The future of reporting lies in real-time insights and continuous closing cycles. Real-time data is becoming a vital currency for businesses, but financial data is more often bottlenecked by the cumbersome month-end close process. Following the launch of ChatGPT and the rise of AI, automation is now at the forefront of transforming this process toward a zero-day close. Businesses still have a long road ahead to achieve this level of efficiency, but any step toward continuous closing cycles is a step in the right direction.

Is a Zero-Day Close Possible?

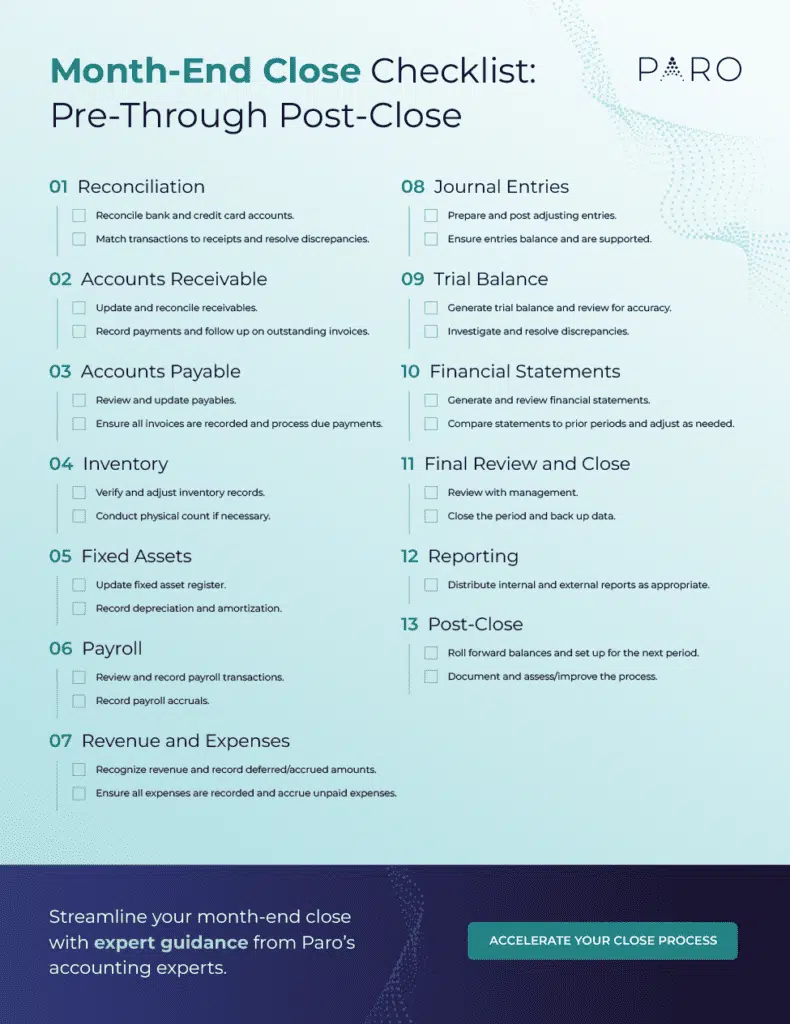

The month-end close process ensures that all of the previous month’s transactions have been recorded, reconciled and corrected for errors. The process varies by business, but it can take a week or even more before financial information can be reported to decision makers—and all too often, it’s no longer relevant.

A zero-day close—also known as a continuous close—allows you to close the books as you go, so you can provide vital financial information in real time, at any time. It may seem like a fantasy, especially since enterprises with sophisticated processes still struggle to master the close. But today’s technological advances can, at the very least, help your business report faster or adopt a more effective “soft” close with confidence.

Even if getting to a continuous close is not your endgame, working toward it can reap significant benefits.

The Advantages of a Faster Month-End Close Process

Automation is key. In fact, 72 percent of businesses that automate reconciliations achieve their month-end close within a week, whereas only 25 percent of non-automating businesses achieve the same close.

When you remove or significantly reduce manual work from accounting and business processes, you create both short and long-term gains:

- Improved accuracy and compliance: Continuous, automated reconciliations lower the incidence of errors and solve for them faster. Easier and faster data access streamline the audit process and make regulatory deadlines less daunting.

