Business Tax Minimization Strategies, Powered by AI

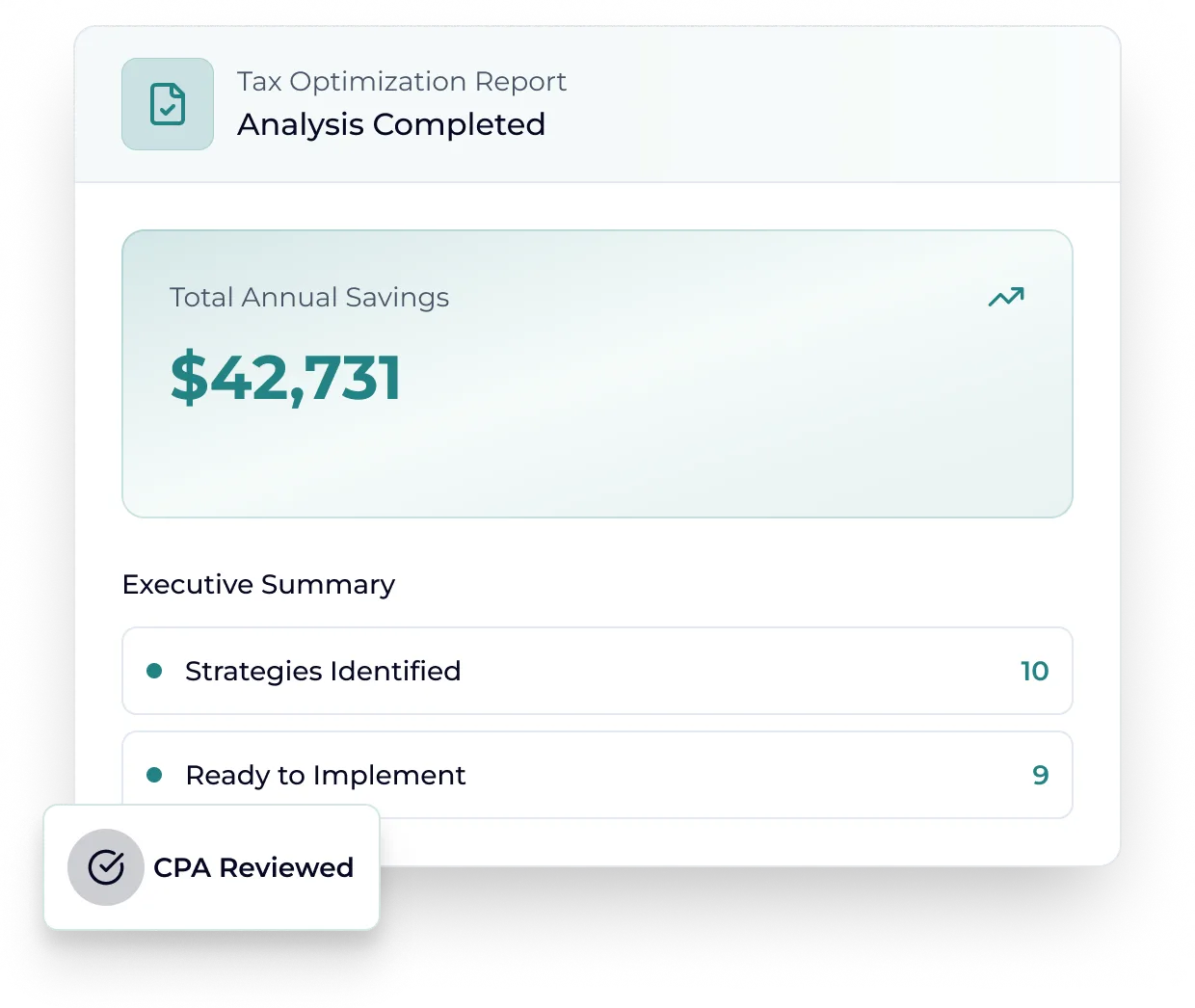

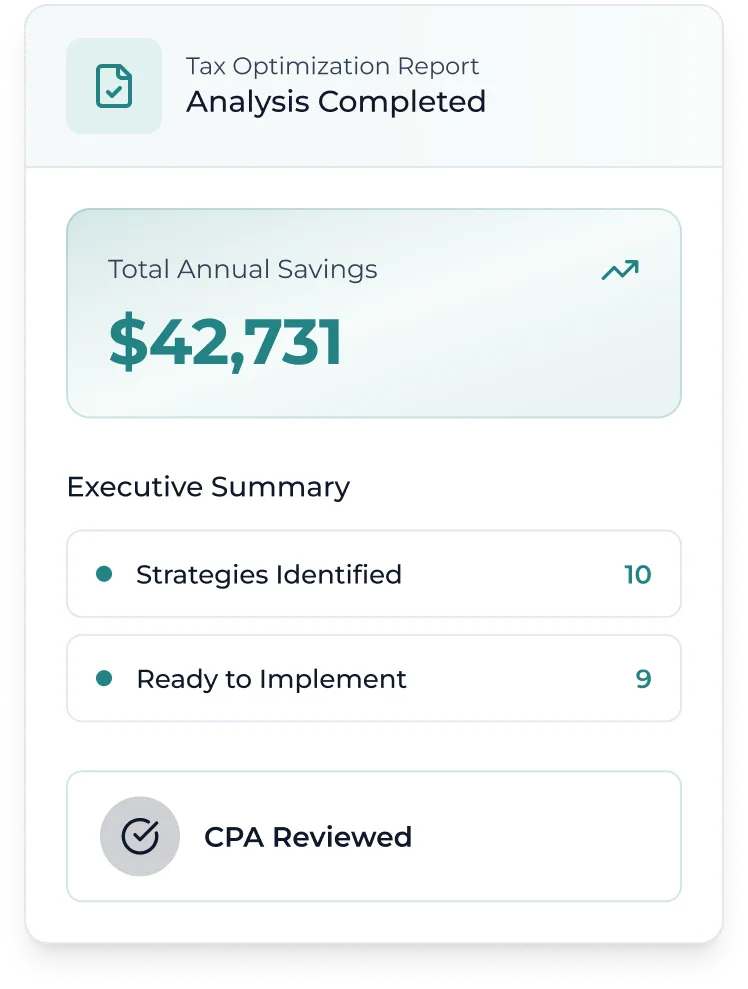

Paro combines the best of AI and human expertise to bring you tailored tax minimization strategies that you can trust. Get an AI-analyzed, CPA-reviewed Tax Minimization Report personalized to your company in just 48 hours.

GET YOUR REPORT

Built by AI, Backed by Experts

AI analysis meets expert CPA review to deliver custom business tax-saving strategies.

