After establishing your business, there is one factor that will determine if you have the ability to invest in further growth or stay in place: cash flow. Cash flow is often one of the biggest challenges to small businesses trying to scale. Whether you are a team of one or have a team of dozens, cash flow management is going to be at the center of most—if not all—of your next steps.

Why is cash flow so important?

A healthy amount of cash flow is essential for continued growth and investment in the future. Are you ready for your next opportunity?

- Can you afford to buy the inventory needed to fulfill a purchase order from the biggest player in town?

- Will you be able to make payroll next month when football season has passed and demand plummets for your stadium chairs?

- Is it time to make a lease or buy decision on computer equipment for your newest location?

These questions and many others require you to have a firm grip on your cash flow in order to make decisions that align with your strategic vision. Businesses that routinely analyze their cash position will be better positioned to support their obligations and run their operations more efficiently.

Components of cash flow management

First and foremost, it is important to keep accurate and timely records. Once you can accurately report your numbers, then you can properly manage them.

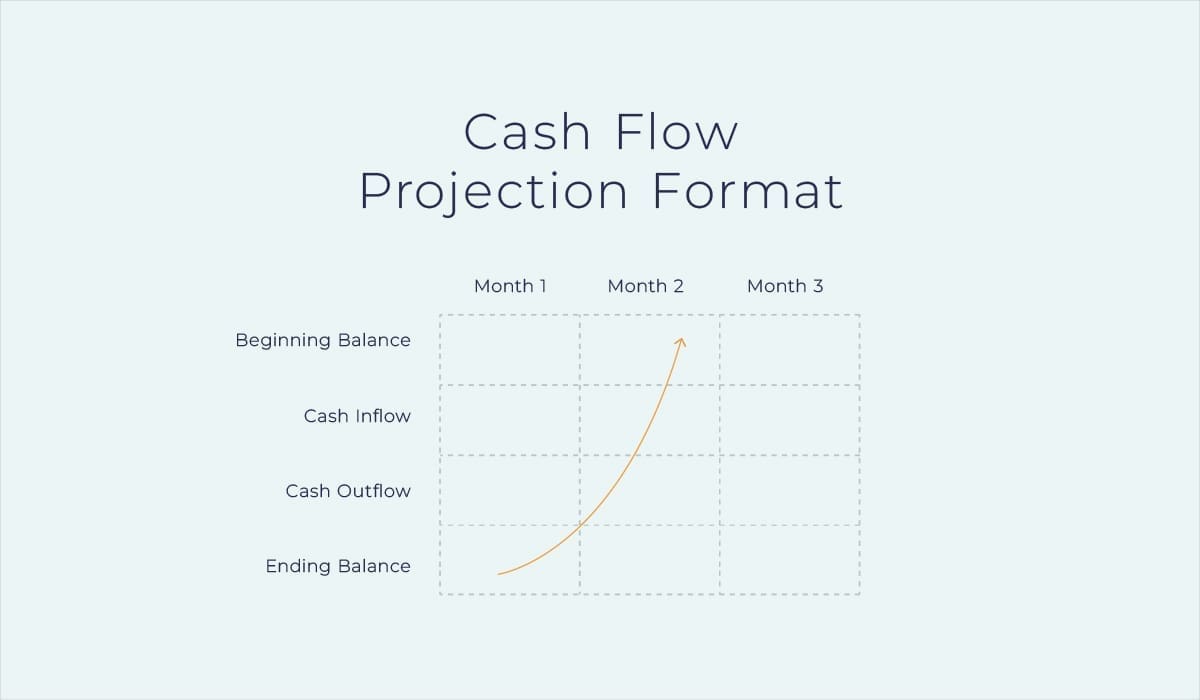

If you prepare a monthly cash flow statement as part of your overall reporting, you are taking the first important step in evaluating and increasing your cash flow. Cash flow projections can use the same template as your financial report (the direct method) or be simplified to focus on cash intensive activities (the indirect method). Most businesses use the indirect method for cash flow reporting.