- Reduced costs: Spend less time on manual processes to reduce labor expenses while achieving greater efficiency. Move the workflow along seamlessly with automated approvals and task routing, and follow up without additional effort.

- Enhanced security: Automated security controls with roll-assigned users lower the risk of unauthorized access.

- Impactful forecasting: Faster or real-time insights into things like cash position can help finance leaders create more agile forecasts.

- Team engagement: Leveraging AI and other automation tools frees up accounting professionals from long, repetitive tasks so that they can spend more time on engaging, value-add work.

7 Steps to Help Your Business Achieve a Continuous Close

To achieve a faster month-end close, accounting teams must think about how they can perform certain tasks throughout the month, rather than at the very end, so that information can be made available more often. This shouldn’t require additional work throughout the month but rather an effective automation strategy, where automation and machine learning tools assist in consolidating, processing and summarizing information.

1. Expose and Prioritize Inefficiencies

Before investing in tools or upending processes, identify the most important challenges first. Gather time logs and feedback from your accounting team to identify issues and delays in the month-end close process. Review logs to pinpoint recurring versus isolated issues and prioritize top problems to address.

2. Sharpen Your Timelines

Have an integrated close calendar with buy-in from stakeholders that appropriately assigns tasks and automates email reminders. Adjust expense report or receivable entry date cut-offs and make other one-time changes to the process order or timeline that will offer permanent gains.

3. Consolidate Data

Closing requires working with a lot of data from many different sources. Therefore, a faster close requires accountants to identify opportunities for data integration across multiple softwares and sources to streamline gathering and processing the data. It’s also always a good idea to provide training in data integrity where there may be skill gaps.

4. Automate Reconciliations

AI can easily take large amounts of data and identify variances, triggering an instant review of transactions for duplicate activity or other anomalies. Automatically flag exceptions to be routed for manual review. Source data—such as bank or subledger balances—can be easily retrieved and compared with general ledger balances.

5. Expedite Receivables and Payables

Use AI tools to scan invoices and payments and match them with existing transactions, vendors or clients. Dashboards can be set up to log and track KPI metrics to spot trends that trigger automated collection activities of high risk accounts.

6. Automate Journal Entries

Recurring journal entries can be automatically generated with or without manual approvals required. You can automate accruals and depreciation schedules for purchases, modifications and disposal of fixed assets. Additionally, you’ll be able to instantly allocate intercompany expenses to divisions based on sales volume, production usage or other variables.

7. Improve Analytics

Rely on AI to gather and organize large data sets and create summaries and graphics that more easily convey what is occurring in the business. Once you’ve accelerated the close process, capitalize on this speed by funneling these insights into interactive dashboards and flash reports for department leaders.

Best Practices for Implementing Automation

While it may be tempting to attack the low hanging fruit first, developing a comprehensive plan and prioritizing activities that have the greatest impact is a wiser choice. You may see higher gains and prevent re-work if one project eclipses another in importance.

- Launch an automation initiative. Solicit input from end users and management to gain insights, achieve buy-in and produce the best results. Strong buy-in will be one of the most important motivators to drive a culture of change amongst the team.

- Continually review priorities and opportunities while phasing in automation over time. Identify existing processes in your month-end close and choose the most pressing bottlenecks and concerns first.

- Document all potential opportunities for automation and quantify the hours that could be saved, along with the effort and resources that would be needed to implement them.

- Explore available automation options within your current software. Industry focus groups and trade association members frequently share what they have automated, their solutions and their implementation processes. Software documentation may have automation features that are not currently being utilized.

- Leverage technology like RPA (robotic process automation) and cloud software integrations with APIs (application programming interfaces) to streamline processes and reduce manual activity.

Accelerate Your Month-End Close

Each day brings more exciting news in financial automation. Many in the accounting industry are equally as excited by the opportunity as they are hesitant about the risks and responsibilities of implementing AI and machine learning solutions to their accounting processes.

Paro’s network of fractional accounting experts have helped businesses shorten their closing cycles and make decisions faster. Find experts adept at assessing needs, identifying solutions and executing new tech stack implementations. Schedule a free consultation to be matched with a vetted professional who can help you take your business one-step closer to the continuous close.