An operating plan is your roadmap to achieving your strategic vision. Typically, operational planning is an annual process that outlines the next year’s goals and operational activities needed to achieve them.

That’s the way it has been done for decades.

But much has changed over the past years. Thanks to rapid digitalization, we have more data than ever, along with robust tools for tracking and insight generation. And in our increasingly globalized business and supply landscape, change is the only constant.

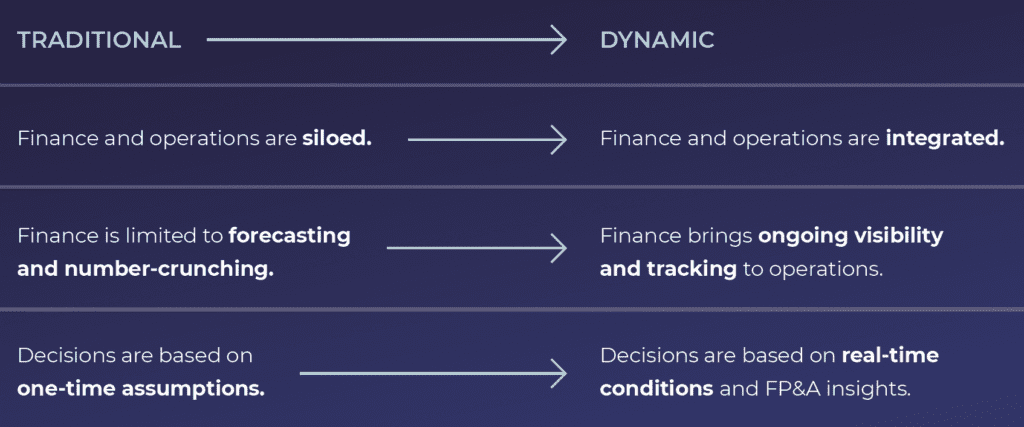

Forward-thinking organizations must now focus on continuous planning, rather than the same one-and-done approach. By integrating finance into everyday operational decision making, businesses develop a keen understanding of how to continuously adjust for changing conditions and performance levels.

Traditional Operational Planning

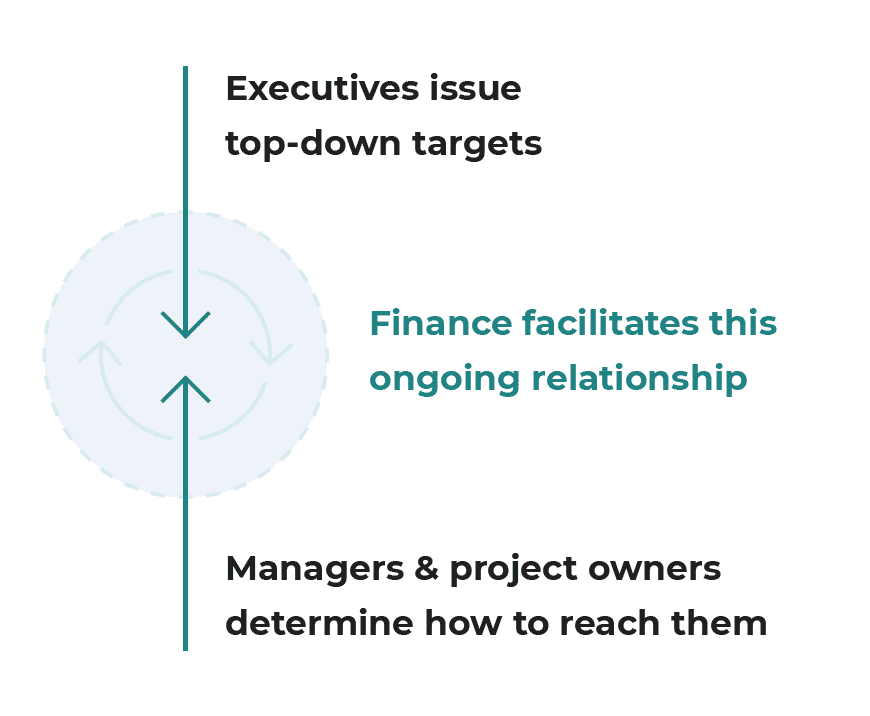

At its core, the operational planning process looks something like this:

All the while, finance builds models and sorts out capital needed to facilitate the process. Finance adjusts these models based on assumptions and input from managers who establish what capabilities and resources they need to fill the gaps.

