You’ve doubled your accounts, and business is booming. You’re quickly pivoting to align your growth with new targets and goals for the future. But one crucial aspect that tends to be overlooked is something so basic to your financial management: transaction categorization.

Your chart of accounts, where your accounts are categorized, is the backbone of your financial reports. An outdated or insufficient chart of accounts can hinder accurate management reporting and decision making, signaling that it’s time for an overhaul.

Chart of Accounts: An Overview

A chart of accounts is a systematic list of all the financial accounts included in your company’s general ledger. It provides insight into your company’s financial performance and ensures reporting compliance.

The chart sorts each account into primary categories, such as assets, liabilities, equity, revenue and expenses. These classifications are the basis of your company’s financial statements, meaning your balance sheet and your income statement. You can then break each category down further into subcategories that best reflect your company’s activities and needs.

Your chart of accounts will list every account, providing a concise description and a unique identification code for each. Balance sheet accounts will be listed first, followed by income statement accounts, each with its own unique numeric signifier.

Chart of Accounts Numbering: How Transaction Categorization Works

The chart of accounts numbering schemes vary by business, but owners often use what comes in their bookkeeping or accounting software to record or automate transaction classification. While that can be a good jumping off point, what they receive is often generalized to the point of being ineffective for optimal use, especially as accounts grow and become more complex.

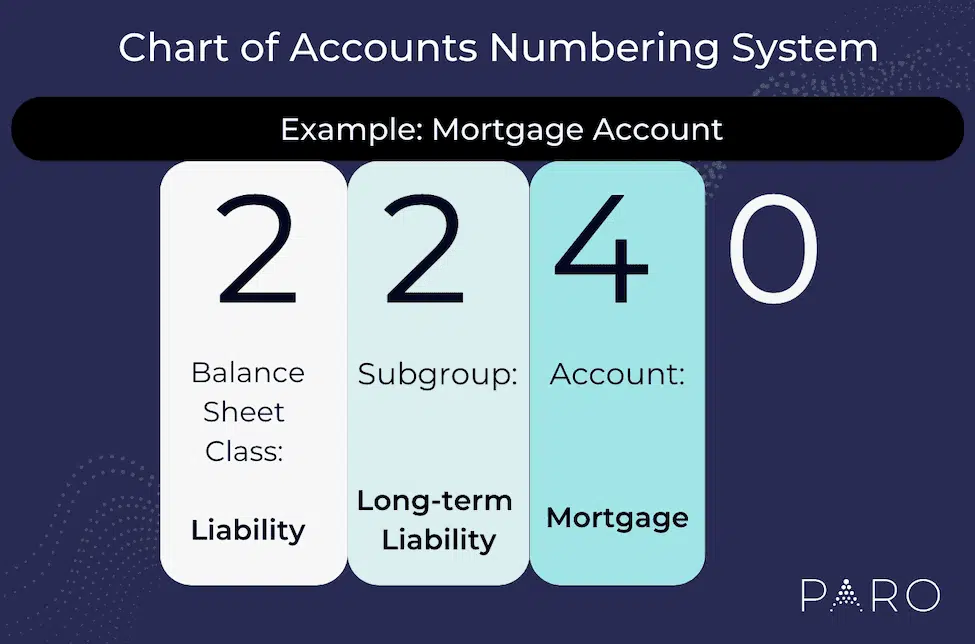

Each organization’s chart will vary, but they have similar hierarchy structures. Most small to midsize businesses should assign account numbers that are four or five digits long. The first digit represents the income statement or balance sheet category the account falls within:

- 1 – Asset Accounts

- 2 – Liability Accounts

- 3 – Owners Equity Accounts

- 4 – Sales / Revenue Accounts

- 5 – Expense Accounts

The next digit is for a specific subgroup within the category, such as separating current assets from long-term assets. The last digits designate specific types of charges or accounts that will help users understand where money is or where it has flowed into and out of the business.

Example: Accounts Receivable Account

- Financial report section: Asset → 1000

- Sub-group level: Current Asset → 1100

- Accounts receivable → 1130

For larger companies, additional numbers are used upfront to designate a subsidiary and a department, which gives business leaders more specific account information. Some businesses get even more granular by separating direct and indirect costs, as well as operating and overhead expenses. Non-operating accounts, such as taxes and interest, may also have their own higher-level category.

