As a business owner, you probably are already aware of cash basis vs. accrual basis accounting. Here, we’ll explain the differences between them and help you decide which one is right for your business. Finally, we’ll show you how to switch from one to the other.

What’s the Difference? Cash Basis vs. Accrual Basis Accounting

Cash basis and accrual basis are both IRS-approved accounting methods. In other words, depending on the size of your business, you’re free to use either one. They’re simply two different ways accountants calculate revenue and expenses for a company.

However, if your business revenue exceeds an average of $25 million per year, the IRS requires you to use accrual basis. This is important to keep in mind as your business grows.

With cash basis accounting, you log your revenue and expenses as they occur. This is similar to balancing your checkbook, as you log any money coming in when it comes in. Then, when money goes out, you log that in the moment as well.

Cash Basis Accounting Example

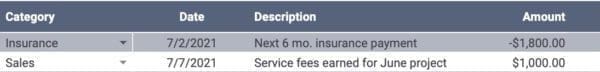

Let’s say you earned $1,000 in July for a service you performed in June. You would put that money in your ledger when you receive payment in July, rather than when the bill was sent in June.

Simultaneously, if you’re paying six months’ worth of insurance valued at $1,800 at the beginning of July, you would log that payment in July as well.

Overall, you now would record an $800 net loss for the month of July. That’s because, in July, you only earned $1,000 for your June work while you spent $1,800 on insurance payments for the next six months.

For most of us, this method of accounting is fairly straight-forward and simple.

Accrual Basis Accounting Example

Accrual accounting works differently.

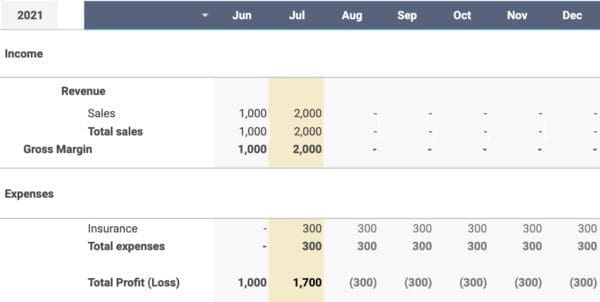

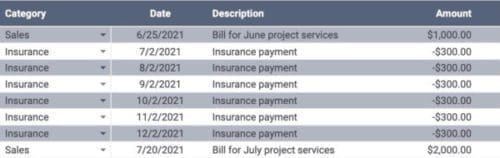

Using this method, you would have logged your $1,000 service in June when you sent the bill. It would already be recorded in your ledger, so nothing happens when the payment is actually received in July.

Additionally, let’s say you billed an additional $2,000 worth of work in July that you don’t expect to receive payment on until August or September. Unlike with the cash basis method, the date the payment is received doesn’t matter. Your July billings are all recorded as July revenue. That means you earned $2,000 in revenue that month.

At the same time, that $1,800 insurance bill you paid in July will now be spread out throughout the full six months that it’s covering. In other words, you only spent $300 on insurance in July and another $300 on insurance in each month from August through December. All you need to record in your ledger for expenses in July is the first $300.

When you calculate this all together, accrual basis accounting shows you’ve actually earned a $1,700 profit in the month of July.

You can see what a difference these two accounting methods make for your bottom line.

Why a Company Chooses Cash vs. Accrual Accounting

Cash basis accounting may look simpler on the surface. In fact, it may even be better for certain small businesses when they’re first starting out. However, as businesses grow, the accrual accounting method offers significant advantages because cash accounting doesn’t give an accurate picture of how your business performs over time.

For some companies, accrual accounting may have benefits over the cash method because:

1. The IRS requires companies with over $25 million in average annual revenue to use the accrual method. So, if you expect your company to scale into a large company—one that might be required to use the accrual method eventually—it might be better to make the switch now. To make the switch, you need to file IRS Form 3115, and that can be a complicated process. Keep reading to learn more about this below.

2. Companies that keep a lot of inventory on hand may be required to use accrual basis accounting as well. That’s because companies selling their inventory on credit may not have their revenues and expenses recorded in the same accounting period. Obviously, this difficulty can be overcome by using the accrual method.

3. Finally, if you’re looking for investors, accrual accounting gives them a more accurate picture of your company’s overall health. Accrual enables potential investors to more accurately see what your company’s balance sheet looks like on a month-to-month basis, so they can better analyze risks to their investment.

For these reasons, though many small businesses choose to use the cash method, it might not be the best method, especially if you expect to scale into a larger business down the line.

How You Can Switch from Cash to Accrual Accounting

If your business is currently using cash accounting, but you want to switch to accrual, you can certainly do that. However, the IRS requires you to use the same accounting method throughout an entire tax year. So, no switching horses midyear.

If you do want to make the switch, your company will need permission from the IRS. This can be a lengthy process, but it might be worth it for the sake of your investors, inventory or potential growth.

As mentioned above, you must file IRS Form 3115. Then, switching from cash to accrual requires a multi-step process that includes the following:

- Add up accrued and prepaid expenses: This includes all the expenses you’ve billed for but haven’t received payment on yet.

- Add in your accounts receivable: This covers all unpaid customer invoices you need to add to your books.

- Subtract cash payments and receipts: This could wind up affecting your previous period’s earnings, but you need to track it nonetheless.

- Subtract prepayments: These turn into short-term liabilities until you deliver goods or services.

Finally, when filing your Form 3115, you need to attach your profit and loss statement and balance sheet from the previous year.

Get Help Switching from Cash to Accrual

Given the lengthy requirements of the process, it’s never too soon for a business with growth aspirations to make the switch. If your company doesn’t currently have a dedicated CFO or finance team, you don’t have to do it alone. Your business can still get help.

For starters, there’s software out there. This can be useful for a small team, but it still requires an investment of time and energy. There are also companies dedicated to helping match your organization with an accounting professional on either a short- or long-term basis.

At Paro, we precisely match clients with the best-fit finance experts to achieve specific goals. If you want to make the switch from cash basis to accrual accounting, let us help you find the accounting support you need today.