Find Tax Opportunities, Fast

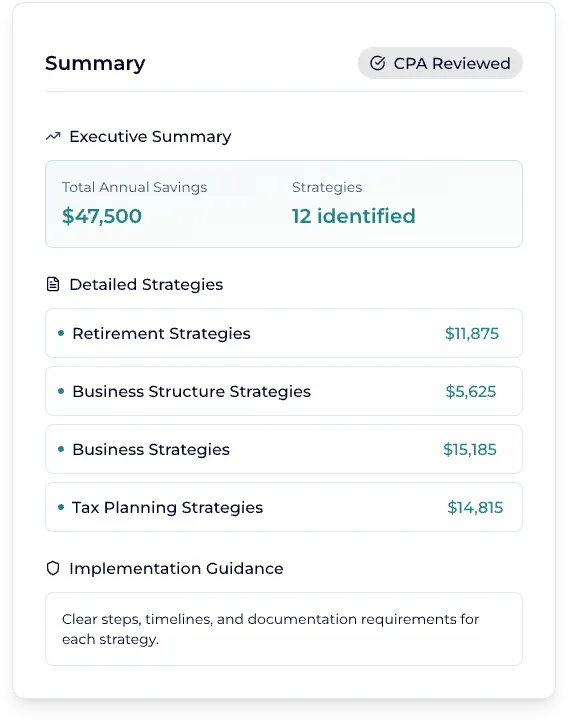

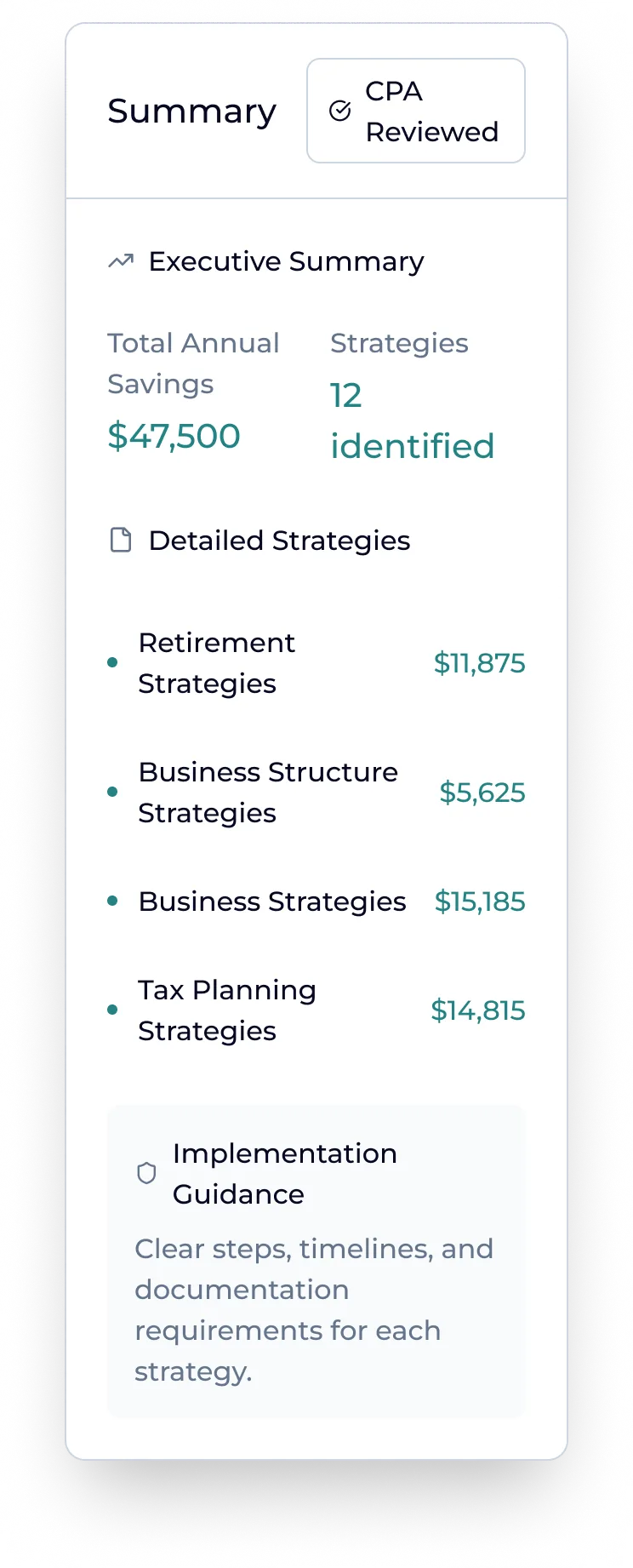

Our AI agent analyzes 20+ business tax savings strategies and identifies the top recommendations in minutes.

Save With Confidence

Each report is reviewed by a licensed CPA with 10+ years of experience to assess the math, legality and recommendations.

Tax Optimization Simplified

Your jargon-free report outlines the top tax saving opportunities for your company with clear, actionable steps.

Maximum Impact

Our AI scores your top recommendations and ranks them based on financial impact, applicability, complexity, risk and cash flow.

