Small businesses are a key driver of the economy. Numbering more than 33.1 million in the U.S. alone, they make up 99.9% of all firms nationwide. And survival rates are robust: more than half of small businesses are still operating after five years. Carefully planned growth is often the key to their continued survival.

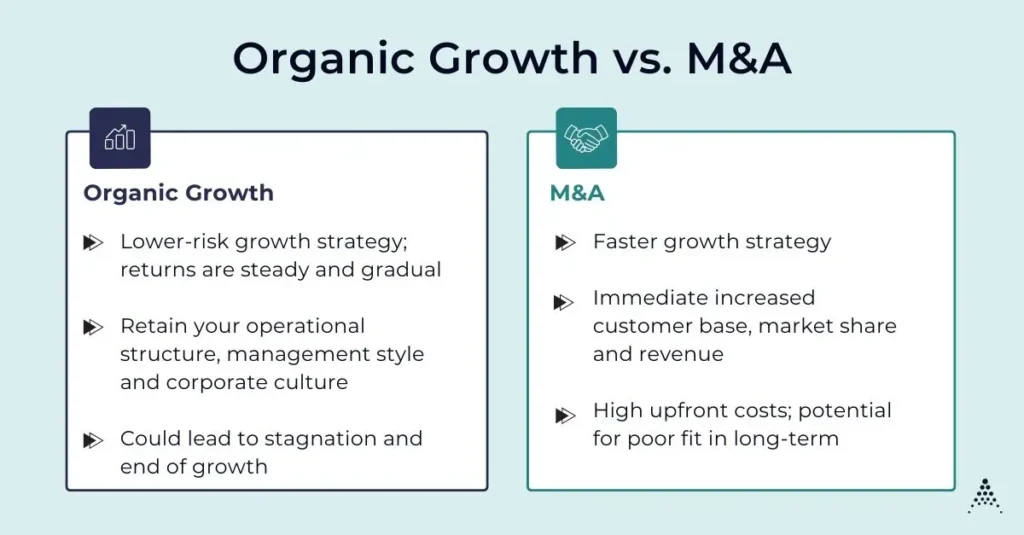

Small business owners have two main growth strategies to choose from: organic growth or mergers and acquisitions (M&A). There is no single correct option—the right choice depends on the company’s goals, market conditions and the business owner’s risk tolerance.

Let’s delve into how these small business growth strategies work, learn how to identify the right strategy for your business needs and goals, and explore the steps you can follow to put your plan into action.

Small Business Growth Strategies: A Brief Explanation

What Is Organic Growth?

Organic growth is an internal process that achieves growth by releasing new products and gradually increasing revenue. A slower but more sustainable strategy, organic growth is a long-term approach.

What Is M&A?

Sometimes called “inorganic growth,” M&A is an external process that achieves growth by buying or merging with other companies. A faster but riskier growth strategy, M&As can happen vertically along the value chain or horizontally among competitors.

Whichever direction you choose, it’s important to realize that your business expansion strategy is not a one-time decision but an ongoing process to be reconsidered and adjusted as needed.

How To Choose the Best Growth Strategy for Your Company

Discerning the right growth strategy for your small business takes considerable research and planning. Following this general framework can get you started.

1. Evaluate Your Business Capabilities

The first and most important step is to thoroughly review your company’s capabilities and financial status. You need complete visibility into your operational readiness, capacity and market positioning.

- Select an assessment model that suits your circumstances. (There are many models to choose from.) The U.S. Agency for International Development notes that business capacity is complex and exists at several levels simultaneously, from individual skills to full system capabilities.

- Apply your model to your company’s administration, technical functions and resources. Make sure to look at your organizational culture and structure as well.

Perform an internal audit, a complete check-up of your organization’s financial health. Then conduct a cost-benefit analysis for each type of growth strategy.

GROWTH STRATEGY IN ACTION:

Many small businesses, especially those with lean finance teams, benefit from outside help with comprehensive evaluations, as an impartial eye often improves these company-wide, deep-dive assessments. For example, when the CEO of telecom program management company inRange Solutions needed help with their growth strategy, a fractional CFO delivered a new financial reporting package that provided projections and variance analysis. The final assessment revealed nearly $500K in operational savings—a huge boost to their growth confidence.

2. Identify Existing Opportunities

The next crucial task is to assess the market itself. Existing market conditions might encourage you to grow your business organically, or they might offer an unexpected M&A opportunity. You’ll want to review past data and forecast trends to situate your company properly in today’s evolving business landscape.

- Evaluate customer needs. Is there an unmet demand? Can your existing products or services meet that demand? If not, what is the best course of evolution?

- Study historical market trends. Analyze past shifts in customer needs and behavior and extrapolate from them to predict future changes and trends.

- Analyze your competitors. How similar are your offerings? How different are they?

- Examine your value chain. Can you capitalize on your intersections with suppliers or distributors?

Visibility into market trends and potential can add weight to both organic growth and M&A strategies. An improved product might be the trigger your company needs to maximize revenue, while acquiring a supplier might generate significant cost efficiencies. Alternatively, merging with a competitor could substantially increase market share.

GROWTH STRATEGY IN ACTION:

Conducting a market analysis can be challenging for small business owners who are busy with their day-to-day responsibilities. An experienced fractional CFO can analyze trends, develop forecasts, model the results of strategic decisions and even suggest new markets. For instance, a fractional CFO encouraged Keyo, a touchless biometric technology firm, to enter a brand-new market during the COVID-19 pandemic: the medical sector. The CFO’s timely advice and solid financial models catapulted Keyo’s growth to the next level.

