In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09, creating the FASB Accounting Standards Codification Topic 606: “Revenue from Contracts with Customers“, commonly known as “Topic 606” or “ASC 606”. Despite being in effect for several years, confusion persists regarding its interpretation and application. The complexity of revenue contracts can lead to material misstatements, making it critical for accounting teams to seek expert assistance to ensure correct application of the standard.

In Plain English, What is ASC 606?

The “big picture” for recognizing revenue in accordance with ASC 606 is that entities can recognize revenue only to the extent that they’ve delivered on their “promises” within a customer contract.

Sometimes this is very simple, such as the selling of a retail good in exchange for cash at the cash register. But it can quickly become very complex.

- Some contracts are for a promised service, where the service is performed over an extended period of time.

- Some contracts are based on an entity promising to deliver goods in piecemeal in route to fulfilling a larger order, which can also include specific provisions for when the customer officially “accepts” the goods.

- Some contracts involve three parties, such as promising to broker a transaction between two other entities for a commission.

- Some contracts may involve a promise to license software or other forms of intellectual property (IP) in exchange for payment, including arrangements where the entity receives both fixed payments and payments based on subsequent sales resulting from the customer’s use of the licensed IP (e.g., royalties).

- Some contracts contain discounts, rebates and other provisions that create uncertainty as to the final amount that will ultimately be received.

- And some contracts may involve an entity promising to provide multiple goods and services within a single contract, which impacts the amount of revenue that can be recognized at a given point in time.

ASC 606 provides a universal set of principles that can be applied to revenue contracts with customers regardless of industry, as opposed to several revenue recognition models for differing industries and types of revenue arrangements. The old “realized or realizable” guidance for recognizing revenue has been superseded and accounting professionals will need to ensure they are applying the new framework under FASB ASC Topic 606: “Revenue from contracts with customers”.

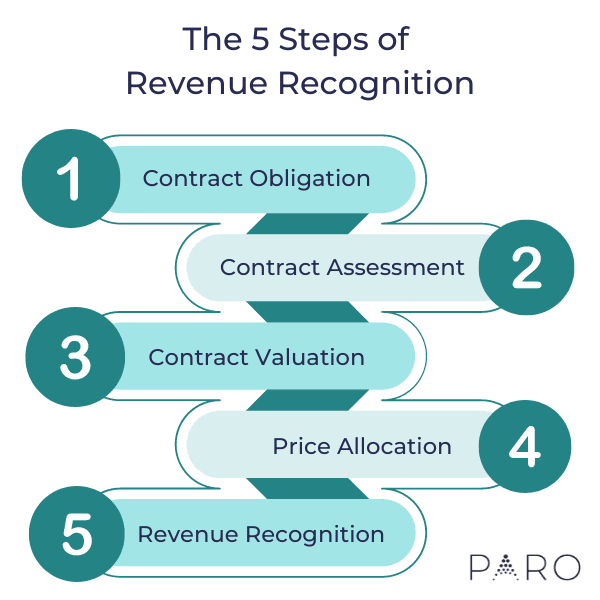

The Five-Step Process of Revenue Recognition

ASC 606 outlines a five-step process that entities must apply to all revenue contracts with customers. As mentioned, some revenue contracts are very simple and require minimal analysis. But for many contracts, this analysis will not be as straight-forward and will require controllers and their respective accounting functions to perform robust analyses and documentation. That documentation is typically requested by auditors if or when the entity is subject to such an engagement.

The five steps are as follows:

- Identify the contract with a customer.

- Identify the performance obligations in the contract.

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognize revenue when (or as) the entity satisfies its performance obligation(s)

You will need to ensure that you have applied these five steps to each type of revenue contract at your organization.

