A merger or acquisition is a high-stakes transaction, especially when each company’s infrastructure is complex. M&A due diligence must be thorough to minimize risk and maximize value. Often, the backbone of this process—financial due diligence—requires the expertise of a professional who understands the nuances of financial statements, valuation techniques and more. These professionals are crucial in an M&A transaction, but a company or firm’s current leadership may not have the specialized knowledge or bandwidth to thoroughly assess a target. This due diligence checklist provides a basis for your team to understand the pillars of financial due diligence and where a fractional or outsourced strategic advisor can help.

Types of M&A Due Diligence

Due diligence, when done correctly, allows both parties to maximize business value. The process of due diligence in an M&A covers various parts of the company’s internal infrastructure.

- Financial due diligence: evaluates financial performance and financial statement accuracy for future projections

- Human resource due diligence: analyzes employee records and policies for talent retention

- IT due diligence: reviews IT infrastructure and performs security assessments to identify risks

- Operational due diligence: evaluates day-to-day operations to understand processes and systems

- Taxes due diligence: reviews current and future tax liabilities for the new business entity

- Legal due diligence: examines contractual obligations, liabilities and legal structures

Financial Due Diligence Is the Basis for Assessing an M&A

While all forms of due diligence will impact the success of the merger or acquisition, financial due diligence provides the empirical foundation for assessing the target company’s financial performance, identifying potential risks and synergies and determining value.

Having dedicated finance expertise allows businesses to determine potential cash flow outcomes and financial goals for the M&A transaction. Interim finance experts can streamline this process by providing your finance team with specialized M&A expertise and bandwidth to focus on day-to-day financial operations.

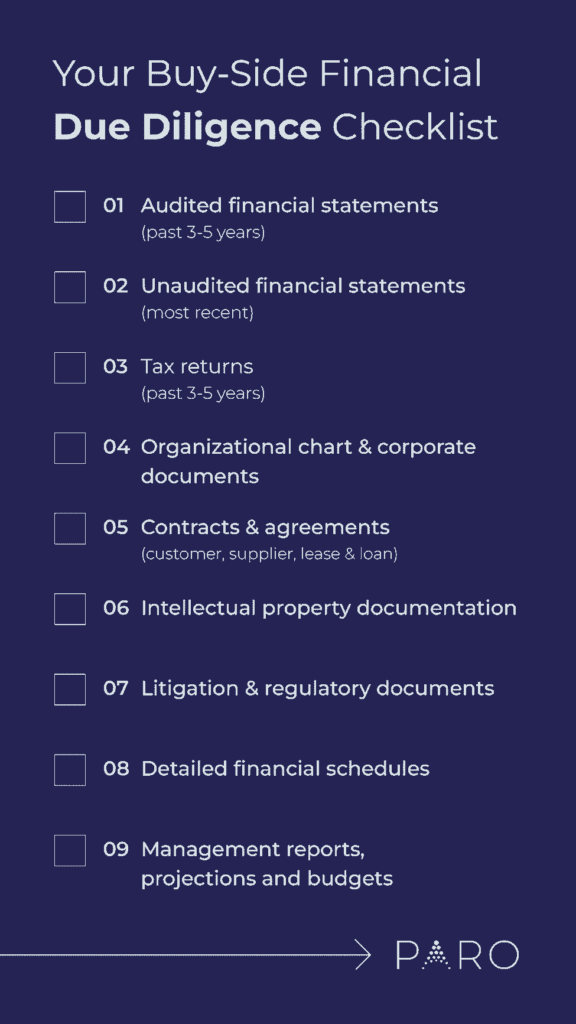

The Financial Due Diligence Checklist

M&A due diligence requires lengthy review of many company documents. Below is a due diligence checklist of the types of documents that will be helpful in your process.

In addition to these documents, the following steps should be taken to analyze the information you gather and assess the risks and opportunities of your target.

1. Analyze Specific Ratios or Metrics to Support Valuation

A common issue in M&A centers around the valuation of the entire enterprise. Business owners may overpay during the financial deal only to discover that present operations cannot hit the targeted ROI established in financial statements. This issue may lead to large write-downs.

Accurate valuation allows a company to avoid overpaying by evaluating historical financial trends as well as future projections. A financial professional will build two specific models used for financial valuation and synergy analysis: Net Present Value (NPV) and Internal Rate of Return (IRR).

