In the quest to stay lean, small businesses and startups must constantly prioritize hiring to balance growth with financial discipline. For accounting and finance functions, a single leader—often a controller or CFO—is tasked with overseeing financial operations and overall financial health. Though business leaders often refer to these roles interchangeably, it’s important to understand the differences between a controller versus CFO and how they deliver distinct value.

For businesses that aren’t ready to hire full-time or need the expertise from both roles, fractional talent allows businesses to hire flexibly to their exact needs at their current stage of business.

Controller vs. CFO: What’s the Difference?

The difference between a controller and CFO may seem inconsequential for businesses that task their finance leader with both high-level strategy and basic accounting functions. But businesses that hire for the specialized expertise that each role provides will get more from their talent.

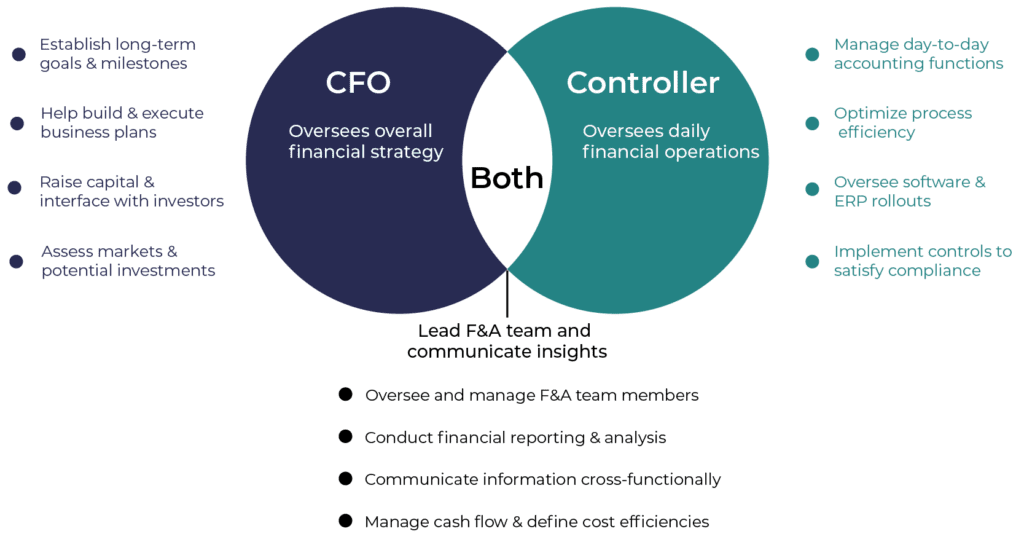

The core difference between a CFO versus a controller is time. While the CFO is focused on the long-term strategy and business plan, a controller is focused on present, day-to-day financial operations to support strategy and cost efficiency. However, the controller role is becoming more strategic in recent days as CFOs look for their support in order to increase bandwidth.

Both the controller and CFO should be team leaders that manage the finance and accounting department and its managers with an eye for efficiency and cost. They should also be good communicators that can analyze data and explain complex financial information to leadership and stakeholders.

When to Hire a Controller

Organizations typically start with bookkeeping software to track transactions with the help of a bookkeeper or accountant. As employees are brought in, the payroll function expands. Volume increases, tax time comes and, suddenly, the day-to-day transactions are too much to track reliably.

It’s time to hire a controller when:

- You’re ready to switch to accrual accounting, which requires meeting certain accounting standards and generally accepted accounting principles (GAAP).

- Your accountant must produce financial statements and reports for investors or lenders.

- You’re experiencing growth into new locations that increase compliance obligations.

- Your accounting team is growing, which requires team management and standardized processes.

- You need to increase the efficiency of your reporting and monthly close, or more importantly, the accuracy of your statements.

For businesses that have a CFO but no controller, a controller can help relieve the CFO from accounting duties to focus on high-level strategy.

Controller Expertise

Controllers typically have accounting degrees, such as certified public accountants (CPAs) or certified managerial accountants (CMAs). They may have deep experience in your industry or bring something new to the table based on their previous experience at other organizations.