How to Apply Each of the 5 Steps of Revenue Recognition

Step 1: Identify the Contract With a Customer

While this step may seem like common sense at face value, sometimes the existence of a contract for revenue recognition purposes is not as clear. A contract for accounting purposes may exist when no formalized agreement is in place. In the other hand, the existence of a formalized agreement doesn’t necessarily mean there’s a contract in scope of ASC 606 (e.g., a master service agreement, a contract covered in other areas of the codification such as leases under ASC 842, etc).

A contract under ASC 606 does not necessarily need to be in writing for the transaction to be in scope of the standard, so the guidance provides very specific indicators that will dictate whether a contract exists, which includes:

- An approval between all parties

- Definition and enforceability of rights and obligations

- Establishment of payment terms

- Probability that payment will be received

- Commercial substance

This determination can be very complex, especially with smaller enterprises where entities do business with related parties and contract terms are informal. You will need the assistance of an expert to help you through this assessment.

Step 2: Identify the Performance Obligations in the Contract

Misidentifying performance obligations, either by omission or by incorrectly treating a promise as “distinct” when it does not meet the criteria, can result in a material misstatement of revenue.

ASC 606 provides very specific rules for determining whether a promise within a revenue contract should be deemed a performance obligation, and when it should be bundled with other promises until it forms such an obligation. This is a critical area of the assessment and responsible for countless errors and restatements of reported financial information. Controllers and their organizations need to engage the services of an expert to ensure the various promises within a contract are first identified, and then whether these promises possess “distinction” to be performance obligations.

Step 3: Determine the Transaction Price

This step involves the assessment of total consideration that’s expected to be received in a contract after all is said and done. The term “consideration” is usually synonymous with cash, but it could include anything of value that’s being transferred in the contract. For example, a customer may compensate an entity with shares of stock or other assets, which is known as non-cash consideration. For most transactions, however, consideration is entirely in the form of cash.

ASC 606 offers very specific rules for measuring the amount of consideration your business expects to receive. For example, refunds, rebates, discounts, commissions and anything else that would cause this amount to vary is known as variable consideration. The resulting amount after your assessment will represent the transaction price of the revenue contract, but professional judgment is necessary to ensure that the standard is applied correctly and the amount is accurate.

Step 4: Allocate Transaction Price to the Performance Obligations in the Contract

With the performance obligations identified and the transaction price determined, entities will need to next allocate the transaction price to the identified performance obligations based on their “standalone selling prices”.

A Simplified Example of Transaction Price Allocation

To illustrate this process, let’s assume the transaction price for a contract was $1,000, and it included promise X, promise Y and promise Z. If promise X was purchased separately, it would cost $500, and promises Y and Z would cost $400 and $300, respectively.

As such, if each promise was purchased on a “standalone basis” in their own contract, the sum of the three contracts would be $1,200. Of the $1,200, promise X represents 42% of the $1,200, and promise Y and Z represent 33% and 25%, respectively.

So, allocating the $1,000 transaction price to each promise would result in 42% of the $1,000 being recognized upon satisfying promise X, 33% of the $1,000 after satisfying promise Y, and 25% of the $1,000 after satisfying promise Z. This is what is meant by allocating the transaction price to performance obligations based on standalone selling prices (SSP).

| Promise | Standalone Selling Price (SSP) | % of Total SSP | Allocated Transaction Price |

| X | $500 | 42% | $420 |

| Y | $400 | 33% | $330 |

| Z | $300 | 25% | $250 |

| Total | $1,200 | 100% | $1,000 |

While this example is very simple, this is most never the case in reality. Often promises—goods and services—are not sold on a standalone basis, and such hypothetical prices would need to be estimated based on very specific rules. This becomes especially judgmental and complex in the absence of observable information, such as price lists or history of selling such good or service.

You’ll need to use an expert to assist in estimating such SSPs, ensuring the allocation objective is achieved and the correct amount of revenue is recognized as various performance obligations are satisfied.

Step 5: Recognize Revenue as the Entity Satisfies Its Performance Obligation(s)

With the first four steps completed, revenue is then ready to be recognized. Under ASC 606, revenue is recognized when—or as—performance obligations are satisfied, and only to that extent.