- Net Present Valuation (NPV): This metric reviews the current value of cash inflows and outflows during a specific time period to determine future returns on investments.

- Internal Rate of Return (IRR): This metric determines an investment’s potential annual rate of growth and profitability.

Using both models allows companies to create projections based on specific scenarios of how a deal could look in three to 10 years in order to avoid overvaluing the deal. A strategic advisor will use their pattern recognition skills to call out if there are concerns or unseen value in the models. This objective view acts as a stress test by using quantitative analysis and insights from your finance team.

In addition, investors and acquirers will analyze financial ratios, such as price-to-earnings (P/E) or EBITDA, to examine the company’s performance, efficiency and profitability to align with its valuation.

2. Acquire Historical Financial Statements

A finance expert will go through the target’s historical financial statements to check for accuracy, regulatory compliance and performance. This includes:

- Audited financial statements from the past 3-5 years

- Unaudited financial statements for the most recent period

- Tax returns from the past 3-5 years

- Quarterly or annual projections and budgets

Looking at the balance sheet, income statement or cash flow statement will determine asset value, working capital and outstanding debts of the target company, among other key insights. Historical statements can also help your business or firm identify potential red flags, such as poor inventory management or even bad debt expenses.

3. Review Important Tax Documents

In addition to financial statements and projections, a finance professional will look at past tax returns or disputes, as well as other information to support the following:

- Integration planning and harmonization of tax accounting processes

- Deal structuring and its implications on tax liability

- Mitigation of ongoing tax risks and penalties

- Tax synergies and potential savings

4. Assess Internal Controls & Potential Liabilities

Investors and businesses want to fully understand the potential risks of the deal. An M&A deal is often a lengthy process, and unexpected issues or slowdowns could stop a deal from closing. Finance experts ask several questions when acquiring a private company, such as:

- Is the company audit ready?

- Do they have strong internal controls set up?

- What are the nature and extent of the seller’s liabilities?

- Are there any problematic contracts, litigation risks or intellectual property issues?

To answer these questions, a finance expert will review:

- Organizational charts & corporate documents

- Contracts & agreements (customer, supplier, lease & loan)

- Intellectual property documentation

- Litigation & regulatory documents

These questions should be part of any financial due diligence checklist, as they so often uncover information that could break the M&A deal, overvalue the company or cause future legal issues. Acquirers need to know what existing, pending and settled litigations have taken place. They also need to ensure that there are no issues with intellectual property licenses or the potential transfer of ownership rights during the M&A process, which could have financial implications down the road.

5. Evaluate the Target’s Quality of Earnings

The clarity gained around the quality of earnings often has a direct impact on deal value. The quality of earnings (QoE) analysis offers insights on the sustainability and reliability of the target company’s earnings. This will help your team determine if earnings quality aligns with the deal’s true valuation and projections.

At this stage, a finance expert will identify potential issues that may impact future earnings and red flags associated with:

- Revenue recognition policies

- Non-recurring gains or losses

- Accounting policies

- And more

6. Analyze Sales Pipeline

A finance expert will analyze the target’s growth profile, customer concentration, and sales pipeline to evaluate sales processes, understand the current customer base, and determine consumer risks. This involves examining:

- Sales reports and projections

- Customer contracts and agreements

- CRM data and sales metrics

The Value of Interim Financial Expertise in M&A Due Diligence

Engaging a third-party financial expert allows companies to obtain an objective assessment of a target’s finances and internal controls, crucial for making informed investment decisions. For example, a venture capital firm, preparing to invest over $20 million into a PaaS company, leveraged expert-driven buy-side due diligence to evaluate the company’s internal finance staff, accounting policies and revenue recognition models. This assessment ensured the target company could scale effectively with the VC firm’s investment.

These comprehensive due diligence reports revealed that the PaaS company’s internal finance team was well prepared and capable of transitioning to the necessary financial frameworks, confirming their growth potential and audit readiness. With this detailed and reliable analysis, the VC firm confidently proceeded with a $20 million investment, assured of the company’s capability to align with their strategic goals.

Obtain M&A Due Diligence Expertise

A fractional finance expert who has years of experience in driving M&A success can assess whether a deal will achieve the desired outcomes. They perform the necessary due diligence and help ensure that your business achieves its goals with the acquisition.

Paro can match your business with a fractional finance expert who is experienced in transaction advisory, to support your due diligence and M&A needs. Schedule a consultation to learn more about our expert solutions.