Tax Minimization Strategies To Maximize Your Savings

- Upload your recent company tax returns and input basic company details

- Our AI analyzes 20+ business tax strategies in minutes

- Your personalized recommendations are scored based on financial impact, complexity, risk and more

- A licensed CPA with 10+ years of experience reviews your report and validates the math, legality and recommendations

- A jargon-free PDF containing clear, actionable recommendations in your inbox within 48 hours

- Top priority recommendations and a roadmap for implementing them at a fraction of the time and cost of traditional business tax advisory

- Analysis spanning 20+ strategies, including small business tax credits, the C&B deduction, S Corp election and equipment expensing

- Access to vetted CPAs, business tax advisory and other finance pros who can help you put your strategies into action

AI-Powered Analysis for Real Results

Paro’s AI agent analyzes your past business tax returns to unlock CPA-reviewed tax optimization strategies.

48-hour

report delivery

20+

opportunities analyzed

Top 3

strategies highlighted

CPA

reviewed & verified

Security & Compliance You Can Trust

Your data security and privacy are our top priorities.

Our Privacy Commitment

We understand that your financial data is sensitive. That’s why we’ve built our platform with privacy and security at the core:

- Your data is encrypted in transit and at rest using industry-leading protocols

- All infrastructure runs on SOC 2 certified cloud platforms

- You can request deletion of your data at any time after report delivery

- All CPAs and staff sign strict confidentiality agreements

Explore the Intersection of Finance and AI

From data preparation to dynamic workflows, access resources that simplify AI’s role in finance and accounting and help you prepare for the future of AI.

Dynamic Workflows & AI Agents: Your Advisory Blueprint

Small CPA firms can use dynamic workflows and AI agents to eliminate bottlenecks, automate tasks and free up time for revenue-driving advisory.

The Future of AI: How Finance Leaders Will Lead Its Adoption

The future of AI is now. Learn how finance leaders will be pivotal in leading AI integration in their organizations to enhance efficiency and decision making.

Data Prep for Machine Learning & AI: Key Steps for Finance Teams

Learn the basic data preparation steps for implementing AI in the finance function and how finance professionals can participate in the success of AI solutions.

Where Expert Talent Meets Agentic AI

Paro is transforming the back office through the industry’s first intelligent work ecosystem—where expert talent and AI agents work together to deliver superior business outcomes.

FAQ

Taxation can vary greatly based on a number of factors such as your industry, your tax election status and your legal structure (i.e., whether you’re a C corporation, an LLC, a multimember LLC, etc.). Your Paro report takes a full view of your existing tax data into account to understand your situation and figure out the best way to find business tax deductions and credits available to you.

As a business owner, your vision for retirement is also a factor. A Paro report can ascertain whether you’re maximizing opportunities like SEP IRA contributions and identify other retirement plan solutions, if available to you, that offer the largest possible deductible contribution for a higher overall tax deduction.

Our premium analysis Tax Minimization Strategies Report costs $2,500. You also have the option to schedule a free consultation with a Paro Solutions Consultant to discuss how the AI-powered analysis could support your business before you purchase the full report.

Yes. Paro has a network of vetted, experienced CPAs and other finance professionals who can help your company implement the recommendations included in your personalized report. When you purchase the report, you will have the option to set up a free consultation with a Paro Solutions Consultant, who can discuss your specific timelines, requirements and budget and help connect you with the right finance or tax professional for your needs.

You will have the option to schedule a free consultation with a Paro Solutions Consultant to discuss how the AI-powered analysis could support your business and answer any questions you may have about the personalized report before you take the next step.

It depends on the type of business. Some of the most commonly sought out deductions include:

- home office deduction

- vehicle tax deduction

- business meals/entertainment

- software and subscriptions

- advertising and marketing costs

- insurance

- professional fees

For the home office, the rules vary based on which deduction method you choose: regular vs. simplified.

Start-up costs, equipment and asset depreciation also require specialized understanding, as the timing of these expenses impacts your tax savings potential.

Ready To Unlock Your Tax Savings Strategies?

Take the first step toward getting your CPA-reviewed report that highlights potential opportunities your company may be missing.

GET STARTED