Proactive management of your capitalization table creates immense benefits for your startup. It aligns all shareholders to the company’s worth and growth story. A transparent view of equity distribution and ownership structure gives founders confidence discussing new funding needs or employee stock incentives. And it enables modeling exit scenario returns for the team.

Getting started is easier than it appears once you understand the table’s most important components and how to properly update it over time.

What Is a Cap Table?

A capitalization table, or cap table, serves as a company’s definitive record of equity ownership, especially in private companies. Keeping clear information on who owns what types of shares and how much their shares are worth is crucial for early-stage startups, especially once they begin attracting outside investment.

As a startup continues to grow by going through funding rounds, launching new products, hiring key employees and eventually pursuing liquidity via an IPO or acquisition, its cap table must evolve to reflect how changes impact ownership stakes. Maintaining an accurate cap table is also essential for complying with securities laws and regulations, as irregularities can lead to legal complications.

Essential Cap Table Components

While cap table formats can vary, these essential elements help founders, potential investors, and employees get at-a-glance information on a company’s distribution of equity:

- Shareholder names: This shows the “who” of ownership, listing founders’ names, investors from funding rounds and employees who’ve received shares.

- Share class and number: This shows the “what” of ownership, detailing the type and number of shares each equity owner holds. Ownership may be derived from common and preferred stock or options and more complex financial instruments like convertible notes and warrants.

- Ownership percentage: Details each shareholder’s level of control and voting rights based on their effective percentage of equity ownership.

- Share price and value: Informs fundraising targets and startup valuation estimates by detailing each owner’s share price and total value.

- Company valuation: This can tell you how the value of your company changes or grows over time, helping you analyze the worth of your ownership stake and potentially attract investors.

When Should Startups Create One?

A company should start a cap table as soon as it begins issuing equity. Establish a cap table early so that initial ownership structures are tracked accurately, being sure to list common stock distributions to co-founders and other early employees.

A cap table is a dynamic document that needs an update after any event affecting equity ownership. Some examples include (but are not limited to):

- New rounds of investment

- Stock buybacks or repurchases

- Departures of employees with vested stock

- Changes in share price or valuation

- Mergers, acquisitions and other restructuring events

Complete regular updates to your cap table to ensure that it accurately reflects your company’s current equity structure.

Why Does a Cap Table Matter?

In many ways, a startup cap table is the financial DNA of the venture. It provides clarity on ownership, influence and the potential financial future for all stakeholders involved, forming the cornerstone of myriad critical business processes and strategic decisions, including:

- Avoiding dilution confusion: Stakeholders can visualize how shares issued with each new funding round affect founder or investor ownership.

- Forecasting: Support company valuations by modeling the impact of future funding scenarios on ownership stakes.

- Talent management: Properly budgeting for and implementing competitive equity plans can help attract and retain talent.

- Investor reporting: Maintain trust with investors by facilitating consistent, transparent communication that aligns with shareholder agreements and expectations.

- Exit strategy planning: Project how proceeds would be distributed in various liquidity events, such as an IPO or acquisition, to ensure stakeholders can make informed decisions about the company’s direction.

Maintaining an accurate equity structure overview ensures that every stakeholder’s contribution and share is clearly mapped, understood and valued.

Best Practices for Proactive Management

What is a cap table, if not another administrative task? Instead, consider it a strategic endeavor that can significantly influence your business trajectory. Here’s how to master it:

- Update your cap table in real time. Don’t let cap table updates pile up. Make changes to shares, valuations, debt converted to equity, etc. promptly.

- Automate calculations. Use cap table software that automatically updates share ownership percentages, dilution calculations etc. Streamline permissions so users can reference or add pertinent details while keeping sensitive investor information private.

- Record all financing rounds. Every time there is a change in share ownership from new investments, note the details like class of stock, price paid per share accurately.

- Note equity incentive grants. Every employee stock option grant, restricted stock issued etc. must be documented on the cap table. Keep track of vested vs unvested.

- Make cap table reporting easy. Ensure you can easily analyze and visualize cap table information by investor, share class etc. and can pull reports quickly.

- Perform audits regularly. Conduct periodic reviews, check for discrepancies, verify calculations are correct and tie out to actual shareholder agreements/409A valuation data.

- Calendar important events. Timelines around IPO eligibility, option expirations, leave of absence for employees, etc. need close tracking.

- Store signed documents properly. All signed financing agreements, restricted stock purchase docs etc. used for cap table support must be archived securely.

How to Create a Cap Table: Example

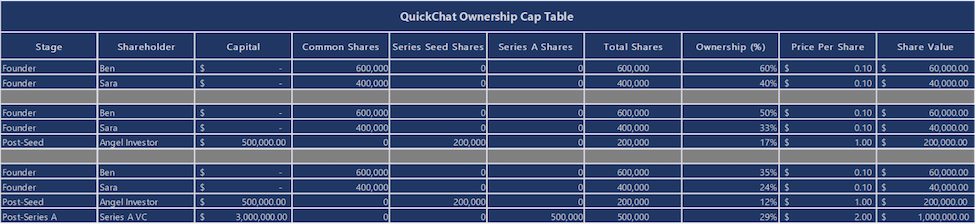

Ben and Sara are two ambitious entrepreneurs who formed an LLC for their AI-powered instant messaging app startup, QuickChat. Recognizing the importance of a well-structured cap table to map out their ownership stakes, they create one when they distribute their first shares of founder common stock.

Based on standard pre-seed valuations for tech startups, Ben takes 600,000 QuickChat shares, and Sara takes 400,000 shares, each priced at $0.10. Ben’s ownership is 60% to Sara’s 40%.

QuickChat attracts a $500K seed investment from an angel investor at a $2 million valuation. The investor receives 200,000 Series Seed preferred shares priced at $1 each, diluting Ben and Sara’s ownership to 48% and 32%, respectively. Ben and Sara update their cap table to reflect this event.

The app takes off, and QuickChat raises $3 million in Series A funding from a venture capital firm, valuing the company at $10 million. The VC is allocated 500,000 Series A preferred shares at $2 each. Though this further dilutes Ben and Sara’s stakes, they dutifully update their cap table and continue to do so throughout future funding rounds, a merger and QuickChat’s eventual IPO.

Here’s what their cap table would look like through their Series A funding, along with a visual representation of their ownership as it dilutes over time:

| Share-holder | Share Type | Owner % | Shares | Seed Shares | Owner % Seed | Owner % Series A | Series A Shares | Total Bus. Value |

| Ben | Founder Common | 60% | 600,000 | 600,000 | 50% | 35.29% | 600,000 | $10M |

| Sara | Founder Common | 40% | 400,000 | 400,000 | 33.33% | 23.53% | 400,000 | $10M |

| Angel Investor | Series Seed Preferred | – | – | 200,000 | 16.67% | 11.76% | 200,000 | $10M |

| VC Firm | Series A Preferred | – | – | – | – | 29.41% | 500,000 | $10M |

Get Expert Support Building Your Cap Table

Regularly updating your capitalization table can help you leverage strategic benefits and avoid pitfalls that could hinder future funding and exit opportunities.

If you’d still rather focus on other areas of your business, let Paro’s on-demand finance experts support you in creating a cap table. Paro offers tailored support from cap table creation and modeling to investor reporting, valuation and liquidity event planning. Contact us for a free consultation today to find the right solution for your business.