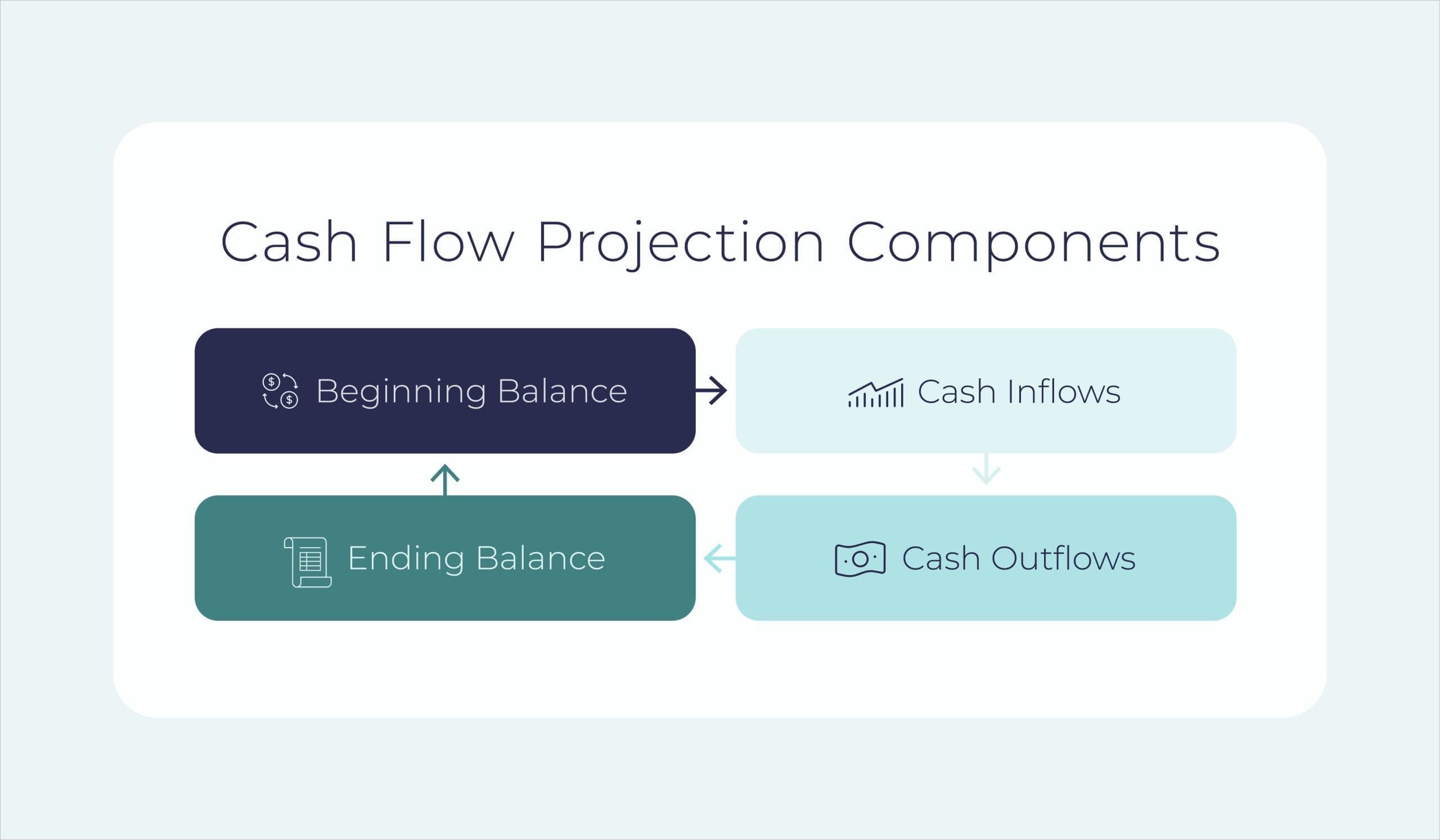

Simplified cash flow projections—or forecasts—start with a beginning balance. Your beginning balance will be either your final cash flow balance for the previous month or the balance from the prior period for which you have forecasted. This ending balance comes from subtracting your cash outflow from your combined beginning balance and cash inflow. Cash inflow and outflow contain variables that are outlined below.

What is included in cash inflow?

Cash inflow may include money received in:

- Cash sales

- Payment of accounts receivable invoices

- Proceeds from loans, grants or funds

What is included in cash outflow?

The expenses paid out by a business are numerous, including cash payments for:

- Employee wages

- Suppliers

- Taxes and other obligations

- Rent and loans

- Inventory

- Assets

- Bills recorded in accounts payable

Keep in mind how you pay your suppliers. If you pay a supplier by credit card, it will have no effect on cash flow that month. It will instead increase your liability on your balance sheet. When the credit card payment is made, it will be included in the cash flow for the month when it is paid.

How cash and accrual accounting affect your cash flow report

Many businesses operate on either a cash or accrual basis of accounting. Accrual accounting records transactions when expenses are incurred, rather than when payments are made. Prepaid expenses work in a similar manner.

Cash flow reports for those that operate on a cash basis are less complex, since those that use accrual accounting will need to exclude all accruals and prepaid expenses. Businesses that use accrual accounting must strictly include transactions that involve receiving or spending cash or cash equivalents (e.g., checks or money orders).

If a computer, for example, is leased over several months, the payment is recorded as an asset to the business, and the expense is recorded over the months included in the lease. Since no cash is exchanged in many of these periods, activity for the accrual transactions are excluded or subtracted from the cash flow projection.

For both accounting methods, accounts payable and receivable transactions remain on the balance sheet and only impact cash flow when payments are received or bills are paid.

How to build a small business cash flow model

Forecasting by quarter, month or week is common. If your business is in an early stage, projecting a week at a time will be a valuable way to understand each element within your cash flow analysis.

The cash inflow and cash outflow sections list each high-level category, which are then subtotaled, resulting in the net cash flow for the month. The ending balance is then brought forward as the beginning balance for the subsequent month. Net profit is not the same as a positive cash flow, so be sure to differentiate the two as you analyze your numbers.

If a month’s ending cash inflow exceeds cash outflow, there is positive cash flow. However, if negative cash flow exists, there is a deficit. These cash flow models will show your liquidity at each point in time.

