Initial interest from an investor is exciting, but it’s just the beginning of a formal relationship between a founder and investor. Skillfully navigating the mechanics of the deal—the negotiation process—will steer the success of that long-term relationship.

Founders should prepare for investor negotiations just as diligently as they prepare their pitch. What is a term sheet, for example? And what components of the terms should founders understand before coming to an agreement?

What is a term sheet?

A term sheet is a brief business document that is used to nail down the key aspects of a funding arrangement between an investor and a business founder. While it likely contains some legalese, in its simplest form, it is a list of the terms to be agreed upon before closing a deal.

Term sheets will usually follow a certain template:

- The investment amount – the amount of money to be invested, which could differ from what the company stated they are seeking

- Valuation – the amount that the company is worth, either pre-money (pre-investment) or post-money (post-investment).

- Securities being issued – the number and type of shares that will be issued in exchange for the investment (i.e., how much company equity will be owned by investors)

- Investor protections – these may include approval requirements for major purchases, loans, board size changes and a preferred repayment status

- Board rights – provisions—or covenants—for board seats and voting rights

- Timeframe for the response – the number of days or final date the term sheet is available for consideration

- Other terms – liquidation preferences (i.e., priority of asset distribution in the event of liquidation) and other contingencies affecting price

Each element within the term sheet is open for negotiation.

“You need to accept that investors will want some control in the company to protect their investment. Some things are deal breakers, so prioritize what is important to you and work through the rest,” states Chris C., Paro fractional CFO.

What startup founders should know about term sheets

While a term sheet is non-binding, signing it signals that both parties plan to go forward with a final agreement after due diligence is complete.

It is essential that founders understand all aspects and covenants of the term sheet—and their implications to the company—prior to signing. Having a CFO-level professional and/or a lawyer familiar with this process can help you navigate the following:

- Nuances in term language

- The time agreed to for due diligence

- Board rights and special covenants

Don’t overlook covenants

Covenants are types of clauses that stipulate certain promises or restrictions that startups must adhere to for the duration of the agreement.

“I find, typically, there are misplaced anxieties,” states Chris. In his experience working with startups, he sees that founders often spend more time concerned with valuation and overlook these important parts of the term sheet. “What they don’t seem to be concerned enough about is the covenant.”

Covenants can substantially impact your business, especially if they’re breached. Covenants may have a performance component or exist to protect the investor. Some covenants include obtaining rights to specific intellectual property, maintaining a cash burn target or anti-dilution provisions to protect investors in the event of a down round. However, Chris notes that many covenants don’t necessarily indicate something negative.

Understand key components ahead of time: what is a cap table, pre-money valuation, and post-money valuation

“Many founders don’t really understand pre-money and post-money investment and cap tables, [which are] the first things that I include in the financial model,” states Chris.

These concepts are crucial to evaluating a term sheet, but they can become complicated. He recommends going over these components with a CFO who has experience supporting venture and private equity-backed companies.

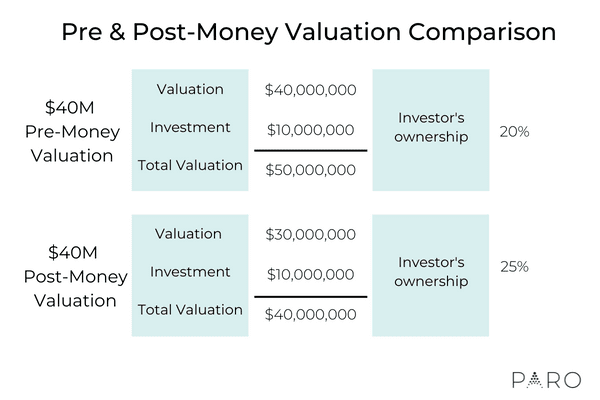

To start, pre-money valuation shows your company’s value before the investment, and post-money valuation indicates your value after the proposed investment. Knowing whether you are basing the deal off of a pre-money or post-money valuation can impact your ownership in the company.

