Knowing where you’re going starts with knowing where you’ve been. You must plan, track and monitor your organization’s performance with a financial model if you want to grow steadily and profitably.

And with financial planning and analysis serving as the backbone of sustainable growth, budget variance is the finger that points the way. Budget variance shows how to move forward based on how your business has performed versus your expectations.

What is budget variance?

Budget variance is the difference between your budgeted expenses and revenue and your actual expenses and revenue. Budget variance analysis shows whether you are on track to meet your business objectives.

Budget variance also confirms if you are making proper assumptions about your company’s performance, such as your projections for how much revenue will increase in a budget period or the percentage of clients you will retain in that time.

The accuracy — and, thus, usefulness — of your budget variance depends on the integrity of your financials. Accurate and timely accounting and bookkeeping are essential to ensure you have a trustworthy basis for further analysis.

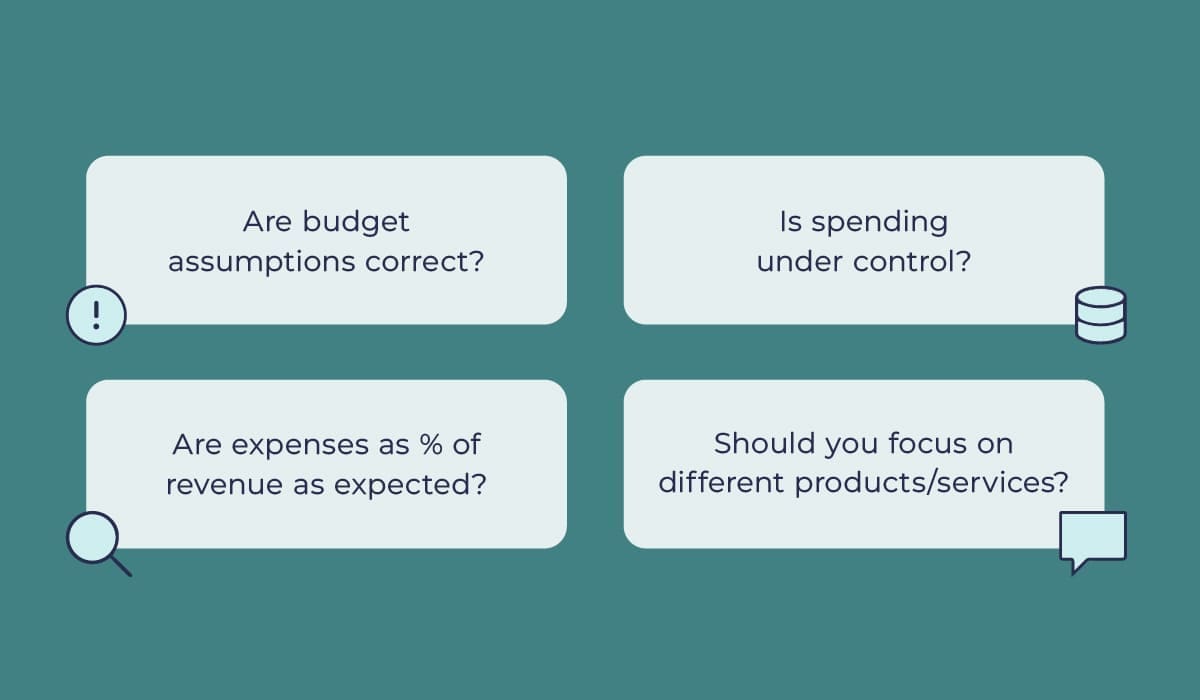

Insights gleaned from budget variance analysis

While budget variance inherently looks at past performance, the insights gathered provide guidance for future decisions.

Are your budget assumptions correct?

When creating a budget, assumptions are made about client acquisition, churn, revenue per client, product sales per category, etc. Doing a budget variance enables you to see whether your growth assumptions were correct and make adjustments accordingly.

Are you controlling overspending?

Expense budget variances help ensure your business has financial discipline. If vendor services cost more than budgeted or employee travel expenses are unaccounted for, variance analysis will give you visibility so you can have conversations about whether the expenses were justified.

Are expenses as a percentage of revenue in line with expectations?

Evaluate variable expenses such as cost of goods sold (COGS), sales commissions, and royalties as a percentage of revenue to determine if you’ve budgeted correctly. Using a percentage of revenue budget versus actual comparison also can be useful for other expenses, such as sales, marketing and payroll.

Any reduction in the percentage indicates that the company is becoming more efficient and profitable as the top line grows. That type of economy of scale is one indicator that helps investors determine the long-term profitability of a business.

Should you be focusing on different products or services?

If you had budgeted revenue of $1M for product line A and $2M for product line B, but ended up with the reverse in your actuals, you may want to evaluate your sales and marketing focus areas.

Are your margins consistent?

By reviewing budget variance on a monthly basis, you can track trends such as decreases in profit margins even if a new product’s sales are in line with expectations. This can trigger a discussion about whether your business could absorb a lower profit margin to take advantage of a growing sector or should instead reduce product marketing efforts and refocus on other areas of growth.

Other applications of variance analysis

Conducting a regular budget variance analysis provides concrete steps to help your company save money, improve efficiencies and contribute to business growth. Other common applications of variance analysis include the following:

- Project cost expense variance: If you consistently incur higher labor costs than anticipated for projects, you can decide whether it is best to improve efficiency, increase prices or accept lower profitability.

- Payroll cost variance: If hiring costs drive up your labor expenses, you might have to determine whether to reduce project volume or outsource nonessential work.

- Revenue KPI variance: If revenue increases because the company exceeds conversion goals, raise benchmarks to promote continuous improvement and growth.

You also can use variance analysis to spot issues such as overspending or to identify opportunities such as overlooked product lines that you should expand.

Best practices for budget variance analysis

A worthwhile budget variance analysis depends on the quality of your existing budget, as well as how quickly you can collect actual data for comparison. Prepare for a useful budget variance analysis by adopting best practices such as the following:

- Build your budget so it makes sense for your business.

- Standardize and automate your process of gathering and recording financial data from your P&L, cash flow and balance sheet accounts at consistent intervals.

- Allow time to collect actuals for non-financial information. This is especially important if your budget was built using key inputs like the number of new customers, market growth or conversion rates. This data will help you understand why any variance exists.

- If your revenue is seasonal, invest the time to break your annual budget into months. This helps ensure your spending throughout the year is aligned with your cash inflow.

- Update your budget at least quarterly so you have a basis for variance analysis instead of a static budget.

Regularly identifying, analyzing and addressing budget variances will keep your business on track. At Paro, we precisely match clients with the right services and subject matter expertise to achieve specific goals. Our exclusive, carefully curated network of remote finance experts provide a range of over 100 financial services, ranging from basic bookkeeping and accounting to highly specialized corporate development and strategic advisory.

Leverage the expertise of Paro’s financial analysts to build your financial model and provide budget variance analysis so you can determine the best way to move forward based on where you have been.