A Robust, AI-Powered Financial Health Analysis

Get a data-driven view of your company’s financial health in the context of your bigger operating picture. Our AI agent analyzes your information in tandem with external conditions and predictive insights to generate a game plan to improve your performance.

GET YOUR COMPANY SCORE

A Powerful Report with Expert Support

Paro’s Financial Health Analysis AI agent brings the power of a Big Four financial team to your business without the high price tag.

Seamless, Secure Setup

Import your financial documents in minutes with read-only access. To ensure your privacy and security, no data is ever stored or shared.

Powerful AI Analysis

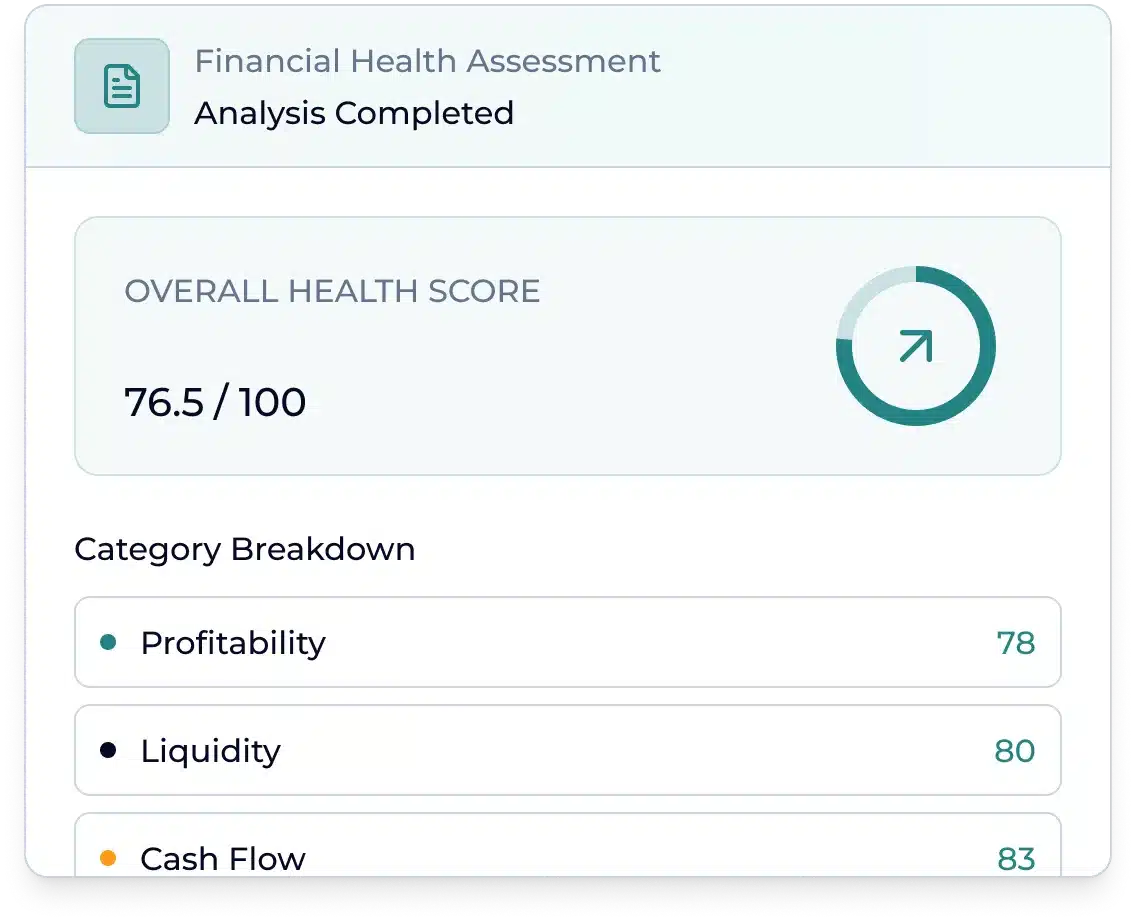

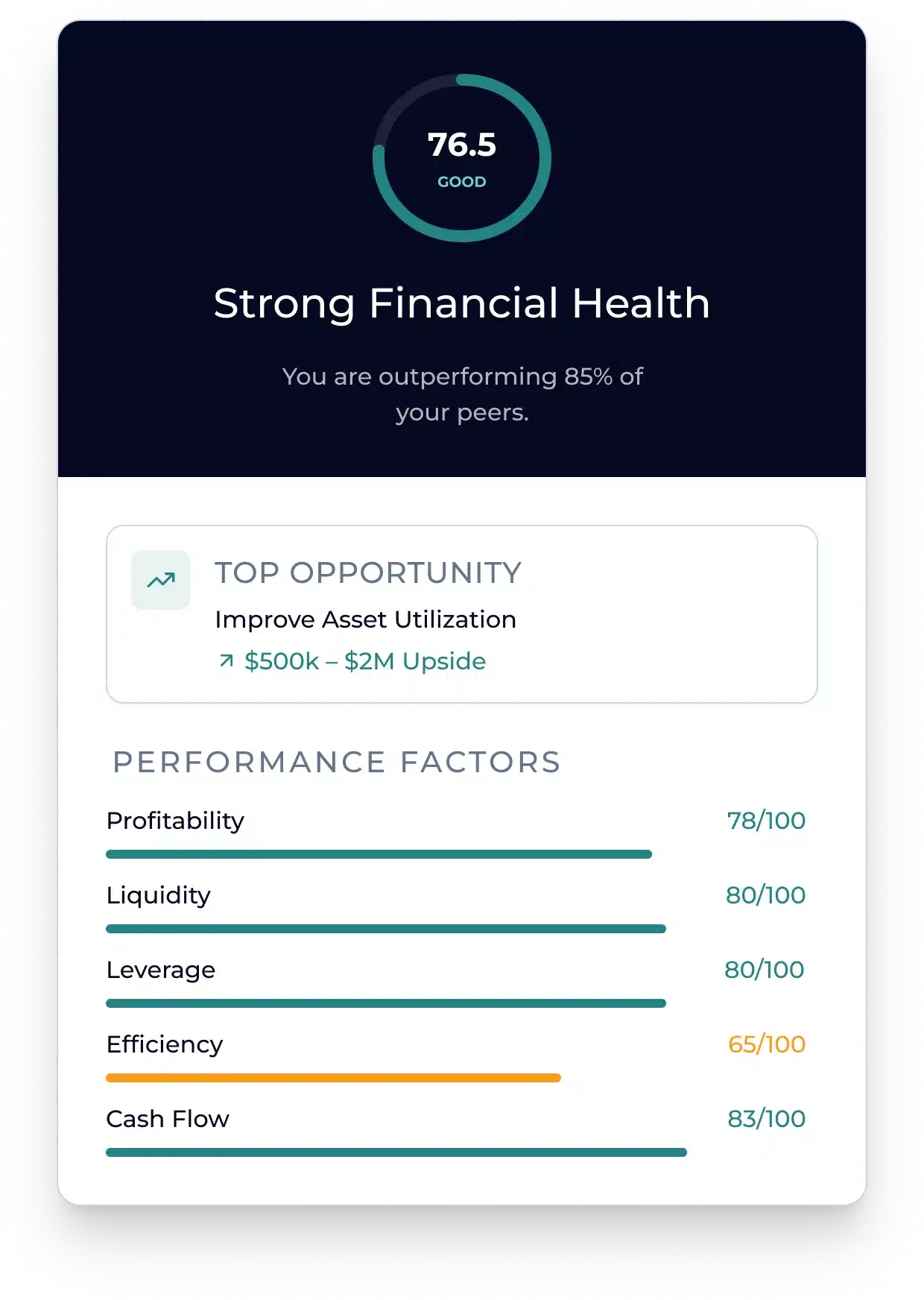

Get a precise AI financial statement analysis score with a real-time assessment of your business and relevant success factors.

Instantly Actionable

Get one personalized recommendation free, then go deeper with the full report or tailored expert support.

Peer Benchmarking

See how your business stacks up to similar companies in your industry, and find out how to gain the edge.

