It’s common for small business owners to take on bookkeeping tasks themselves—i.e., paying and tracking bills, handling customer invoices or managing payroll. Many business owners believe this route is cheaper, and that may be true when a company is getting off the ground. However, as finances get more complex, the cost of hiring a bookkeeper is often less than the cost of your time and energy.

How much does it cost to hire a bookkeeper, and how can a flexible bookkeeping service help you reduce your operating costs?

Bookkeeping Costs for Small Businesses: The True Cost of Doing It Yourself

Bookkeeping tasks seem minor at first—inputting receipts, tracking employee timesheets, etc. Thus, many small businesses have an existing employee or office manager take on these tasks rather than hire a professional. While this seems like a cost-effective solution at first, the costs of DIY bookkeeping can start to add up over time:

- Cost of errors: An untrained professional may make mistakes that could cost the company time and energy to fix. While professional bookkeepers are not immune from errors, they walk in with set processes that promote accuracy and efficiency.

- Opportunity costs: DIY bookkeeping takes away from time that could be spent innovating and growing the business. If your daily job is more bookkeeping and less strategy, it’s time to hire a bookkeeper.

- Financial costs: Bookkeepers don’t just know how to keep your books up-to-date. They’re also knowledgeable on various tax write-offs and deductions that can help minimize business costs and increase profitability. Their experience can help you save money and stay compliant.

How Much Does It Cost to Hire A Bookkeeper?

The reported median salary for a full-time bookkeeper is $42,488. This does not include the cost of recruiting or full-time benefits, which can increase this amount substantially. The hourly wage of a bookkeeper is $20 per hour on average in the U.S.

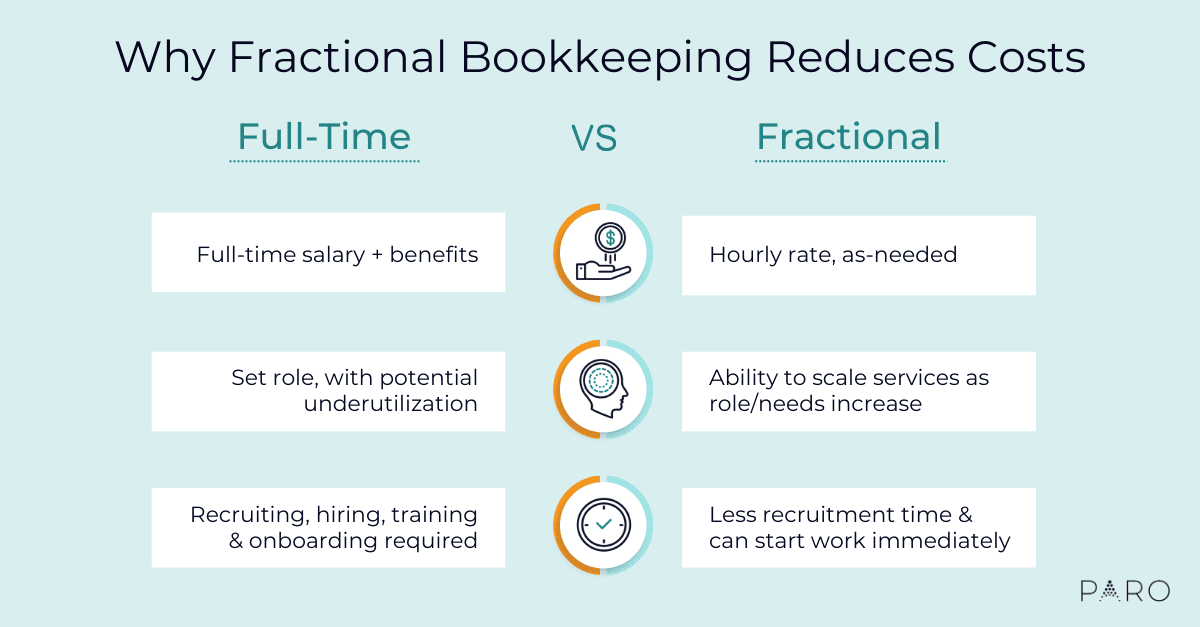

Small businesses, however, can choose to reduce operating costs within their finance team by hiring a fractional or outsourced bookkeeper. With an experienced and qualified bookkeeper at $50-$70 per hour, the cost of bookkeeping services at 10 to 20 hours per month is much lower than a full-time hire. A business owner can also avoid the cost of underutilization of a full-time hire if there is not enough work to justify the position.

What to Factor in the Cost of a Bookkeeper

The cost of bookkeeping services varies based on the platform or marketplace you use and the quality of the expertise you receive. The rate that an outsourced bookkeeper charges will vary based on a number of factors, including:

- Geographic location: Different states in the U.S. have different salary standards for living. The cost to hire a bookkeeper in New York may be more expensive than a bookkeeper in Missouri.

- Level of education: A bookkeeper with a degree is likely able to charge more than a bookkeeper without a degree.

- Certifications: There are certain certifications that a bookkeeper may obtain to increase their employability and earning potential, such as software certifications, the American Institute of Professional Bookkeepers (AIPB) certification or the National Association of Certified Public Bookkeepers (NACPB) certification.

- Years of experience: Bookkeepers with more years of experience are able to charge more than bookkeepers who are just starting out.

- Frequency of service: Many bookkeepers will adjust their hourly rate depending on how often a business needs them or what a business needs them for. For example, most bookkeepers lower their rate for clients that they work with on a regular basis as opposed to just a few times a year.

The Cost Benefits of Outsourcing a Bookkeeper

Small businesses in need of bookkeeping services will usually hire a full charge bookkeeper or a bookkeeper company that is solely responsible for the business’s accounting. A full charge bookkeeper can take over most day-to-day financial operations for a small company, such as:

- Accounts payable

- Accounts receivable

- Payroll management

- Account reconciliations

- Financial reporting (e.g., cash flow statements or balance sheets)

Small businesses usually don’t need a full-time bookkeeper as their finances are not yet complex enough to fill one person’s time. In this case, outsourced bookkeeping services provide a flexible, cost-effective solution.

- With a freelance professional, you only pay for the time and service that you need.

- You can hire outside of your geography to avoid the high costs of major urban areas or to simply find the best talent available for your specific business.

- You don’t have to waste any time with costly onboarding and training. An outsourced expert will be able to get to work right away.

- You can free up your time and employee time to focus on driving and growing the business. The cost of hiring a bookkeeper may therefore be offset by more potential revenue-producing activities.

Your level of need will determine how much it costs to hire a bookkeeper, but ultimately, your business will save money by taking advantage of the flexibility that fractional bookkeeping services can provide.

Get All-In-One Bookkeeping Services

Looking for cost-effective bookkeeping services provided by industry experts? Paro offers bookkeeping solutions powered by elite fractional experts. Learn how Paro can give you ownership over your company finances and more time to focus on strategic business activities.