performance changes.

What Is a 13-Week Cash Flow Forecast?

A 13-week cash flow forecast is an essential decision-making tool for businesses of all sizes, but they can be made especially simple for small business financial planning, as smaller entities don’t often have the expertise or technology for advanced forecasting.

A cash flow forecast, often called a cash flow projection—though forecasts and projections are technically different—can help you identify potential cash flow shortages and understand how much cash will be available for future investments, such as equipment or an expansion. A 13-week forecast in particular projects future company cash flow within a 13-week period based on current and anticipated inflows and outflows.

By focusing on a 13-week period, you’ll gain a better understanding of your immediate cash flow needs and make necessary adjustments to ensure you have enough cash on hand to cover your company’s expenses.

What Are The Components Of A Cash Flow Forecast?

Cash flow forecasts can use a similar forecast template as a financial report (the direct method) or be simplified to focus on cash-intensive activities (the indirect method). Most businesses currently use the indirect method for cash flow forecasts.

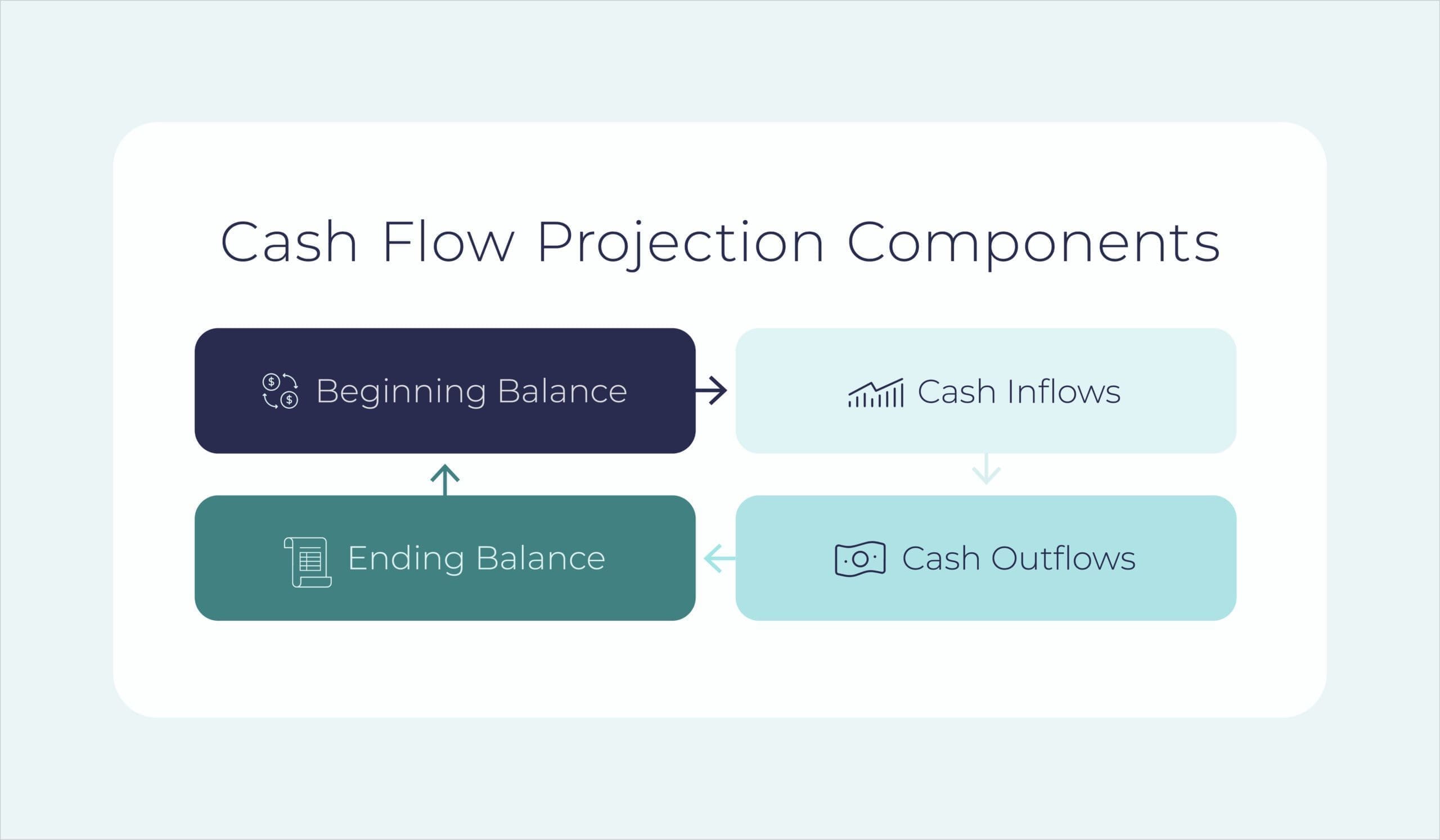

Simplified cash flow forecasts start with a beginning balance. Each company’s beginning balance will be either the final cash flow balance for the previous month or the balance from the last period that was forecasted. This ending balance comes from subtracting cash outflow from the combined beginning balance and cash inflow. Cash inflow and outflow contain the following variables:

What is included in cash inflow?

Cash inflow may include money received in:

- Cash sales

- Payment of accounts receivable invoices

- Proceeds from loans, grants, or funds

What is included in cash outflow?