Why Update Your Chart of Accounts?

Owners should consider updating their chart of accounts when questions about routine business activity cannot be easily answered. Reports and dashboards can be modified, but looking deeply at account classifications should be done first, particularly if the process hasn’t been done within the last few years.

Why is this so vital to a growing business?

- Reporting accuracy: At the most basic level, account classification must be consistent and specific to ensure that financial statements are correct, especially as transaction volume increases.

- Scalability: Establishing a strong classification structure helps you handle growing data volume. This matters especially when analyzing increasingly complex transactions, such as mergers and acquisitions, investments or foreign business activities.

- Compliance: An accurate and organized system keeps your financial statements GAAP compliant, so that your stakeholders or investors can make meaningful decisions.

- Granularity: With an optimized chart of accounts structure, you can drill down into specific segments, departments or products to capture data around profitability or make decisions based on specific account types.

Changes to the chart of accounts must be done very sparingly and with a great deal of forethought. Make it as easy as possible for your stakeholders to understand the data.

Watch for These Common Mistakes

Transaction categorization is not the same for every business, but any business can fall victim to these mistakes:

- Oversimplification – If all sales are coded to one sales account, businesses that have both recurring revenue and cash transactions will often have difficulty getting information separately for pricing, budget and forecasting purposes.

- Duplication – Reporting is the primary concern with duplicate accounts. Both accounts need to be mapped separately—and correctly—within all reports and dashboards in order for duplicates to not create an issue.

- Too many accounts – If not tightly controlled, accounts may be added for infrequent activity that has little relevance going forward. Another method can be identified to track this activity if needed.

- Inaccurately categorized accounts – Added accounts might not have used the format and structure of the original CoA. A five-year loan that is categorized within the “current asset” coding sequence will likely appear incorrectly on the company’s balance sheet.

Service, manufacturing and SaaS businesses have different business models, and their charts of accounts will reflect those differences. For example, cost of goods sold (CoGS) is needed in retail, but not in industries without physical products. Removing or inactivating unused accounts is an important part of updating your chart of accounts.

Best Practices to Smooth Out the Process

One of the primary benefits of an optimized chart of accounts is being able to quickly and easily obtain answers. Whether isolating travel expenses for further analysis or drilling down to isolate budget variances, providing fast, accurate information will make you that much more competitive.

Upgrading your chart of accounts enables you to:

- Improve reporting accuracy and timeliness.

- Streamline report customizations.

- Align financial analysis and budgeting.

- Serve both external and management reporting needs.

For the best outcomes, follow these best practices:

- Develop a plan: Book meetings with stakeholders and schedule the new adoption process from implementation to post-mortem. Set specific project goals.

- Create documentation and a training process: Your final chart of accounts structure and numbering conventions should be easily explainable and referenced.

- Build in flexibility: Plan for the future by spacing out numbering sequences for future growth.

- Simplify where you can: Disable unused accounts and those that are being “retired.” Streamline account usage if there isn’t a significant value-add. Gas, water and electricity can easily be rolled into one utility account.

- Set a period-end conversion date: Mid-month conversions to new accounts and processes can cause difficulties. Plan to convert to the updated chart after month-end.

- Execute and follow up: After implementation, review reports and dashboards to confirm that all new mapping is working as expected. Analyze whether goals have been met and follow up with stakeholders.

Pro tip: During your evaluation, use your existing financial software’s features, such as tagging, unused fields and report filters.

It’s not always intuitive to complete a review or determine the best course of action. As your needs become more complex with multiple product lines, revenue streams, divisions or future mergers and acquisitions, you need accounting services to set up the best hierarchy and structure to serve your business.

Overhaul Your Chart of Accounts with Expert Support

When bandwidth is tight, analyzing and updating a large or complex chart of accounts can be daunting. Paro’s fractional accounting experts have more than 15 years of experience on average, working with small businesses and growing startups that seek to optimize their accounting systems. With best-fit matching and a fast onboarding process, they’ll seamlessly integrate into your business and provide value within a matter of days.