Imagine your construction firm buys a $75,000 tractor with a five-year useful life. Your depreciation strategy could make all the difference between claiming a tax deduction for 20% or 100% of the asset’s value in its first year.

Accumulated depreciation also has significant implications for other key aspects of your financial management, including everything from job costing to equipment replacement planning. Let’s explore how it works and the role it plays in your construction business.

What Is Accumulated Depreciation?

Accumulated depreciation is a running total of the depreciation you’ve deducted for a fixed asset to date. It appears on the balance sheet as a contra-asset, which means it carries a credit balance that offsets an associated asset account’s debit balance.

Example: Your construction firm purchases an excavator with no salvage value for $50,000. You depreciate the equipment evenly over its five-year useful life, claiming $10,000 in depreciation expense for it each year.

After your excavator’s fourth year, you have $40,000 of accumulated depreciation. You show this amount on your balance sheet as a contra-asset tied to the excavator’s asset account, which has a $50,000 balance. They net out to a positive $10,000, the excavator’s book value.

Accumulated Depreciation vs. Depreciation Expense

Accumulated depreciation is a balance sheet account that tracks all the depreciation you’ve recorded so far. Depreciation expense is an income statement that reflects the amount you’re deducting in the current accounting period.

When recording depreciation onto the financial statements, these two accounts fall on opposite sides of the journal entry. Typically, you debit depreciation expense and credit accumulated depreciation to increase both, like so:

Journal Entry #1: Record depreciation on equipment for 2025.

| Account | Debit | Credit |

| Depreciation Expense | $25,000 | |

| Accumulated Depreciation | $25,000 |

Accumulated Depreciation on the Balance Sheet

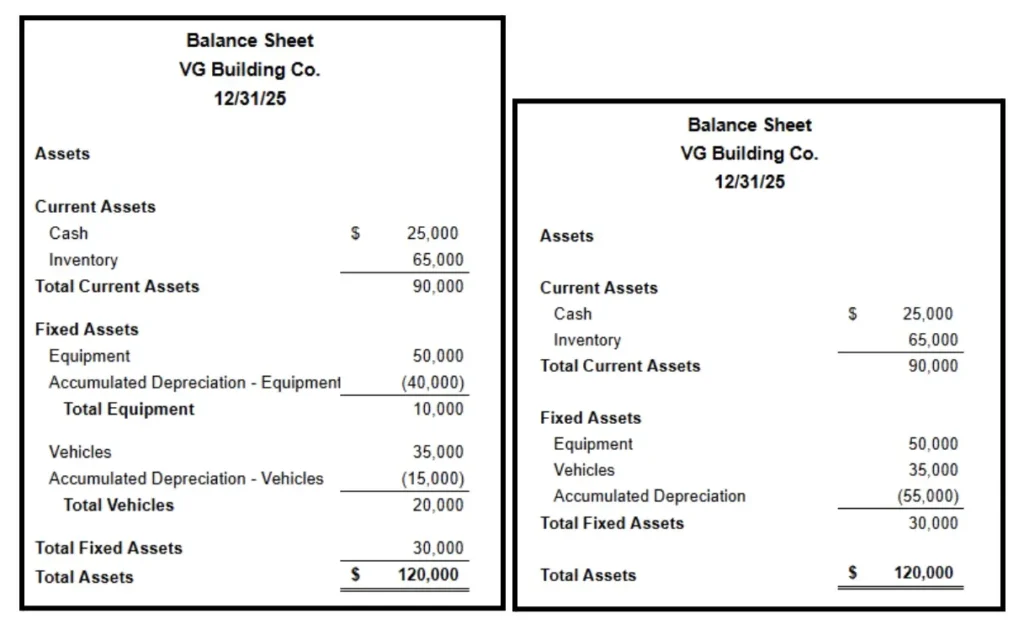

Accumulated depreciation appears on the top half of the balance sheet and carries a credit balance, but it’s a contra-asset—not a liability. Typically, you can present it either by individual asset or in aggregate, as demonstrated below:

This presentation improves the transparency and usefulness of your financial statements. Users can see your original cost bases, accumulated depreciation and net book values at a glance. It also helps signal asset age, as the ratio of accumulated depreciation to book value indicates what percent of an asset’s useful life has passed.

Pro Tip: As accumulated depreciation grows over time, it can impact key financial ratios. For example, rising accumulated depreciation inflates the debt-to-asset ratio, which can indicate increased leverage and higher risk to lenders and investors.

How To Calculate Accumulated Depreciation

Depreciation reflects the cost of wear and tear that your fixed assets have experienced over time, but it isn’t an actual cash expense. As a result, there are several ways to estimate it. Here are some of the most common:

- Straight-line: This is the simplest and most common method. It involves depreciating assets evenly over their useful lives.

- Double-declining balance (DDB): This accelerated method recognizes more depreciation upfront, reflecting how assets lose value faster in their early years.

- Units of production: This method ties depreciation to usage rather than time. It’s ideal when an asset’s wear is directly connected to a measurable output.

- Sum-of-the-years’-digits: This accelerated method calculates depreciation using the number of years in an asset’s useful life. It frontloads deductions but is less accelerated than declining balance methods like the DDB.