Cash outflow is defined as any cash payments paid out by a business during a specified period of time. These include:

- Employee wages

- Suppliers

- Taxes and other obligations

- Rent and loans

- Inventory

- Assets

- Bills recorded in accounts payable

You should also keep in mind how you pay your suppliers. If you pay a supplier by credit card, this transaction will have no effect on cash flow that month. It will instead increase the liability on the company balance sheet. When the credit card payment is made, it will be included in the cash outflow for the month when it’s paid.

How Cash & Accrual Accounting Affect a Cash Flow Forecast

Many businesses operate on either a cash or accrual basis of accounting. Accrual accounting records transactions when expenses are incurred rather than when payments are made. Cash accounting works the opposite way. It recognizes expenses when cash or funds are actually paid as opposed to when they are incurred.

A company’s choice between cash accounting and accrual accounting will affect its cash flow forecast. In cash accounting, the forecast may not reflect the actual timing of when the revenue was earned or the expense was incurred. This can result in fluctuations in cash flow that do not reflect the underlying business activity.

In contrast, accrual accounting can provide a more accurate picture of the underlying business activity and cash flow. In this sense, accrual accounting can help businesses forecast future cash flows more accurately by accounting for revenue and expenses that may not have been received or paid out in cash yet.

How To Build A 13-Week Cash Flow Forecast

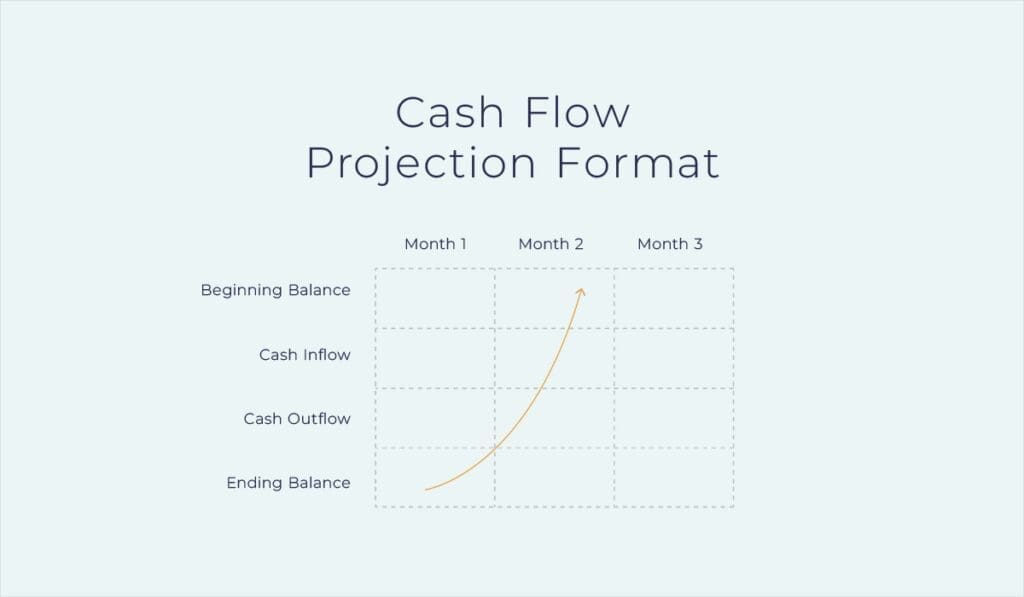

Cash flow forecasts can be formatted in different ways with varying degrees of granularity, such as the basic cash flow forecast template below. The critical piece is that it provides enough information for you to have an understanding of your cash position at different points in time, so you can course correct and stay ready for the unexpected.

Cash flow forecasts flow as follows:

- The cash inflow and outflow sections list each high-level category. They’re then sub-totaled, resulting in the net cash flow for the month.

- The ending balance is then brought forward as the beginning balance for the subsequent month.

Remember, net profit is not the same as a positive cash flow, so companies should be sure to differentiate the two as they analyze their numbers.

If a month’s ending cash inflow exceeds cash outflow, there is positive cash flow. However, if negative cash flow exists, there’s a deficit. Thus, these cash flow forecasts will show your liquidity at each point in time.

Adjusting Your Forecast Assumptions

With cash flow assumptions, be realistic rather than idealistic. Projecting cash flow conservatively is often the best course of action.

To determine the numbers that will be put into the company’s forecast, consider the following assumptions and record them as well as the amounts within the forecast.

Assumptions include:

- Timing of inventory purchases that support the anticipated sales volume

- Seasonal fluctuations, holidays and planned events or sales

- The current profit margin for the company’s products or services

- Desired capital purchases to support company growth

- The company’s accounts receivable turnover rate

- Staffing change fluctuations in relation to sales volume

- The number of paydays within each month

The beauty of forecasting is playing with different assumptions. Potential expansions, mergers or discontinued product lines can each be played out in a cash flow forecast to help determine which course of action is best suited for the company’s strategic vision.

Need assistance with your 13-week cash flow forecasts? Are you ready to add more complexity? At Paro, we offer customized finance solutions for every financial aspect of your business, whether that’s forecasting consulting, cash flow projections or general cash flow management. Our remote finance and accounting services experts bring years of experience in your industry and possess the right technical skills to deliver at any level of sophistication.