Cash flow models can be formatted in different ways in varying degrees of granularity. You can use specialized software or spreadsheets depending on the complexity of your business. The critical piece is that it provides enough information for you to have an understanding of your cash position at different points in time to enable accurate decision making and course corrections.

Define and adjust cash flow assumptions

With cash flow assumptions, be realistic rather than idealistic. Projecting cash flow conservatively is often the best course of action.

To determine the numbers that will be put into your cash flow model, consider the following assumptions and record them in conjunction with the amounts within your cash flow projection.

Assumptions include:

- Timing of inventory purchases that support the anticipated sales volume

- Seasonal fluctuations, holidays and planned events or sales

- The current profit margin for your products or services

- Desired capital purchases to support company growth

- Your accounts receivable turnover rate

- Staffing change fluctuations in relation to sales volume

- The number of paydays within each month

The beauty of modeling is playing with different assumptions. Potential expansions, mergers or discontinued product lines can each be played out in a cash flow model to help determine which course of action is best suited for your strategic vision.

Prepare for action to change your cash position

If the results of your cash flow model are concerning, remember that this process is a positive step forward. Your effort to evaluate your cash position gives you the insight to prevent unwanted surprises. No business wants to be in the position of having to postpone paying bills or payroll, but knowing in advance what may occur given your assumptions allows you to take corrective action.

Actionable ways to correct negative cash flow

Short-term negative cash flow is sometimes expected, such as during a period of growth or an investment made to remain competitive. However, if negative cash flow is consistent, or your bills are in jeopardy of not being paid, then you may need to take one or more of the following actions to mitigate issues in the short or long term.

- Determine ways to generate more sales.

- Reduce your expenses.

- Adjust the timing of bringing on a new hire or making an equipment purchase.

- Review your accounts receivable and accounts payable policies.

- Sell older inventory at a discount.

- Sell unused business assets.

- Adjust market strategy.

- Seek out business loans or grants.

- Consider adding an investor to provide an influx of cash.

Manage accounts receivable

Unless you conduct all business transactions at a point of sale terminal or with a ‘Buy Now’ button, accounts receivable will likely have a significant impact on your cash flow.

Beyond staying on top of invoicing, collections and contracts, consider this list of ways to increase your cash flow and bring in payments sooner.

- Reduce your invoice due days from net 30 to net 10.

- Require payment on receipt, particularly for consumables.

- Offer prepayment discounts when quotes are given.

- Train and incentivize the sales team to obtain down payments.

- Add a late penalty.

- Make subscription offers encourage retainer contracts to even out cash flow.

- Increase the down payment amount required from 25% to 50%.

- Identify the slow payers and change their payment terms or cut off extending credit in the future.

- Factor your receivables (sell a block of your receivables to receive capital in advance of your customer payments).

Rely on the applications and software you have to set up reminders for collection calls and to send out second and third invoices in short intervals.

Reviewing your payment options can highlight additional opportunities for convenience and faster payments

- Include ‘Pay Now’ buttons within each email and on each invoice attachment.

- Facilitate credit cards with online payment processing if they’re not yet in use.

- Expand your payment options by adding third-party processors like GooglePay, Apple Pay or PayPal.

- Encourage—or only allow—payments by debit cards or electronic funds transfer (EFT) to reduce or eliminate credit card expenses.

- Add bank lockbox processing so payments are immediately deposited upon receipt. If you have one already, consider adding a second across the country to reduce lag.

Manage accounts payable

The payments you make also offer opportunities to increase cash flow.

- Negotiate payment plans to even out your cash flow.

- Request higher credit limits to support sales fluctuations.

- Consider buy versus lease options.

- Slow down your outgoing payments. Select invoices for payment based on their due date rather than paying each bill as soon as it arrives.

If you must be late with a payment, be upfront with your vendor and contact them personally. Assure them when the payment will be made and make it as promised. Turn this into a positive opportunity to strengthen your business relationship and build trust.

Plan for contingencies and create cash reserves

Handling sudden cash needs, whether they are due to economic downturns, seasonal slumps or an unexpected repair, each have a damaging impact on healthy cash reserves.

Some industries, like insurance, have legal requirements to maintain cash reserves, but for others it is simply a best practice. Nonprofits may want a three- to six-month reserve in case donations dry up. Food service distributors and outlets typically operate with paper-thin margins, so reserves are necessary when a small issue can have an outsized impact.

If cash reserves just are not possible at this time, apply for a line of credit with a lender before you need it. Establishing these relationships ahead of time allows for organic development and secures your pathway to growth.

Support your cash flow strategy with the right expertise

Cash flow management is an iterative process that requires constant feeding, review and proactivity. Planning and prioritizing your income, expenditures and cash expectations will help grow your business in the way you envision.

Achieving monthly net profits is an attainable goal, but don’t build your future on them until your cash flow allows you to fund the projects and expansions that you foresee down the road. Better analysis leads to better growth decisions.

If managing your cash flow is stretching your time and resources, Paro can match you with the right cash flow strategy, guided by a fractional expert with industry knowledge to match your business needs. Find immediate small business cash flow solutions to help you scale sustainably.