As your business grows or seeks investor capital, you’ll naturally need a more advanced understanding of your financial performance. More financial complexity means plenty more ways to assess financial health. Accounting teams will start to report metrics like EBITDA (earnings before interest, tax, depreciation and amortization) and EBIT (earnings before interest and tax) on financial statements, and it’s important to understand how these metrics enhance your reporting and decision making. Learn the strengths and limitations of EBITDA vs. EBIT alongside other common financial metrics and how an accountant can give you and your company’s stakeholders a deeper view of the business.

What is EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation and amortization. It represents the earnings of a business before deducting interest payments, tax payments, depreciation and amortization costs. EBITDA is commonly used by companies to measure their operating profitability. The metric removes all non-operating expenses like capital expenditures and tax liability. Thus, EBITDA gives a clear view of a company’s ability to generate cash from its operations without factoring in non-cash operational costs or how it finances its business.

Let’s break the components of EBITDA down:

- Earnings: A company’s profit or net income, usually found in the company’s income statement.

- Interest: The amount of money a company pays in interest on its debt obligations.

- Taxes: The tax that a company incurs on its taxable income.

- Depreciation: The accounting method used to allocate the cost of a tangible asset (e.g., equipment, machinery, buildings) over its useful life.

- Amortization: The accounting method used to allocate the cost of an intangible asset (e.g., patents, trademarks) over its useful life.

EBITDA vs. EBIT: What’s the Difference?

EBITDA differs from EBIT in that EBIT deducts the cost of depreciation and amortization while EBITDA does not. EBIT is similar to operating income while EBITDA is often used as a proxy for cash flow. Similar to the cash flow metric, EBITDA measures a company’s ability to generate cash from its operations without the effects of financing or accounting decisions.

Both EBIT and EBITDA are usually calculated using data from a company’s financial statements—specifically its income statement. When deciding whether to use EBITDA vs. EBIT to value a company, businesses that invest heavily in equipment, machinery, inventory or intangibles like patents and trademarks find EBITDA to be a better metric due to their high depreciation and amortization costs.

Using the EBITDA Margin to Assess Efficiency

Accountants use EBITDA to evaluate a company’s financial performance based solely on its core operations. Investors, on the other hand, use the EBITDA margin to evaluate a company’s operating efficiency and profitability in comparison with other businesses in the industry. The EBITDA margin is calculated by dividing EBITDA by revenue, and it indicates the percentage of revenue that a company generates as operating profit. This margin can also be calculated with EBIT.

Comparing Key Performance Metrics for Businesses

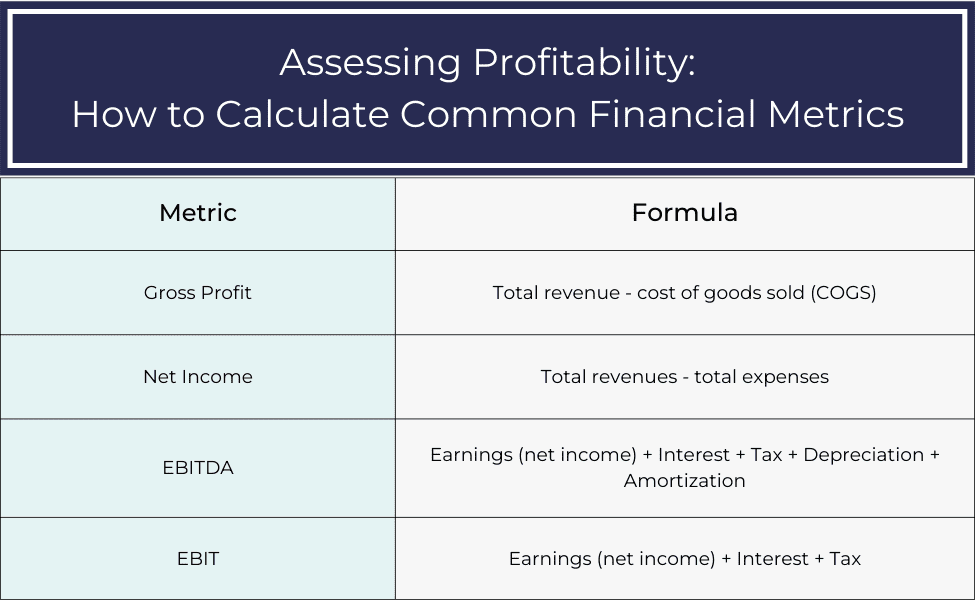

Whether you’re comparing EBITDA vs. EBIT or EBITDA with other common financial metrics, it’s important to understand when each metric is most appropriate to analyze. Accountants and investors will have different opinions on which metric is best, so consult with a professional to get the information that’s most relevant to your business.

EBITDA cannot take the place of other important metrics, such as:

- Cash flow: This metric measures how cash flows in and out of a company.

- Gross profit: This metric calculates the profit a company makes after deducting the costs of making its products or offering its services.

- Net income: This metric measures how much a company makes after subtracting all costs, including tax, interest, wages, etc.

EBITDA vs. Cash Flow

While EBITDA and cash flow measure the performance of a company’s operations, there are arguments as to which metric provides the most accurate picture of your financial performance. Cash flow offers a more granular look at day-to-day financial management, while EBITDA is a fast, high-level look at earnings and profitability that’s useful in industry benchmarking.

EBITDA vs. Gross Profit

Similar to cash flow, measuring EBITDA vs. gross profit offers different benefits. Your gross profit can help determine profit margins and how efficiently you produce your product. This metric is helpful for analyzing and improving your internal operations. However, EBITDA is more useful for analyzing efficiency across your market.

EBITDA vs. Net Income

EBITDA demonstrates profitability based on what your operations can control. However, tax, interest and other financial expenses should not be ignored when assessing financial health. By calculating net income, you can get a fuller view of financial sustainability, as well as how much money is available for shareholders or for business investments.

Find the Right Metrics That Matter at Your Stage of Business

Different metrics can play a greater role at different stages of a company’s growth. For example, in the early stages of a business, it may be most important to focus on cash flow while the business has limited access to funding and is carefully managing its resources. As the business grows and takes on more debt or seeks investors, EBITDA will be important to track in your reports.

There is no set time frame for how often a business should look at these metrics, because it can depend on a variety of factors, including business size, finance team capabilities, data availability and even market trends. However, most businesses conduct financial assessments at least quarterly to ensure that they are staying on track to meet their goals.

Your metrics rely on accurate and timely reporting first and foremost. An outsourced accountant or controller can help you build the reports you need to gain visibility into your financial performance. Once these metrics or numbers are reported in your income statement and other financial statements, a fractional financial analyst or CFO can help you further asses profitability and how to move forward.

Want to strengthen your company’s financial reporting and analysis? Our on-demand solutions give you top-tier expertise from a fractional finance professional, so you can dig deeper into the health of your business. Learn more about how Paro’s qualified accounting experts can help your business achieve its goals.