An AI Financial Statement Analysis for Deeper Insights

- Upload your company financial documents such as P&L statements and balance sheets

- A meticulously trained AI agent performs a company financial statement review and analyzes your information against operational, market and other contextual data to calculate your free financial health score

- The agent assesses your strengths, vulnerabilities, financial ratios and other indicators and predictors of financial health before generating a set of recommendations to address and optimize them

- At this stage, an experienced finance expert from the Paro network can step in to help clarify and execute each recommendation

- You decide how to proceed: with the report as your guide or with help from a Paro expert

- A free financial health analysis score reflecting a real-time snapshot of your business health

- One complimentary custom recommendation to help you get started on your areas of improvement

- Option to purchase a comprehensive report that provides:

- A detailed picture of your business profitability, liquidity, leverage, efficiency and cash flow, along with areas of risk and exposure

- A clear, jargon-free list of realistic actions you can take to improve your company’s financial health

- Optional support from a Paro finance expert to help you mobilize each recommendation effectively

Free

Financial health score

5

Categories ranked

$$$

Revenue savings identified

Expert

Support available

Jumpstart Your Journey to Better Performance

Paro’s financial health assessment isn’t just a snapshot of your business. It’s a roadmap with tailored next steps and a clear path to implementation.

UNLOCK YOUR FINANCIAL INSIGHTSSecurity & Compliance You Can Trust

Your data security and privacy are our top priorities.

Our Privacy Commitment

We understand that your financial data is sensitive. That’s why we’ve built our platform with privacy and security at the core:

- Your data is encrypted in transit and at rest using industry-leading protocols

- All infrastructure runs on SOC 2 certified cloud platforms

- You can request deletion of your data at any time after report delivery

- All CPAs and staff sign strict confidentiality agreements

Explore the Intersection of Finance and AI

From data preparation to dynamic workflows, access resources that simplify AI’s role in finance and accounting and help you prepare for the future of AI.

Dynamic Workflows & AI Agents: Your Advisory Blueprint

Small CPA firms can use dynamic workflows and AI agents to eliminate bottlenecks, automate tasks and free up time for revenue-driving advisory.

The Future of AI: How Finance Leaders Will Lead Its Adoption

The future of AI is now. Learn how finance leaders will be pivotal in leading AI integration in their organizations to enhance efficiency and decision making.

Data Prep for Machine Learning & AI: Key Steps for Finance Teams

Learn the basic data preparation steps for implementing AI in the finance function and how finance professionals can participate in the success of AI solutions.

Where Expert Talent Meets Agentic AI

Paro is transforming the back office through the industry’s first intelligent work ecosystem—where expert talent and AI agents work together to deliver superior business outcomes.

FAQ

In essence, a company financial health assessment articulates your ability to pay your bills, make money and manage your short- and long-term debts. To be truly helpful, however, the analysis should also show you how you can improve.

Our analysis centers around KPIs related to cash flow, liquidity, profitability, borrowing leverage and efficiency, plus a breakdown of the individual factors that impact these high-level KPIs, like asset turnover and operating margins.

Paro’s AI agent then outputs a financial health score and outlines a list of tactics to improve these metrics, customized to your business capabilities and nuances. Whether you choose to navigate the full report yourself or consult with a Paro expert for help, you can expect to come away with clear next steps.

Generative and agentic AI are subsets of AI technology that make Paro’s financial analysis score and report not only possible but also fast and highly effective.

Put simply, AI performs two fundamental functions:

- Extract and analyze large volumes of data from a diverse range of structured, unstructured, internal and external data sources.

- Output insights, predictions and recommendations based on that analysis.

The primary difference between an AI agent and a traditional human analyst is scale: AI can perform these actions with much greater speed and scale, meaning it can take in more information and find patterns much faster than humans. It’s important to note, however, that human oversight must be incorporated into the agentic AI process to ensure quality and ethics standards.

These benefits are especially well-suited for financial analyses, where AI can continually access, make sense of and learn from loads of data from all kinds of organizations, institutions and bodies of information to help businesses understand where they are, where they’re headed and how they can either pivot or change course to achieve their goals.

The accountant’s role lies largely in grooming your documentation to ensure accuracy and organization in your financial statements, cash flow and compliance records, etc. This differs greatly from the work of a financial analyst, who uses sophisticated tools (and now, AI) to analyze the information provided by an accountant and other sources to make high-quality, proven strategic recommendations.

A financial health analysis isn’t just for struggling businesses. It’s an evergreen tool that can be used by any business looking to grow, whether you’re in search of funding or aiming to sharpen conversations with stakeholders or finance teams. For finance leaders, it’s a great way to inspire new thinking and ensure you’re covering your bases in a world where business success factors evolve rapidly due to disruption.

Ready To Unlock Your Company’s Financial Health?

Take the first step toward getting your robust report that shows where your company is excelling—and where you need to improve.

GENERATE YOUR REPORT