Solutions that Bridge Your Gaps

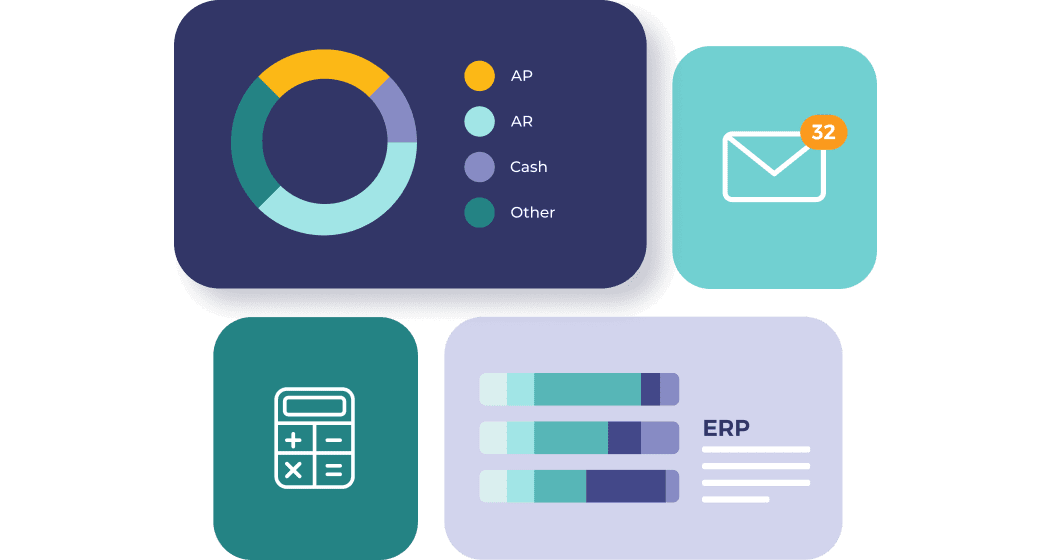

Maximize Tech Stack ROI & Operational Efficiency

Future-proof your firm with our tailored solutions for optimizing technology investments. From current state assessment to AI-enabled data analytics, we enhance your strategic capabilities for peak performance.

Explore Tech & AI ServicesTalent Acquisition, Elevated

Our platform provides on-demand access to top-tier finance professionals when you need to fill crucial vacancies or solve pressing challenges. But we go beyond short-term fixes. With Paro, you gain a strategic partner that deeply understands your business and helps you navigate the road ahead.

The right talent, right now

Get paired with the top 2% of finance professionals 20x faster. Our proprietary AI matching finds your perfect fit across 60+ industries and 250+ skill sets.

Seamless integration, maximum efficiency

Your Paro experts hit the ground running with innovative tools and processes to onboard smoothly and streamline your projects.

A focus on your growth

Data-rich insights guide you toward solutions that anticipate your next challenge and ensure you’re matched with someone who has been there.

Become a Paro Expert

Join an elite network of professionals and get the tools to build your own independent business.

Achieving Your Vision Together

Experience the same success as other organizations like yours with the help of Paro’s finance, accounting and bookkeeping services.

Deborah B.

CFO

Paro offered refreshing ideas for how to streamline our operations to make them more efficient. Their team was consistently helpful, intelligent and thoughtful.

Elizabeth O.

Principal

I should have done this years ago. The burden that has been lifted is amazing.

Tim L.

Creative Director & Founder

Paro’s services have given me something that I have not had in years—peace of mind and a Profit and Loss Statement!

TRUSTED BY BUSINESSES LIKE YOURS

Eye on the Industry

Explore the latest research, trending topics and more from our library of finance and accounting resources.

How to Build a Basic Financial Model Investors Will Love: A Step-by-Step Guide with Examples

Building a financial model doesn’t have to be overwhelming. Our guide breaks down the basics step-by-step, showing you how to create a clear, actionable financial model tailored to your business goals.

What Is a Good Profit Margin? Formulas, Benchmarks & More

Profit margins play an important role in many strategic decisions. Learn how to calculate yours, why they matter and how you stack up to your industry peers.

Rules of the Road: What to Know about the IRS Mileage Rate 2025

The IRS mileage reimbursement for 2025 is 70 cents per mile. Learn how it impacts your business expenses and how to maximize deductions.

How to Build a Basic Financial Model Investors Will Love: A Step-by-Step Guide with Examples

Building a financial model doesn’t have to be overwhelming. Our guide breaks down the basics step-by-step, showing you how to create a clear, actionable financial model tailored to your business goals.

What Is a Good Profit Margin? Formulas, Benchmarks & More

Profit margins play an important role in many strategic decisions. Learn how to calculate yours, why they matter and how you stack up to your industry peers.

Rules of the Road: What to Know about the IRS Mileage Rate 2025

The IRS mileage reimbursement for 2025 is 70 cents per mile. Learn how it impacts your business expenses and how to maximize deductions.