3. Align Your Growth Strategy With Your Business Goals

Finally, remember that growth at any cost is not an effective strategy. Seizing a growth opportunity just because it exists is counterproductive. Whether it’s M&A or organic expansion, your chosen growth strategy must also support your ultimate business goals.

- Outline and rank different business outcomes to determine which are most important to you. For instance, would you rather improve your margins on an existing service or discover a new market? Which is a higher priority: iterating to enhance a product or reducing production costs on your existing brands?

- Understand your exit horizon. Are you looking for a rapid transition? Do you envision your company making incremental progress for years to come?

- Know the limits of your risk tolerance, both financially and in terms of maintaining leadership control.

Aligning your growth strategy with your business goals is an ongoing activity. If long-term financial sustainability is a key goal, organic growth strategies are often the better fit, as they lead to slower but continual growth. However, future margins might be improved by acquiring suppliers or distributors to maximize cost efficiencies.

If you want your business to reach new markets, M&A can be a more fitting growth strategy since it often offers immediate gains. That said, if maintaining control of your business is a higher priority than scaling up, M&A opportunities that require surrendering a leadership stake might not be the right choice.

GROWTH STRATEGY IN ACTION:

The key to choosing the right strategy for your small business is intensive preparatory analysis. When looking to grow his business, the CEO of Agency 39A, a digital solutions company, needed to investigate his business performance and goals to make the best growth decisions. Working with a fractional financial expert gave him the financial tools, forecasts and KPIs he needed to understand and evaluate how his choices would impact the business, even under changing conditions. Armed with such knowledge, he made growth choices that improved the business’s margins and positioned them for triple-digit growth.

Growth Challenges and Considerations

Whether you choose organic growth or M&A, both small business growth strategies come with financial and operational challenges and considerations. Consider the following:

Organic Growth

- Organic expansion is a slower process, but it’s also sustained and controlled. It is a lower-risk growth strategy: returns are steadier and more gradual.

- The business usually retains its operational structure, management style and corporate culture.

- The initial financial outlay is often minimal, as increasing revenue provides the means to reinvest in the business.

- However, if revenue growth is the only method to increase facility size, marketing efforts or staff operations, changing trends may impede progress.

- Additionally, iterative product development can lead to stagnation and an eventual end to growth.

If organic expansion is the best fit for your small business, remaining open to and aware of external market influences is vital. Sudden market fluctuations can overturn predicted forecasts and squander growth potential if revenue is the only source of growth.

Regular financial forecasts and projections are crucial to maintaining momentum, and future trends may suggest a different course of action. Pay close attention to the working capital your company will need to boost resilience in lean times or jumpstart product evolution.

M&A

- The M&A approach offers faster growth. Increased customer base, market share and revenue are immediately apparent.

- The upfront costs are also much higher and may involve taking on new debt, relinquishing equity or both.

- Both mergers and acquisitions are complex legal transactions, requiring substantial time and effort, sometimes at the expense of continuing business function.

- In some cases, a merger or acquisition that looked good on paper is a poor fit in reality, leading to a disastrous misuse of resources.

The post-merger process can be intricate and full of friction. Each company will have integration demands and requirements. Tech stacks and operational procedures must be combined, and management styles aligned. Integration takes time and effort that goes beyond ongoing business delivery.

Balancing Growth and Valuation

Your business expansion strategy impacts your company’s risk profile and, thus, its valuation. The immediate growth offered by M&A would seem to make it the favored strategy for valuation. However, real-world applications are not that simple.

Thinking Through Organic Growth

On the one hand, as an inherently less risky strategy, the slower progress of organic expansion can be appealing to risk-averse investors. In addition, moderate but continuous revenue growth underscores a company’s strong understanding of its customer behaviors and demands, which can attract long-term investment. However, a too-slow increase in revenue might raise concerns about continued business viability.

Thinking Through M&A

On the other hand, an M&A growth strategy has obvious immediate potential. Combining companies can rapidly and significantly increase market share, which is generally a positive sign for investors. But some acquisition opportunities arise due to business losses or poor management. Difficulties during the post-merger integration can negatively affect business performance. And tying up financial resources during acquisition can lead to missed market opportunities.

These factors can affect future valuations, which can, in turn, impact your exit strategy. Matching your growth strategy to your primary business objectives is a smart way to manage risk, leading to improved valuation down the line.

Expert Growth Strategy Advice for Your Business

The path to growth is an individual choice that depends on market opportunities and the risk tolerance and business goals of each small business owner. Organic growth and M&A both have their advantages and disadvantages. They can influence future business valuation, potential investors and even exit opportunities.

To determine which avenue is best for your business, you must

- Appraise your existing business capacity thoroughly for a full estimation of financial capability, operational health and risk tolerance.

- Identify new opportunities and potential markets.

- Ensure the choice aligns with your long-term business goals.

Hardworking business owners can benefit from expert advice to create or enact their small business growth strategies. Whether assessing markets and patterns, establishing growth expectations, or conducting financial due diligence and managing transitions, outsourced fractional CFO services help you plan for success.

Get experienced assistance with deep-dive financial analysis, market trend forecasting and growth strategy planning with Paro’s fractional CFO services.