Accumulated Depreciation Example

The calculation method you choose has a significant impact on the rate at which depreciation accumulates on your assets—and the timing of your depreciation deductions for tax purposes.

Example: You purchase a bulldozer with a five-year useful life and a $10,000 salvage value for $100,000. To decide between depreciating it with the straight-line or DDB methods, you calculate your future annual deductions under each one.

Straight-Line Depreciation = (Cost Basis – Salvage Value) ÷ Useful Life

Year 1: ($100,000 – $10,000) ÷ 5 = $18,000 annual depreciation

For the next four years, you’d continue to claim $18,000 in depreciation annually, spreading your deductions evenly throughout the asset’s useful life. At the end of year five, you’d have $90,000 in accumulated depreciation. Simultaneously, the book value would reach $10,000, the estimated salvage value.

Annual DDB Depreciation = (2 × Straight-Line Depreciation Rate) × Beginning Book Value

Straight-Line Rate = 1 ÷ Useful Life

Straight-Line Rate = 1 ÷ 5 = 20%

Year 1: (2 × 20%) x $100,000 book value = $40,000

$100,000 book value – $40,000 depreciation = $60,000 book value

Year 2: (2 × 20%) x $60,000 book value = $24,000

$60,000 book value – $20,400 depreciation = $36,000 book value

Year 3: (2 × 20%) x $36,000 book value = $14,400 depreciation

$36,000 book value – $14,400 depreciation = $21,600 book value

Year 4: (2 × 20%) x $21,600 book value = $8,640 depreciation

$21,600 book value – $8,640 depreciation = $12,960 book value

Year 5: (2 × 20%) rate x $12,960 book value = $5,184 depreciation expense

$12,960 book value – $5,184 depreciation = $7,776 book value

Full DDB depreciation in year 5 would reduce the equipment’s book value to $7,776, which is less than the salvage value of $10,000. As a result, you would stop depreciating it partially through the year and only write off $2,960.

Compared to the straight-line method, this would maximize your upfront depreciation deductions at the cost of reducing them in the later years of the bulldozer’s life.

Why Accumulated Depreciation Matters for Construction Companies

Construction companies often have balance sheets full of heavy equipment and other fixed assets necessary for operations. As a result, depreciation plays an especially significant role in your financial planning.

Here are some areas where it has the greatest impact:

- Income tax deduction timing: Depreciation can easily generate thousands of dollars in deductible business expenses that directly reduce your taxable income. As a result, how you time them—such as by frontloading or spreading them out evenly—has a huge effect on your annual tax liabilities.

- Job costing and project profitability: Allocating depreciation to each project is essential for accurate job costing. If you don’t factor in wear and tear on machinery, your project margins can become artificially inflated, causing you to underbid and erode profitability.

- Budgeting and capital management: Accumulated depreciation tells you when assets are nearing the end of their useful lives, helping you forecast when they might fail. This informs capital expenditure budgets and lets you schedule replacements in advance to minimize downtime.

Best Practices for Depreciation Management

Depreciation is one of the most important line items in the financial statements, especially for companies with considerable fixed assets. Here are some practical tips to help you manage it in your construction business:

- Prioritize strategic tax planning: You have a surprising degree of control over the timing of your depreciation deductions. In addition to accelerated calculation methods, Section 179 and bonus depreciation rules may let you expense qualifying assets in their first year of service up to certain limits. This can be lucrative, particularly in your early years when cash flows are often tightest.

- Leverage accounting software: Modern bookkeeping tools can automatically record depreciation schedules, saving time and reducing manual errors. To keep this organized, make sure you set yours up to track accumulated depreciation by asset, even if your balance sheet only shows the amount in aggregate.

- Consider getting expert support: The right financial professional can guide you through the complexities of depreciation strategy. For example, a specialized construction accountant can help you choose optimal depreciation methods, time capital expenditures, and utilize Section 179 or bonus depreciation to minimize taxes.

Pro Tip: The One Big Beautiful Bill Act (OBBBA) significantly increased the potential benefits of both special depreciation provisions in 2025. Most notably, maximum bonus depreciation rates jumped from 40% to 100% of a qualifying asset’s value, while section 179 deduction limits went from $1.22 million to $2.5 million.

FAQs on Accumulated Depreciation

Is Accumulated Depreciation an Asset?

Accumulated depreciation isn’t an asset. While accounting software may list it as one for organizational purposes, accumulated depreciation is technically a contra-asset that offsets an associated asset account.

Is Accumulated Depreciation a Debit or Credit?

Accumulated depreciation normally carries a credit balance. Each time you record a journal entry to account for the non-cash deduction, you debit depreciation expense and credit accumulated depreciation.

Where Does Accumulated Depreciation Go on a Balance Sheet?

Accumulated depreciation goes on the top half of the balance sheet with your assets and liabilities. It typically appears directly beneath your fixed asset accounts, where you can show a separate total for each asset or combine them into one line item.

Get Construction Accounting Help Through Paro

Accumulated depreciation has an outsized role in construction firm finances due to the industry’s reliance on expensive machinery. As a result, understanding how to calculate, claim and present it is essential for successful financial management.

Construction companies also face other unique financial challenges, like complex job costing and revenue recognition. If you need help navigating any such hurdles, use Paro to connect with an accounting expert whose skills match your needs.