Controller Responsibilities

To support you in your business, a controller’s priority is to ensure the completeness and accuracy of your financial statements. While a controller can also help you forecast and budget, their core focus is on accurate and timely reporting.

Controllers have responsibility over the following:

- Accounts payable

- Accounts receivable

- Payroll activity

- Month-end close

- Tax and accounting regulatory filing

- Compliance and audits

Controllers are often seen as tactical managers who ensure that directives, policies and standards are followed. They implement internal control to minimize fraud and improve reporting quality.

When to Hire a CFO

If you have a controller, they can provide you with analysis, but their bandwidth and relationship building capabilities may not be enough to lead in a merger or acquisition or expand to additional products.

You should consider hiring a CFO when:

- You’re fundraising or need to manage and communicate with investors to maintain their confidence.

- You’re eyeing a major transaction and require transaction advisory services or are building toward an exit strategy.

- You want to reduce costs and streamline your operations and business processes.

- You’re designing a compensation strategy to retain your top talent.

- You’re looking to move into new geographies or product and service offerings.

A fractional CFO can bridge the gap until you need a full-time CFO and provide interim support during an unexpected event or major transition. Historical bank collapses and the supply chain crisis are very real reminders of situations where having a fractional CFO can make a world of difference to a startup or high-growth business.

CFO Expertise

Chief financial officers may have an accounting background, earned an MBA (Masters of Business Administration) and developed their business acumen over years of experience. CFOs are expert analysts, great communicators and consider all parts of the organization to build a big-picture strategy.

CFO Responsibilities

CFOs are strategic financial advisors and are the face of the organization to financial partners such as banks, investors, shareholders and the business community. They typically maintain a strong network of contacts to stay on top of industry trends or to use when opportunities arise.

CFOs are responsible for the following:

- Devising and implementing growth strategies

- Reviewing and executing contracts

- Managing company investment activities

- Attesting to the completeness and accuracy of the company’s financials

- Assessing new opportunities and moves in the market

Cybersecurity, contracting insurance and spearheading transactions all lie in the domain of the CFO. At mature institutions, CFOs lead the finance department and may have their own staff for financial planning and analysis (FP&A) and treasury management personnel in addition to being responsible for the accounting department.

Analysis & Technology: Where CFO and Controller Expertise Meet

While controllers and CFOs have distinct roles, there are many instances where the two roles overlap.

Both CFOs and controllers are involved in budgeting and forecasting. Where controllers coordinate the preparation of budgets and forecasts to help you plan and manage cash flow, a CFO is also looking to further evaluate risks and forecast the impact of specific scenarios on your business.

Technology and digital transformation is also an area where controllers and CFOs are both intimately involved, especially in an ERP (enterprise resource planning) system implementation. They frequently stay abreast of new technologies and use their management skills to align people, process and technology during a transformation.

Organizational Hierarchy

When there’s only one leader, a CFO or a controller will report directly to either the chief executive officer (CEO) or the board of directors. They must keep the lines of communication open between both to ensure that a unified strategic plan is maintained and nothing is assumed.

When both a controller and CFO are in place, the controller reports directly to the CFO. If no controller is on board, the accounting staff reports to the CFO.

Fractional Talent Makes Expertise Accessible

Hiring a freelance controller versus a CFO does not have to be a choice between one or the other when you’re trying to stay lean. Though hiring full-time will depend on your budget, your industry, your goals and your financial complexity, a fractional professional lets you hire with flexibility.

When local talent pools are sparse or full-time employees don’t make sense economically, a vetted part-time professional can help on a project basis. That means you can employ the expertise of a fractional controller to assess or improve your reporting and get the strategic guidance of a CFO for an upcoming fundraise or go-to-market plan. You’ll avoid the costs of benefits and training and get the talent you need to get to the next level.

CFO vs. Controller: Select the Right Fit

At Paro, we leverage our proprietary AI technology to help you find the best-fit remote finance experts to solve your problems and drive growth. We’ll help you find the right solution for your current business stage to help you save time on recruiting and get back to your business.