Continuing with the earlier example, as soon as the entity delivers on promise X, they would then recognize $420 in revenue, but could not recognize revenue from promises Y and Z until they satisfy those respective performance obligations. Herein lies the overall idea of revenue recognition under Topic 606: only recognize revenue when, or as, you deliver on the promises made in a contract.

Recognizing Revenue Over Time or Point-in-Time

As with the previous four steps, the rules governing the pattern recognition are complex and depend on the nature of the contract. For example, an assessment must be made to determine whether revenue will be recognized at a “point-in-time” or “over time”.

When using the “over time” recognition pattern, entities must determine how to measure progress toward contract completion. Common methods using are the straight-line method (time-based), input-based, output-based, or “right to invoice”.

For point-in-time transactions, it may be difficult to determine when the control of goods transfers to the customer. The revenue recognition standard provides indicators, but expert assessment is required. Scenarios may exist where:

- The customer gains possession of the goods without accepting the inventory.

- The customer has paid for the goods but the legal title hasn’t transferred.

- There’s a bill-and-hold arrangement. The customer requests that goods are stored at the company’s warehouse post-payment until they’re ready to take delivery.

These are just a few examples of the many situations that can complicate the timing of control transfer and revenue recognition in point-in-time transactions. Proper assessment is crucial for financial reporting, especially for transactions near period-end cutoffs.

Avoid These Common Pitfalls

Revenue is oftentimes the most critical line item in a set of financial statements, and external auditors design their audit procedures with this understanding. Whether an audit under the AICPA Statement on Auditing Standards (SAS), an audit under PCAOB standards or even a financial statement review under the AICPA Statement on Standards for Accounting and Review Services (SSARS), revenue recognition will most certainly be scrutinized. Unless your entity’s revenue transactions are obvious and simple, engagement teams will undoubtedly request a policy memo for the interpretation and application of ASC 606.

If you’re not 100% confident in the quality of your application of the standard, and if an audit or review is possible in the future, you’ll need to seek assistance from a professional advisor. The cost of delaying can be substantial in both money and time.

Overestimating Sufficient Judgment

A common judgment error made by many entities is that they believe they do not require such assistance or believe they’ve already applied a sufficient analysis toward their revenue contracts. However, in these cases, entities quickly discover during their audit that they were not prepared or they applied the standard incorrectly. Rushing to correct these errors in the eleventh hour can be incredibly expensive, delay financial reporting and impair an entity’s ability to raise capital.

Using Generalized Templates

Another common misconception is that entities believe they can simply use templates, purchase a software solution or use AI to comply with Topic 606. Since these assessments require substantial judgment related to an entity’s particular facts and circumstances, there’s no template, software application or AI tool that can perform this analysis on an entity’s behalf.

Additionally, simply rolling forward templates from another entity’s financial statements often leads to both the exclusion of applicable provisions, as well as the inclusion of provisions that are not applicable. Each entity needs to perform its own research based on the nature of their contracts and apply professional judgment where required. There’s no “cookie cutter” approach to the revenue recognition standard, and no two entities and their contracts are identical.

Apply the Revenue Recognition Standard With Confidence

It’s the responsibility of each entity to interpret and apply the standard to their respective revenue contracts. To do so effectively, companies should leverage the assistance of professional advisors to ensure proper application of ASC 606.

Paro matches businesses with revenue recognition experts with deep regulatory expertise in their respective industry. To learn more about our accounting standards support, schedule a free consultation. We’ll match you with an expert in as little as 72 hours, so you can get peace of mind faster.

About the Author

Bradley R. provides accounting, audit, tax, financial planning and business advisory services to a wide array of clients, both public and private. He has a comprehensive knowledge of various topics, including US GAAP, SEC reporting, internal control/SOX, financial analytics, auditing, cost analysis, tax and consulting.