Ideally, you emerge from this process with a roadmap for the coming year, which outlines:

- KPIs and success factors

- Action steps and milestones

- Project owners and stakeholders

- Budgets and resources

- Potential bottlenecks and solutions

Often due to rapid change, these plans can become obsolete after a short period of time. And, if not frequently optimized, they offer little benefit in exchange for the large efforts needed to create them.

Enter Dynamic Operational Planning

Imagine you’re planning a road trip. You could plot your course on a paper map at the start of your journey. Or, you could follow a real-time route, optimized for traffic, construction, speed traps and pitstops, such as coffee or gas.

Think of dynamic operational planning as GPS. Whereas finance is typically an enabler of the planning process, dynamic operational planning sees it as a driver:

- Acting as one with the operations vehicle

- Surfacing continuous, cross-enterprise insights

- Powering everyday decisions to pivot, accelerate or shift gears

After all, the goal of operational planning isn’t to make far-out predictions. It’s to create winning outcomes—and that requires continuous planning to course-correct or hit the gas when conditions and forecasts change.

How Finance and Operations Work Together

Today’s business environment requires the CFO and COO to be so in sync that many businesses may hire someone who can do both.

- Real-time visibility and KPI tracking: For continuous planning to work, finance and operations need to be in constant communication: What didn’t we expect? Are certain operations not adding as much value as we thought? A KPI dashboard is a single source of truth that enables immediate cross-departmental collaboration over shared information—not different versions of data scattered across spreadsheets and geographies.

- Connecting the dots: Finance has a critical role in relaying unbiased data analysis based on the here and now. With cross-enterprise financial and operational data in hand, executives can make better decisions with a stronger focus. Financial insights foster greater accountability throughout the process while offering operations a greater understanding of the why behind performance gaps..

- Scenario planning to fill gaps: In dynamic operational planning, forecasting happens more often and in a much richer fashion. Finance can run scenarios to identify potential operational gaps in the strategic vision using historical data, macro trends, operational data and predictive analytics. That way, problems are identified before they happen, and areas of momentum are identified in their early stages.

- Faster budget reallocation: When finance and operations are more integrated, they can move more nimbly. Finance should be prepared to field budget requests in a standardized, ongoing way that allows it to review and prioritize requests quickly. Vice versa, by supplementing annual forecasts with rolling forecasts, finance can help identify budget adjustments more quickly as changes occur in the business.

- Improved headcount management: Lack of talent is a major reason projects fail, and distance between finance and operations is often the cause. When you’re tracking operational and financial data together, you can introduce flexible talent methods to fulfill your ad hoc needs without over-investing.

Under the Hood: The Benefits of Integration

Perceived Mutual Value

A stigma of operational planning is that it’s not truly useful to those who are on the ground. It’s seen as an exercise on paper that doesn’t impact day-to-day activities. Ongoing business insights can create a new level of trust between the operations and finance departments. Key stakeholders, such as investors, also gain confidence in the company’s ability to proactively pivot and address change. With a detailed understanding of processes and operations, finance can become a more valuable partner to the overall organization.

Continuous Learning

In addition to agility, another benefit of continuous planning is regular and accelerated learning and improvement. Because both parties are intimately aware of how operations affect the financials and vice versa, that body of data and shared knowledge becomes the foundation of your learnings for next year.

Break Away from Traditional Planning

Break away from the traditional mode of operational planning and unlock deeper insights into your operational and financial performance. By engaging flexible strategic advisory services, you can ensure the right strategic decisions for your short- and long-term operations.