Expectations are rising for CFOs and the finance function to become strategic partners to their organization. And in a world with more data than ever, the speed with which businesses must digest data and adopt new technologies to use that data is crucial to not falling behind. Predictive and prescriptive analytics still have room to grow at companies across the nation, and while data analytics has been a focus of businesses over the past several years, progress has lulled according to recent data from a survey conducted by NewVantage Partners.

How can CFOs and their teams overcome pitfalls and’ hesitations as they strive for greater analytical maturity? The answer lies in people and culture more so than in technology.

How Maturity in Data Analytics Takes Away the Guesswork

Data is—and should be—the foundation for business decisions and strategic planning. There are four key levels of data analytics, each of which builds on the last to create a deeper understanding of where the business has been, where it’s going and how to get there.

Outsourced CFOs and their finance functions must hit each level to optimize results. Understand how the full data analytics maturity model can transform business performance.

Descriptive Analytics

Descriptive analytics tells you what has happened. It’s achieved through data mining, and that raw data is analyzed and grouped to better understand what has happened.

Example: A review of historical product demand, inventory levels and supplier delivery times identifies product shortages at peak demand periods.

Diagnostic Analytics

Diagnostic analytics work to understand why a particular activity occurred by looking at data patterns and other related data.

Example: An analysis of product shortages finds several potential causes, including supplier delays, inaccurate forecasts and production bottlenecks.

Predictive Analytics

Predictive analytics takes knowledge gained from historical data and combines it with trends to predict what is likely to happen. Predictive analytics often uses AI and machine learning to forecast with large sets of data.

Example: Finance creates a financial model using machine learning algorithms to predict future demand by product and location based on past sales patterns.

Prescriptive Analytics

Prescriptive analytics provides a much higher level of granularity to answer the question of what should be done next. Rather than restricting to one factor or situation, prescriptive analytics uses AI and machine learning to weigh all scenarios and provide statistically-based recommendations.

Example: Finance uses optimization algorithms to simulate different production schedules, inventory policies and supplier allocations to meet supply chain demand.

Is Predictive Analytics Enough?

The difference between predictive vs. prescriptive analytics is that one tells you where you’re heading, but the other tells you how to optimize that trajectory. Predictive analytics can help you understand how certain products or investments can maximize revenue, but they’re still insights. Prescriptive analytics, however, gives you actionable recommendations to further improve performance.

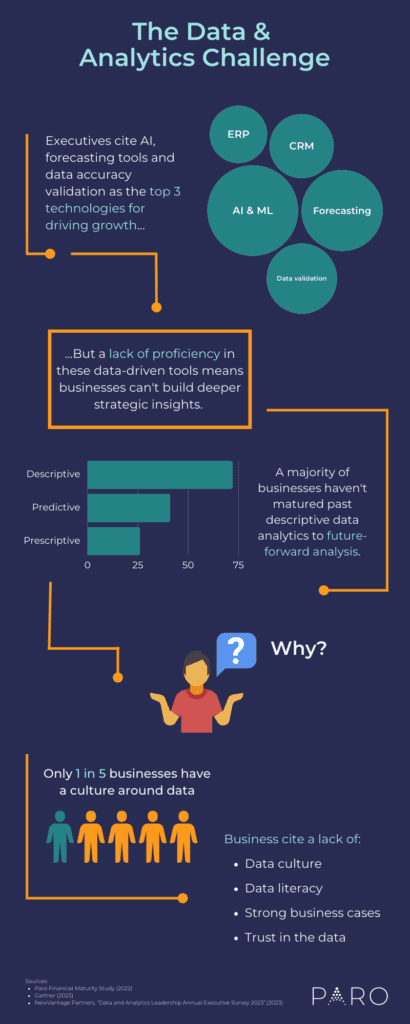

For tomorrow’s finance function, being able to give real-time, actionable recommendations to leadership and individual departments will be table stakes. Yet only 40 percent of businesses currently deploy predictive analytics, according to Gartner research, and even fewer deploy prescriptive analytics at 26 percent.

Why Businesses Are Stalling On the Evolution of Their Data Analytics

Managers that use strictly descriptive and diagnostic analytics take a manual approach in determining next steps. While very common, this can allow the introduction of bias and intuition to steer the company. For the finance function, and especially CFOs, owning the evolution from hindsight to foresight by using predictive and prescriptive analytics is important for minimizing risks and finding new opportunities. But there are barriers to creating a data-driven environment.

To start, many companies cite a poor data culture in their organization. In the NewVantage Partners 2023 survey of Fortune 1000 companies:

- Less than 41 percent of executives reported that their company was competing on data analytics—a nearly seven percent decrease from prior years.

- Under one quarter of executives reported that their companies have created a data-driven organization.

- Only one in five executives reported that a data culture was established in their company.

And finance functions are struggling to realize business value from their record data investments. This is for a number of reasons, including:

- Poor data literacy (less than two percent of executives listed data literacy as an investment priority)

- Improper change management

- Little evidence of ROI for stakeholder buy-in

What CFOs Need to Better Implement Predictive and Prescriptive Analytics

Predictive and prescriptive analytics require two things: technology and people.

While machine learning technology may be the company’s first foray into delivering advanced forecasts or scenario planning—the strong ROI it can deliver is attracting more interest to it daily. However, for executives that don’t see immediate value to their organization, they may be incorrectly assessing tech investments. Too much too fast can lead to poor results, whereas businesses that invest gradually based on their needs will see faster results.

Exclusively considering budgetary factors when evaluating whether to implement automated predictive or prescriptive analytics can be detrimental to your business. Consider how improved analytics align with your strategic vision and company culture, as well as how it can be deployed in various forms to optimize your investment. When you can prove its usefulness and acquire full buy-in, you’re more likely to develop a culture that’s ready and motivated to use the data.

Additionally, CFOs and finance functions need expertise in data analytics, emerging technologies and, most obviously, advanced forecasting and scenario planning. For financial leadership, this also translates to skills in leading digital transformation, operational change and professional development and training.

Overcome Your Challenges in Data Analytics

Progressing to predictive analytics is an incremental step toward developing a more intelligent decision-making process. For those who are truly ready to commit to a new pathway, you’ll find that investing in prescriptive analytics will impact your business holistically and prepare you for a startlingly different future.

If your business is looking for ways to fill gaps in tech stack implementation, data analytics or advanced forecasting and planning, Paro’s network of financial forecasting consultants and fractional finance professionals have the experience and industry knowledge needed to augment your team and ready your business for enhanced analytics.