Data-driven decision making is a skill that modern finance functions are learning to master. As maturing finance and accounting teams move from a transactional focus to a strategic focus, businesses must build their competencies in data management and analysis to be competitive. But becoming a data-driven organization is still a major obstacle for growing businesses.

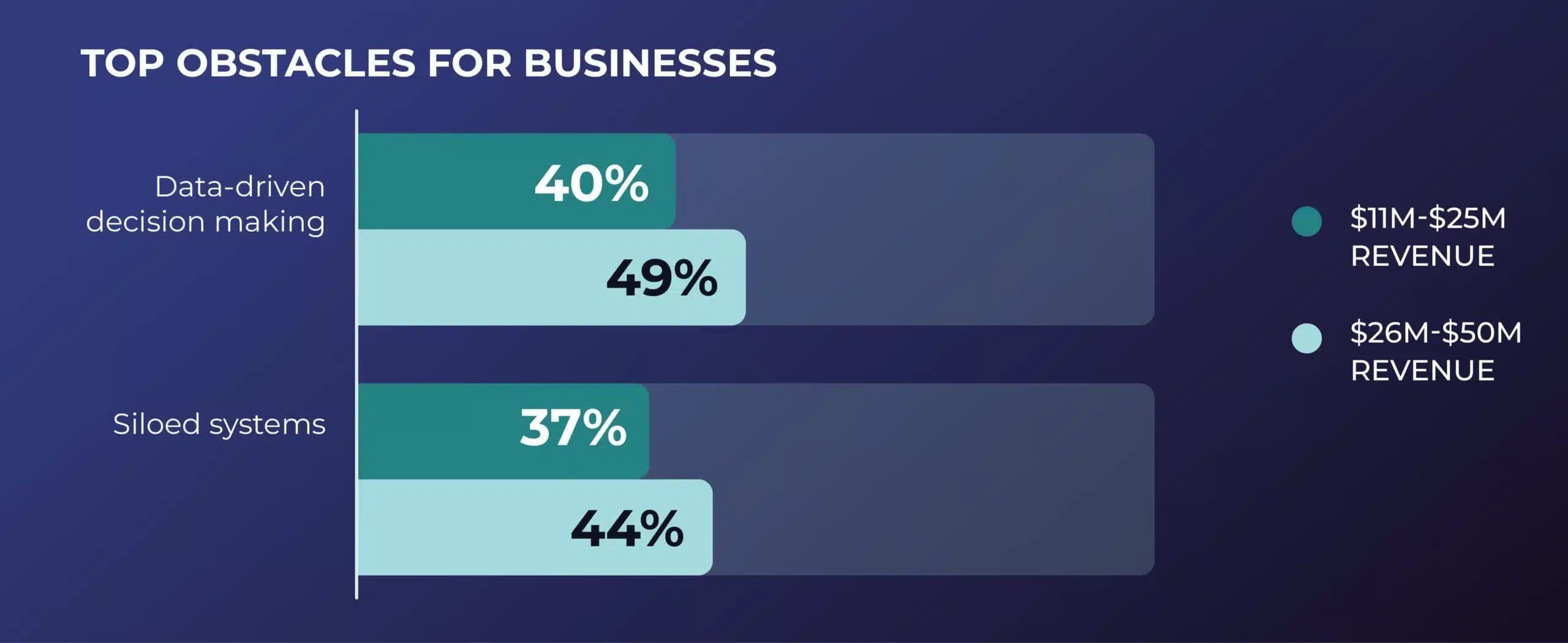

According to a 2022 study of 500 senior finance executives, nearly 45% of businesses with annual revenue between $11M and $50M report that data-driven decision making is one of their top three obstacles for growth. While middle-market businesses often have a sufficient amount of data to use, how they use it determines if they’re truly data-driven.

Here’s why your business may be making a few missteps.

Siloed data inhibits your movement toward a common goal

In conjunction with decision making, siloed systems are one of the top challenges as businesses grow in revenue. These two challenges are connected, as a data-driven organization can only make strategic decisions when teams are working with the same data.

Data silos occur when your business’s various departments are collecting data, but they’re failing to share it with each other. When data is kept separate, it prevents you from having a complete picture of your business and makes cross-team collaboration difficult. Silos also lead to:

- Errors or inconsistencies in data across teams

- Data that leans favorably to the team using it

- Delayed access for other departments requesting data

Not only should data have a single source of truth, each department should also align data-driven decision making toward a main objective, spearheaded by leadership.

How can you fix it? Take steps to a data-driven approach by creating a unified vision so every department understands how they are working toward a common goal. Then integrate your data in order to turn your data silos into a healthy data lake.

Your data-driven approach is used to support a bias or a hunch

When you look for data to support a decision you’ve already made, you’re essentially working backwards. Even if you find data that aligns with your strategy, you’re not letting the data properly do its job. Data-driven organizations allow data to inform their strategy, and they analyze it without bias.

For example, let’s say you suspect that your revenue is down because of a sales issue. You do some research and review the data, looking for the numbers to justify your plan to push for more sales and marketing. Even if you find what you’re looking for, you won’t be taking in the whole picture. By only looking at the data that agrees with your intuition, you could be missing out on important context—like whether the source of decreasing revenue is a pricing or inventory management issue.

How can you fix it? In order to take a truly data-driven approach, you need to collect data that answers specific questions relating to your KPIs. Remember: data informs your strategy, not the other way around.

Too much data creates noise, lacks focus

It might seem counterintuitive that there could be such a thing as too much data, but if you don’t know how to maintain focus, you can miss the information you need the most. Tracking too many metrics or collecting information that doesn’t relate to your key drivers, KPIs or objectives will waste time and resources for your team.

How can you fix it? Make sure you’re asking thoughtful questions about what exactly you want to know and pull only the information relevant to your strategy. Identify the most important data sources and align on the data sets that are most beneficial to your business goals.

Data is only made available at set intervals

You may be doing everything right—carefully gathering data, integrating various data streams and letting data objectively inform strategy. However, you may be using your data too late. If you’re only able to collect important information after month-end close or after the accounting cycle is over, the data you’re using may already be outdated.

Data-driven organizations have visibility into real-time data in order to enable proactive, forward-thinking decisions. Finance functions looking too far into the past, despite their wealth of data, may be making decisions based on assumptions that are no longer true.

How can you fix it? Start exploring how you can implement both faster reporting processes and real-time visualization to detect early changes in your business and your market.

Become a true data-driven organization

Start making moves to improve your data best practices and find the right strategic advisory solutions to help you succeed. A data-driven approach ensures that your solutions and plans are supported by strong business cases. With guided insights and Paro’s data visualization services your business can make more impactful decisions for growth.