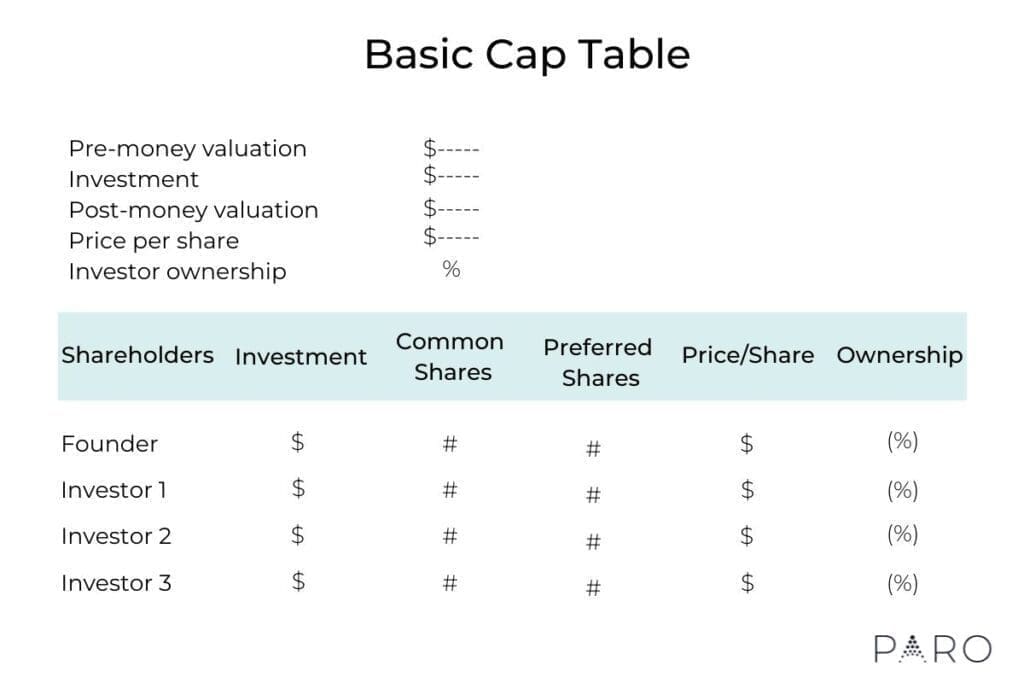

Your pre-money valuation and post-money valuation are also integral to your cap table.

What is a cap table? A cap table identifies:

- The company’s pre-money valuation and post-money valuation

- All shareholders (investors) including the founder

- The number of shares issued

- The types of shares issued

- The percentage of ownership at each round of funding

These elements are important for the prioritization of fund and dividend distribution if the company is later sold, goes public or liquidates.

Additional negotiation tips

Preparation is key in investor negotiations. Having strategic guidance will help you progress through these pivotal points.

- Use of proceeds – Prepare a line itemization of where every investment dollar is projected to be spent, and include a working capital buffer.

- Adequate proceeds – Make sure that the amount you are raising is enough to carry you through to the next round. While asking for less seems more achievable, coming up short and needing more funding earlier than planned will present future challenges.

- Present and defend – Be ready to talk about your vision, plan, and team. Chris characterizes this as being ready to defend your company. Investors have options, and intimately knowing your numbers and your story is essential. Team turnover or inconsistent responses could hurt your chances of receiving funding.

- Competitive landscape – Investors will research your competitors and how you differentiate yourself from them. Be proactive and provide them with the information before they ask for it. If only a few companies are closely related, expand your boundary to include alternative options that achieve the same goals as your products or services.

- Leverage – After you have received a term sheet from an investor, use it as currency. Before it’s signed, you have the opportunity to revisit other prospective investors and let them know you have an interested party. It can accelerate their interest and provide you with additional leverage with the first investor.

Your team is important in investor negotiations

For early startups, having a team that can confidently meet board goals will give confidence to your investors as well. It’s also beneficial to have an experienced partner at the table who understands how to work with investors—and how to evaluate your term sheet once investors are interested. A can help.

Paro offers fundraising solutions and strategic support from part-time CFOs to help founders move easily through the process. Get the insights you need to raise capital and propel to the next stage of growth.